As countries look inward, food security for developing nations becomes more important than ever

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

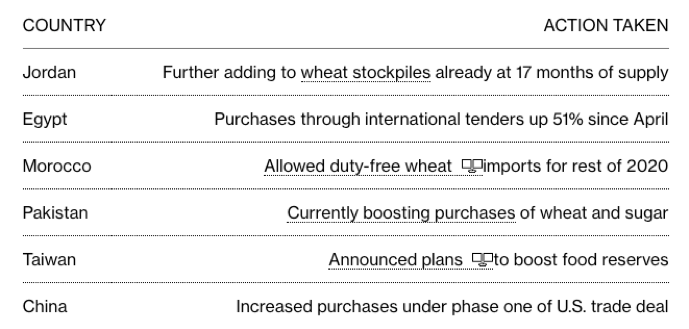

Whether COVID leads to isolationist policy or protectionist policy is up for debate, what we do know is that countries from Egypt and Jordan to Pakistan, Taiwan and China are stockpiling agricultural commodities to boost strategic food stockpiles and protect their food supplies.

Food stockpiling is a precautionary measure against potential disruptions that could be caused by COVID-19 outbreaks.

“COVID-19 has forced consumers to shift from just-in-time inventory management to a more conservative approach which was labelled just-in-case,” said Bank of America Corp. analysts led by Francsico Blanch, head of global commodities. “The result is that consumers are holding more inventory as a precaution against future supply disruptions.”

COVID isn’t the only factor behind the rising prices of corn, wheat and soybeans. Size of domestic supply, local pricing and foreign currencies are factors too. Climate change also has an impact. Floods in China saw that country increase its commodity purchases to mitigate any arising supply issues.

The following table recently published by Bloomberg illustrates the move by countries to stockpile commodities:

While the countries listed in the table above will likely survive and thrive long-term, it is developing countries that will be hardest hit.

A report released by Mining technology recently, suggests “Emerging markets and developing economies, which are heavily dependent on commodities are expected to be the worst affected. Further, the pandemic may result in fundamental shifts to the commodity markets including higher transportation charges, increased trade costs and stockpiling of certain commodities.

Food security challenged

While we are yet to see the full affects the pandemic will have on commodities, predictions are that next season food security will come under the microscope as trade restrictions and export bans hit the most vulnerable countries.

Put simply and while understandable, excess commodity buying by developed countries puts developing countries at even higher risk than they currently are.

The World Bank tweeted:

Despite well supplied markets, export restrictions could hurt food security in importing countries. We must keep food trade flowing between countries.

— Lilia Burunciuc (@Liliabur) April 29, 2020

via @WorldBank https://t.co/f6PeLxWmMC

Commodity dependent emerging markets are highly vulnerable in a post pandemic world.

The World Bank reports “Snags to supply chains have already affected the exports from some emerging market and developing economies of perishable products such as flowers, fruits and vegetables.

What can be done to curb the damage to developing economies?

Empowering local communities to overcome poverty through creating their own food security is the most tangible solution to supply issues.

This is no small fix.

More than 820 million people around the world suffer from hunger.

To create food security, it is important to close the yield gap.

According to the Food and Agriculture Organization of the United Nations, by 2050, 120 million hectares of natural habitats will be converted to farming in developing countries.

However, a study titled Leverage points for improving global food security and the environment headed by researcher Paul West shows that much of the current agricultural land available is not reaching its potential, yielding 50 percent less than what it could produce.

The idea then is to close the gap between what is being produced and what could be produced.

In order to do that, the use of fertiliser must become more efficient.

West estimated in his research that that the use of fertilisers with nitrogen and phosphorus on wheat, rice and maize crops could be reduced by 13-29 percent, while producing the same yields.

Add a little scientific thinking to the timing, placement and type of fertiliser and efficiency will further increase.

Improving irrigation systems is another solution, along with targeting food for direct consumption and decreasing food waste.

Looking at fertiliser specifically, and using sub-Saharan Africa as an example, crop yields in the region are drastically lower than other regions around the globe – as much as three times for those common staples such as corn.

The issue is fertiliser. Consumption of which is expected to almost double in the next 10 years in Africa.

In Nigeria, Indorama built a US$1.5 billion fertiliser plant. In Ethiopia, OCP built a US$2.4 billion fertiliser plant. In Kenya, Toyota Tsusho commissioned a new large-scale fertiliser blending plant to service the Kenya and Tanzania markets.

There are also companies working hard to address the issue of food security among these nations.

More generally, the likes of potash companies such as Highfield Resources (ASX: HFR), Galaxy Resources (ASX: GXY) in Argentina, Danakali (ASX: DNK) in Eritrea and Salt Lake Potash in WA all have good intentions. BHP is also in on the act with its Jansen potash project in Saskatchewan.

Looking at Africa specifically, Minbos Resources Ltd (ASX: MNB) is effectively building a nutrient supply and distribution business that stimulates food security in Angola and the broader Congo Basin.

Its Cabinda Phosphate Project in Angola is designed to boost fertiliser production and food security in the region: producing fertilisers locally will improve the availability of nutrients, reduce transport costs, and protect against exchange rate fluctuations – all issues already listed above.

By assisting subsistence farmers, local food prices could be reduced, improving Africa’s economic competitiveness, while potentially mitigating the high cost of imported fertiliser, which is also contributing to the issue of low crop yields.

Minbos is working closely with the International Fertilizer Development Centre (IFDC), one of the world’s leading fertiliser research and development organisations, to facilitate the development of an innovative fertiliser product, tailored to meet the growing agricultural demand of middle Africa.

Middle Africa is just one of many regions in need of this type of assistance.

Yet, food security for all is a long way from being achieved.

As such, it is important as many countries look inward to their own security, for more and more people to look outward and help struggling developing nations to feed their people.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.