LYN has started drilling - aiming for a new nickel-copper discovery

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 2,631,250 LYN shares and 300,000 LYN options at the time of publishing this article. The Company has been engaged by LYN to share our commentary on the progress of our Investment in LYN over time.

LYN has just started diamond drilling into a 6km nickel-copper-PGE gravity target.

Our exploration Investment Lycaon Resources (ASX:LYN) is aiming to make a large nickel-copper discovery in the Kimberly region of WA.

LYN is drilling two diamond drillholes down to 800m depths - drilling is expected to take ~4 weeks to finish.

With a market cap of $12.6M, cash recently raised, a low ~43 million shares on issue and market expectations generally low, we think this stock could move quickly IF they manage to deliver a discovery.

Observing of course that exploration investing is high risk and big discoveries are rare.

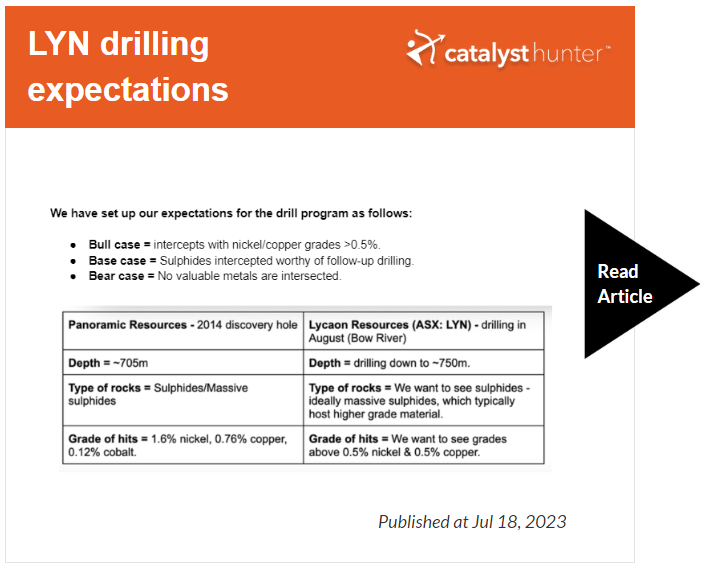

With drilling now underway, we have set up our expectations as follows:.

- Bull case = Intercepts with nickel/copper grades >0.5%.

- Base case = Sulphides intercepted worthy of follow-up drilling.

- Bear case = No valuable metals are intersected.

Nickel is a battery metal and demand is expected to outpace supply over the next decade as the global electrification push continues.

In a signal of this future demand, Andrew Forrest just paid US$760M for nickel projects in WA.

There are very specific types of nickel projects that are in high demand... nickel sulphide projects specifically.

Most of the world’s primary nickel supply comes from sulphide deposits, and they are becoming harder and harder to discover.

When a discovery is made, they almost always lead to major re-rates in a company’s share price.

LYN recently raised $1.5M at 25c. Added to the $2.5M it had at June 30th equates to ~$4M in cash.

Aside from the drilling happening right now, LYN also has a project ~ 94km from WA1 Resources - that went from 13.5c to as high as ~$7 off a rare earths/niobium discovery.

That’s a 50x return to anyone who managed to pick the bottom and the top (almost impossible).

That “WA1 lookalike” is the next project LYN would look to drill.

As a microcap stock, LYN is a high risk explorer, with no guarantee of success. Also WA1’s performance is not an indicator of LYN’s future performance on success.

Back to the Kimberly and LYN’s current drilling

For now, let's focus on the drilling happening now.

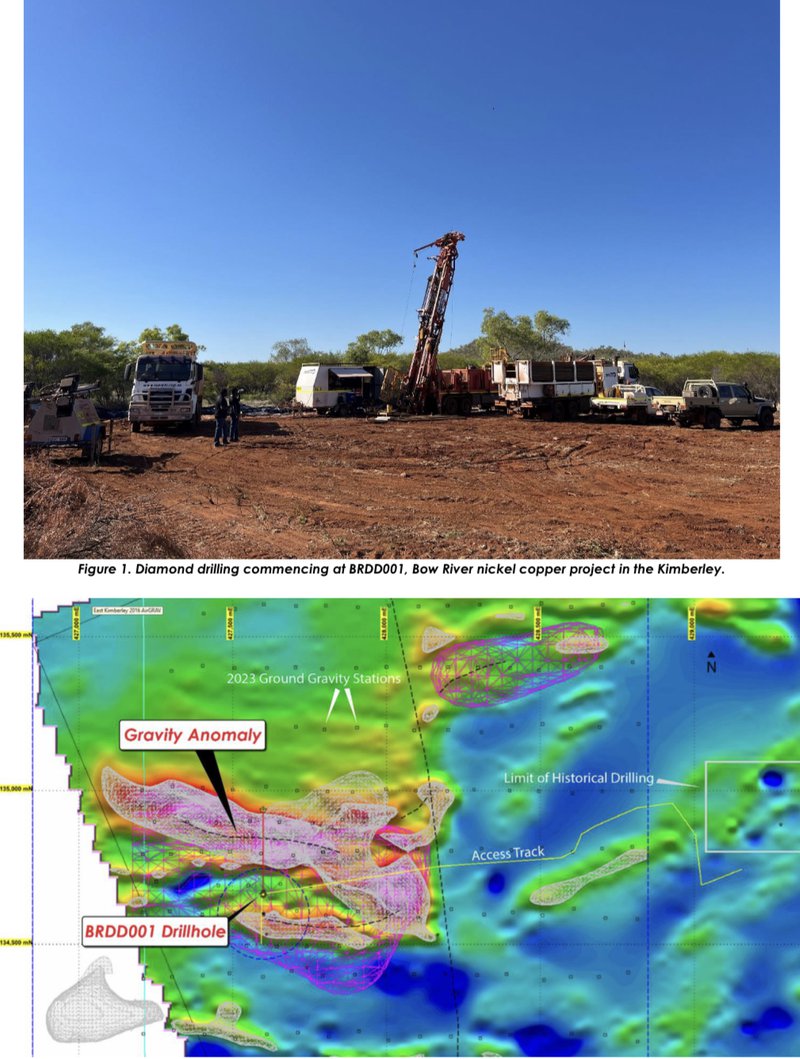

Here’s the drill rig on site, along with the suspicious looking gravity anomaly that LYN will be poking into:

There is a track record in the Kimberly region for nickel-copper discoveries, and it's what has inspired LYN to drill test this anomaly.

Back in 2014, Panoramic Resources started looking for extensions to its existing Savannah nickel mine, which was approaching the more mature stage of its mining operations.

Panoramic drilled deep holes to the north of Savannah and made the “Savannah North” discovery - a discovery ~ 4x bigger than the original Savannah mine.

Off the back of the new discovery, Panoramic reached a market cap of ~$1BN.

$10.5BN IGO, which had been lurking in the region for a while, then launched a takeover bid for Panoramic in 2019 at a $312M valuation.

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

Since the Savannah North discovery, Panoramic’s share price has come down - more related to the inflation in mining costs and less related to the quality of the orebody.

The nickel market has also come a long way since 2014 AND we think nickel still has a big role to play in the whole electrification thematic being a critical raw material for EV batteries.

We think the takeovers of existing nickel projects, and the big re-rates after new discoveries are made is proof there is likely to be a structural supply shortage in the nickel market over the next 5-10 years.

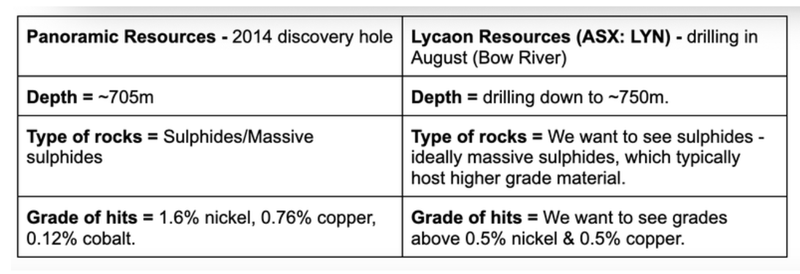

With drilling now underway, we have set up our expectations for the drill program based on the initial discovery hole made by Panoramic Resources.

- Bull case = intercepts with nickel/copper grades >0.5%.

- Base case = Sulphides intercepted worthy of follow-up drilling.

- Bear case = No valuable metals are intersected.

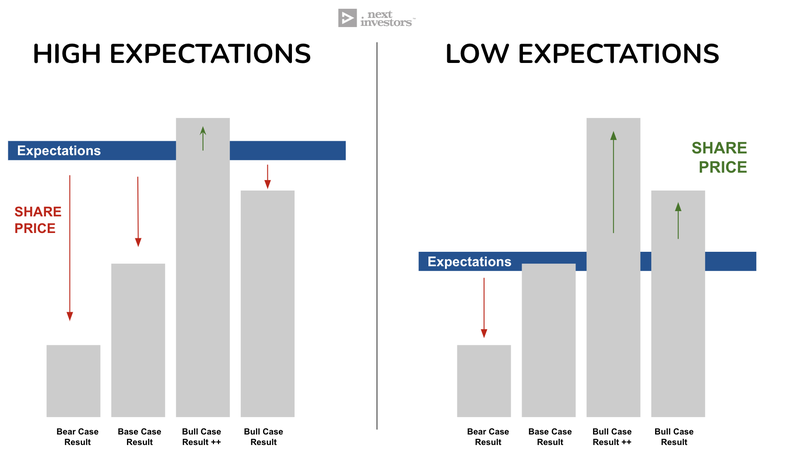

Potential for re-rates are higher... when expectations are low

A key reason we are looking forward to LYN drill testing Bow River is because we think that there aren't any major expectations built into LYN’s share price.

As we noted above, LYN’s current market cap is just $12.6M. Going into drilling, the company should have circa $4M in cash ($2.5M at 30 June + the $1.5M capital raise).

That means LYN trades with an enterprise value of just $8.6M.

Typically companies going into relatively big drilling events can see their market caps reach $30-40-50M and, in some cases, upwards of $100M.

When that happens, the market starts to price in a potential discovery scenario and sets the company up to deliver a big result and grow into its valuation OR a poor result and a big re-rate down in its share price.

LYN on the other hand is going into the drill program with a relatively low EV of $8.6M.

If LYN makes a discovery, this would be a relatively unexpected positive result and we would expect the company’s share price to re-rate to the upside as investors rush to buy shares on market.

Of course, this is speculation on our part, and is not any guarantee.

At the same time, if LYN were to hit nothing, then we don't think it would have as big of an impact on LYN’s share price, given expectations are low going into the drill program.

🎓See our educational article on expectation setting here: Expectation setting leading up to drilling programs

Ultimately we are hoping LYN delivers unexpected success and achieves our LYN Big Bet, which is as follows:

Our ‘Big Bet’:

“LYN’s share price re-rates by over 1,000% off the back of a new discovery and the definition of a deposit significant enough to move into development studies”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our LYN Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

To monitor the progress LYN has made since we first Invested, we maintain this LYN “Progress Tracker”:

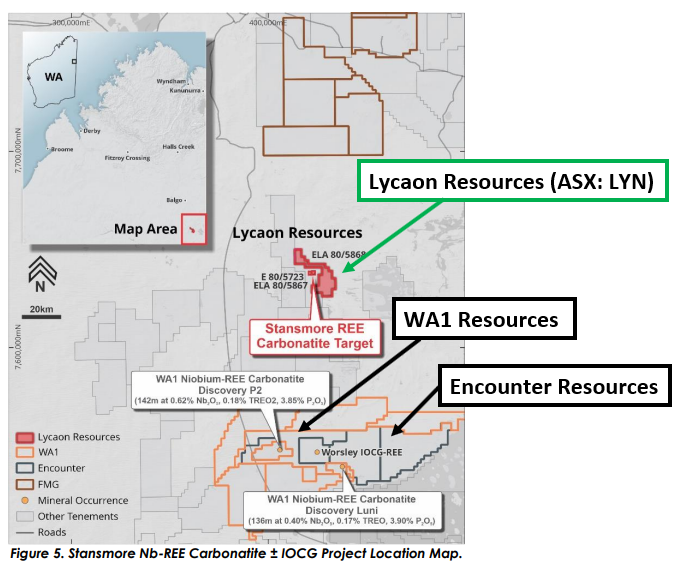

LYN granted more ground near $274M capped WA1 Resources

A few weeks back we also got news from LYN’s projects in the West Arunta region.

When we first announced our Investment in LYN, the key reasons were for the company’s projects next to $275M WA1 Resources and $166M Encounter Resources.

(Source)

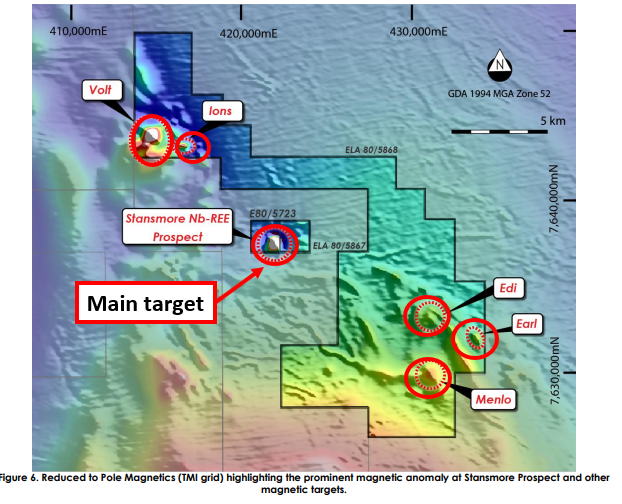

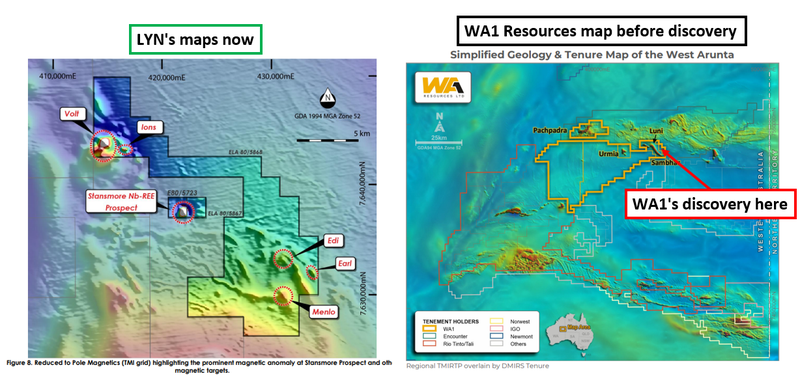

A few weeks back, LYN was granted more ground in the West Arunta and now holds ~173km^2 of ground with six targets it could drill - the most advanced of which is the Stansmore prospect.

LYN’s ground is prospective for niobium and rare earth mineralisation - the same mineralisation that makes up WA1 Resources’ project.

(Source)

Just like LYN, WA1 Resources’ project had similar undrilled geophysical targets BEFORE it announced its discovery.

Here is a side-by-side of the two companies' maps in the lead up to the maiden drill programs:

WA1 Resources’ discovery back in October 2022 sent the company’s share price from ~13.5c per share to a high of ~$7.05 per share.

Now WA1 Resources trades with a market cap of $275M.

Of course, WA1’s past performance is not a guarantee LYN will be able to replicate this - LYN is a high risk explorer that hasn't drilled its target yet.

LYN’s current market cap is ~$12.6M and the recent run up in LYN’s share price from ~13c to now trade at ~30c per share could be something to do with the granting of LYN’s new permits & the progress being made by other explorers nearby.

What’s next for LYN in West Arunta?

LYN is currently at the land access negotiations stage working toward getting native title holder approvals.

In the meantime, we’re hoping this drilling at Bow River comes in with positive news ahead of drilling in West Arunta.

What’s next for LYN?

🔄 Drilling at Bow River Nickel/Copper/cobalt/PGE project:

With drilling now underway, we want to see LYN hit intercepts similar to the ones that lead to the discovery of Panoramic Resources Savannah North project:

🔄 Permitting and approvals for rare earths/niobium project:

LYN is currently running through the land access & permitting process for the ground.

After permitting is organised the company will start target generation work to work out the best spots to drill.

At the same time LYN still needs to settle the acquisition of its project which includes getting shareholder approvals for the deal.

What are the risks?

In the short term, with drilling now underway, the key risk for LYN is “exploration risk”.

As always with junior explorers, there is always a chance the company finds nothing and its projects are deemed stranded.

Check out the key risks to our LYN Investment Thesis in our Investment Memo here:

Our LYN Investment Memo

Below is our LYN Investment Memo, where you can find the following:

- Key objectives for LYN for the coming year

- Why we are Invested in LYN

- What the key risks to our Investment thesis are

- Our Investment plan

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.