Gaming is a long-term winning industry

Published 03-MAR-2021 14:53 P.M.

|

5 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The gaming industry is a high growth industry, growing revenue by 37% in 2020 as the pandemic lifted demand for gaming as way to socialise and be entertained with many traditional leisure activities closed due to Covid-19 restrictions. The gaming industry is not only a high growth industry it is also very profitable, but this in turn has lured big technology companies such as Apple, Google, Amazon, and Microsoft into the industry. Competition will likely increase but so will also the overall global revenue from gaming and analysts remain very positive on the 30 companies in our basket, writes Peter Garnry, Head of Equity Strategy at Saxo Markets

We have introduced five new equity theme baskets this year and we have many more coming. This is a good way to identify long-term trends in the economy but also a more exciting way to analyse the equity market during different volatility regimes.

Today, we are launching our sixth equity theme introducing our Saxo Gaming equity theme basket consisting of 30 gaming stocks.

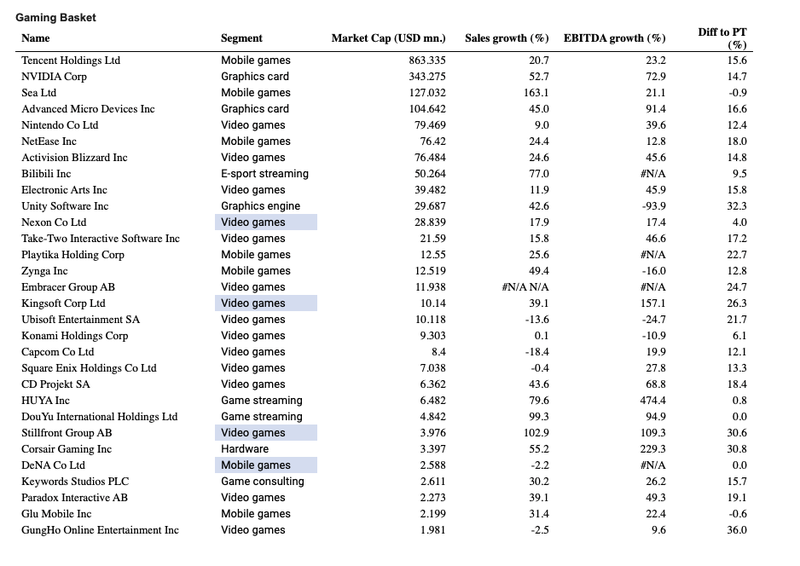

37% revenue growth in 2020

The gaming industry is a sprawling and fragmented industry with many companies deriving revenue and profits from other businesses than gaming. However, we have found 30 companies that we believe provide a good exposure to overall trend in gaming. The geographical split is good and as the segment column indicates exposure can be obtained either through graphics card manufacturers, streaming, or gaming developers. We have chosen the 30 largest gaming related companies on market value so this list should not be viewed as our investment recommendations. We like gaming overall, but investors will have to do the due diligence on the individual companies themselves.

As the table at the bottom of the page indicates, the revenue growth rate is very high with 37% on average in 2020 as the pandemic impacted demand positively. Whereas other high growth industries such as e-commerce is running low margins have difficulties generating large free cash flows, the gaming industry is very profitable. Capital expenditures required are low and revenue can easily scale due to the digital nature of the business. EBITDA growth was 59% in 2020 and analysts are very positive on the industry with an average price target that is 16% above the current price.

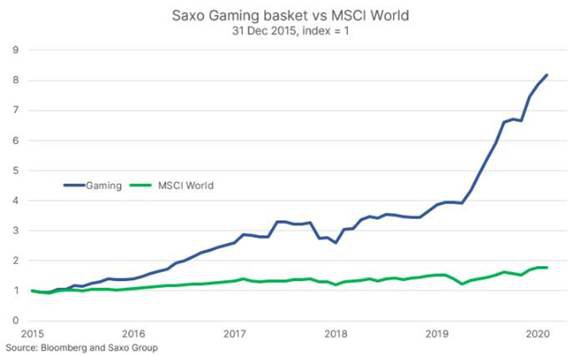

Our gaming basket is up 5.8% year-to-date and up 101% the past year and up 772% over the past five years. Historic performance is no indication of future performance so investors should not put to much weight on these performance metrics. They reflect the high growth of gaming but what is relevant is whether the growth can continue for another decade.

The gaming industry will continue grab leisure market share

The pandemic was a game changer for the gaming industry with many more users being exposed to gaming as sports events and general leisure activity closed. According to data on gaming consumption the average American adult spends around an hour a day gaming socially online, and streaming of esports is gaining popularity. A good indication of this came in 2019 when the CEO of Netflix said that the company’s biggest threat was not Disney or HBO, but that of Fortnite, one of the most popular games in the world.

In 2019 before the pandemic emerged, the industry generated $120BN in revenue (see revenue breakdown below) and by 2021 it is projected that 2.7BN people will be playing games on one platform or another. The industry has benefitted a lot from smartphones allowing the industry to steal time from people commuting or when they have spare moment. Many games are also designed around the same reward feedback loops invented by social media platforms increasing engagement (often just a positive word for addiction). The future of gaming will see fierce competition as the high profitable growth in gaming is luring in big technology firms such as Apple, Google, Amazon, and Microsoft into the industry. The expectation is that VR/AI will be come more dominant features of gaming in the future but so far Facebook’s bet with Oculus has not turned into the success everyone was predicting.

Key risks to consider

The pandemic has lifted revenue growth rates for all gaming companies and elevated their share prices and equity valuations. As society opens on the back of vaccines people likely prioritise to socialise physical for some time and go to restaurants and cafés instead of playing video games. This could reduce revenue growth in 2021. In November 2019, China introduced new regulation that restrict playtime for minors as gaming can be addictive and especially because gaming developers are become better at designing games with reward feedback loops derived from learnings in social media. This Chinese regulation hit initially Tencent hard, but the Chinese company recovered as COVID-19 increased gaming consumption from the elderly population. Similar regulation could come to the developed world over time reducing time spent on gaming.

Other key risks are the difficulties as a gaming developer to constantly develop the next new game that will captivate users to keep growth high. There are several examples of gaming developers once successful losing their ability to innovate. Big companies such as Apple, Google, and Amazon are also seizing opportunities in the gaming space following the footsteps of Microsoft. With these technology giants and their enormous distribution, they could become a big threat to existing gaming developers and their gaming platforms.

Many gaming stocks come with rich equity valuation which means that the implied equity risk premium is low. This means that rising interest rates impacts the equity valuations more and thus the risk of rising interest rates in the US should be a key consideration for investors that want exposure to the gaming industry.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.