Introducing Our Latest Portfolio Addition: $11M Capped ASX Stock Unlocking Food Security in Africa

Sub-Saharan Africa dedicates nearly as much land to growing corn as the US.

However, crop yields in the region are drastically lower than other regions around the globe – as much as three times for those common staples we take for granted such as corn.

There is a key ingredient African countries lack, and if cheaply available would see it catch up to more developed countries’ food production, and remove their reliance on food imports.

That’s fertiliser.

Fertiliser consumption is expected to almost double in the next 10 years in Africa.

International companies have recognised the severe demand of reliable sources of fertiliser, pouring billions of dollars into fertiliser plants. It is all part of a global trend that can be highlighted by China’s attempts to build national food security, with its food self-sufficiency likely to fall from 94.5% in 2015 to around 91% by 2025. Its ‘clean plate’ is another important food security initiative.

In Nigeria, Indorama built a US$1.5 billion fertiliser plant. In Ethiopia, OCP built a US$2.4 billion fertiliser plant. In Kenya, Toyota Tsusho commissioned a new large scale fertiliser blending plant to service the Kenya and Tanzania markets.

There are significant opportunities in Africa, with food demand value ~ $313 billion and growing.

Companies with strong government relationships built up over time are able to get deals done and progress local projects if they can deliver win-win outcomes.

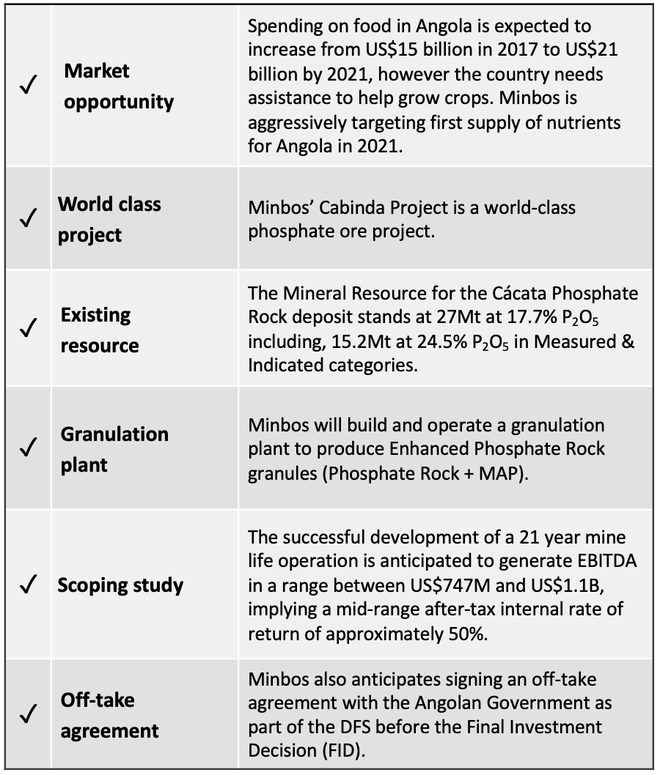

We have recently made a large, long term investment in Minbos Resources Ltd (ASX:MNB), a $11M capped company that has a world-class phosphate ore project within the Cabinda Province of Angola.

MNB has been working on the Cabinda Phosphate Project for years, and has lofty goals – exactly what we like to see from our long term investments.

The company is effectively building a nutrient supply and distribution business that stimulates food security in Angola and the broader Congo Basin.

This project has the potential to impact the whole country by boosting fertiliser production and food security.

There are several reasons we saw this as the right time to add this company as a long-term hold position in our portfolio.

We like the social impact this investment offers, particularly because it could improve food security, poverty and nutrition outcomes and mitigate the impacts of climate change on farmers. In fact, we have a good network of impact investors who focus on ethical stocks that make a good ROI, our last ethical investment VUL has been up 261%.

However, this isn’t just about social good – we are also investing for high capital returns.

The Mineral Resource for its Cacata Phosphate Rock Deposit stands at 27Mt @ 17.7% P2O5, with 15.2 Mt at 24% in the Measured & Inferred Categories, and A$20M in previous expenditure has already been invested in the project.

Results of a Scoping Study released today demonstrate the company could generate strong cash returns on the Project for a relatively small capital investment.

The pre-production CAPEX is between US$22-28M, which is not a lot to get the project into production – and the payback period is just three years, with a Life of Mine (LoM) of 21 years.

The After Tax NPV of the Project is US$159M-$260M.

The financial metrics are starting to stack up especially when compared to the company’s current $11M market cap.

Investors are starting to grow in confidence that this company will be in a position to move into production by late 2021 / early 2022.

As milestones are ticked off on the path to production, we would expect to see significant growth in the company’s valuation – certainly multiples of its current market cap today.

Like all mining projects, funding rounds will be required to get the company to the next level; the company currently has less than $1M in the bank and will need to raise capital to fund the completion of its DFS.

However once completed, this should unlock significant value.

The Scoping Study results will be used to initiate discussions with debt and equity financiers for the construction of the project and frame the scope of work for a Definitive Feasibility Study (DFS).

If Minbos follows in the footsteps of other Angola based mining companies, such as Pensana Rare Earths PLC, we might assume that the Angolan Sovereign Wealth Fund will line itself up to make a sizeable investment in Minbos.

Pensana's performance is impressive:

Minbos would certainly be looking to achieve similar things and has advised the market that it is working on an offtake agreement with the Angolan government as part of the DFS – if successful this would be a major share price catalyst and substantially de-risk any development funding needed for the company’s project.

Can Minbos help increase food production in Africa?

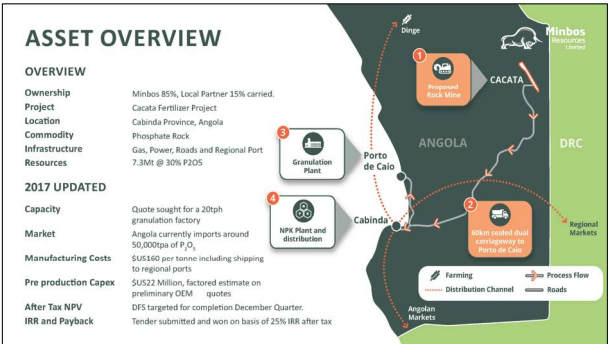

Minbos Resources’ (ASX:MNB) holds an 85% interest in the Cabinda Phosphate Project and will carry in-country partner Soul Rock Ltda (Soul Rock) for a 15% interest. It will also recover the investment made on behalf of Soul Rock from project cashflow.

As we alluded to above, Minbos is in the advanced stages of feasibility studies into building a nutrient supply and distribution business at Cabinda to boost agricultural production and food security within the country and the broader Congo Basin.

In March this year, Minbos was successful in securing the open tender for the Cácata Phosphate Concession within the Cabinda Project.

It has taken 10 years to come to this point, but during this time the company’s focus didn’t waiver from developing known phosphate areas within the exclave of Cabinda.

Below, you can see the location and the experience Minbos has built up in this project during those years.

Minbos initially acquired the rights to the Cácata deposit through a 50:50 joint venture (JV) partnership in 2010. Together with its JV partner, Minbos spent more than $20 million on exploration and pre-feasibility studies that was initially targeting an export focused product.

During this time, Minbos acquired invaluable technical knowledge on the project but, unfortunately, the licence for the project was forfeited as a result of issues the company had with its joint venture partner.

Despite this, the company could see the potential in the project and it forged ahead with agronomic research and development programmes at Cabinda.

Patience was rewarded in June 2019, when the rights to the Cácata deposit opened to a public tender. Minbos beat out all competitors to win back the project, this time with full management control and the ability to move the project forward on its own terms.

With Minbos now able to forge ahead with its plans, its next steps are to develop the potential of the Cabinda Phosphate Project at a time when locally produced fertiliser projects are taking off across the African continent.

CEO Lindsay Reed told shareholders earlier in the year, “Despite the challenges of the past decade, the quality of the Cácata Deposit has never been in question and wholly represents the reason Board and Management persevered to achieve a successful tender outcome.”

In the video below, Reed explains the importance of phosphate to Angola’s food supply ambitions, along with its immediate focus to develop a low-cost/high-yield fertilizer blend suitable for crops and soils within Angola and the wider Congo Basin.

Cácata is well supported by key infrastructure. The deposit is situated within a kilometre of a dual lane highway and a sixty-minute drive to Porto de Caio, a billion-dollar port and industrial development.

Porto de Caio provides the ideal location for a granulation plant with a natural gas terminal and power station within five kilometres and access to a port for barging product to local and regional markets.

This is important because fertiliser consumption on the African continent is projected to reach 13.6 million tonnes by 2030. Producing fertilisers locally will improve the availability of nutrients, reduce transport costs, and protect against exchange rate fluctuations.

In essence, it could transform agriculture in Angola, assisting subsistence farmers in reducing local food prices, enhancing current and future food security and improving Africa’s economic competitiveness.

It may also mitigate the high cost of imported fertiliser, which is contributing to the issue of low crop yields.

Minbos hopes to address this issue by producing low-cost, locally-mined, manufactured and distributed fertiliser, tailor-made for local soils.

“Producing fertilisers locally would improve the availability of nutrients, reduce transport costs and would protect against exchange rate fluctuations which impacts on fertiliser pricing,” Reed told Mining Review Africa.

Producing fertiliser for local markets

“The company is excited to begin its journey to move rapidly to production, using local phosphate rock, to produce fertiliser for local markets using technology developed by the International Fertilizer Development Center,” Reed told shareholders when the company announced the Definitive Feasibility Study (DFS) for Cabinda was underway.

Key to achieving this is the company’s relationship with the International Fertilizer Development Centre (IFDC), one of the world’s leading fertilizer research and development organisations, which has been engaged to undertake a new Greenhouse Trial in Alabama in the US with a view to enhancing the value-in-use of the Cabinda Blend product.

The IFDC is a key technology partner for Minbos and will help to facilitate the development of an innovative fertiliser product, tailored to meet the growing agricultural demand of middle Africa.

Thus far, the IFDC has identified that the Cácata phosphate rock has medium solubility and can be enhanced by the addition of a small amount of MAP to be useful as a phosphate nutrient.

Both Minbos and the IFDC have successfully processed and produced over 500 kg of Cabinda phosphate rock blended with MAP – the Cabinda Blend – at the IFDC’s trial plant in Alabama, USA.

The blend has been used in a number of in-country greenhouse and field trials.

In fact, four trials have been conducted over a two year period and all roads have led to early root development and plant growth as well as economic benefits, including confirmation that Cabinda Phosphate Rock blended with mono-ammonium phosphate (MAP) (Cabinda Blend) returned similar agronomic performance to MAP in crops and soils typical for Angola.

The new Greenhouse Trials are designed to evaluate the Cabinda Blend in local soils on soybean-wheat-sorghum crops grown in sequence to maturity. This will test several research comparisons, including determining the residual effect of Cabinda Phosphate Rock on grain yield and phosphate uptake; estimating a minimum MAP concentration required to generate the Starter Effect, and evaluating the advantage of granulated versus tableted (compacted) product.

The current Field Trial was designed by Plant Nutrition Science and Technology (NPCT) in Brazil and co-ordinated by the Angolan Institute of Agronomic Investigations (IIA). Trials have been harvested and analysis is ongoing.

Field Trials for the next growing season are being planned in collaboration with NPCT, IFDC and the IIA to compare the Cabinda Blend to commercially available fertilisers.

The next field trials will trial multiple crops in different locations to compare the Cabinda blend to commercially available fertilisers.

All of this would be moot, if the metrics in the recent Scoping Study weren’t up to scratch.

Scoping study delivers prized numbers

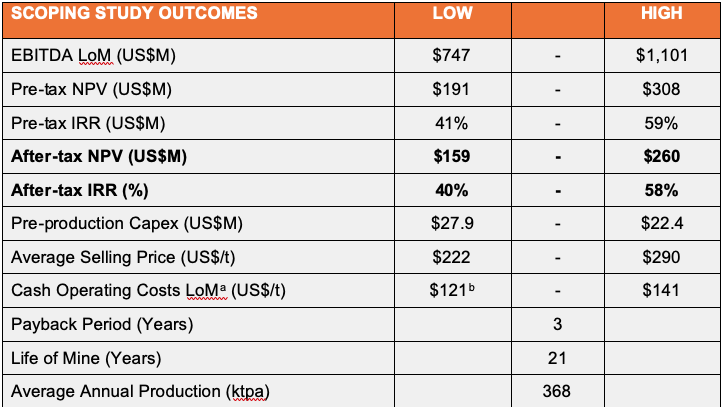

The successful development of a 21 year mine life operation is anticipated to generate EBITDA in a range between US$747 million and US$1.1 billion, implying a mid-range after-tax internal rate of return of approximately 50%.

Importantly, due to the high grade of the mine production target which can be utilised without beneficiation in the granulation plant, the project involves nominal pre-production capital expenditure relative to the returns.

Costs are expected to be in a range between US$22.4 million and US$27.9 million, which is a low capital cost in terms of mining projects worldwide.

With average annual production of about 370,000 tonnes and the average sale price more than US$100 per tonne above life of mine cash operating costs, one would expect financing to be relatively straightforward.

The project level Scoping Study provides estimates for 100% of the project.

The Scoping Study demonstrates the potential for robust returns for the project based on an initial name plate capacity of 150,000 tonnes per annum of enhanced Phosphate Rock but is forecast to commence production at 50,000 tonnes per annum.

The plant is forecast to expand in two stages, adding a second and third granulation circuit to reach a name plate capacity of 450,000 tonnes per annum after 8 years.

The Scoping Study is based on the Mineral Resource Estimate for the Cácata deposit, comprising of 27Mt (million tonnes) @ 17.7% P2O5 (at a cut-off grade of 5% P2O5).

Pit Optimisation studies have been carried out on the Mineral Resource in 2020.

The subsequent open pit design that forms the basis of the Scoping Study comprises 6.54Mt of plant feed mined at an average grade of 30.2% P2O5 and a strip ratio of 3.76:1 for mining over 21 years.

Of the 6.54Mt of plant feed mined, 1.54Mt (24%) is in the Measured Resource category and 5Mt (76%) is in the Resource category.

In the first five years, 636,000 tonnes of plant feed will be mined at 30.2% % P2O5, all of which is classified as Indicated.

The production schedule assumes run of mine phosphate rock will be granulated with mono-ammonium phosphate (MAP) at the granulation plant.

The blending ratio of 84% Phosphate Rock to 16% MAP is based on the agronomic and granulation trials carried out by IFDC as mentioned above.

The ex-port price of the MAP in Angola is assumed to be US$478/t (range US$407 – 532/t).

Capital and operating costs were estimated using a combination of costs built up from first principles, quotations received from contractors/suppliers and benchmarking against similar activities in Africa.

The key metrics of the Scoping Study are impressive:

Note, cash operating costs include all mining, transport, granulation, shipping, government royalties, site administration and raw material purchase costs. When looking at Pre-production CAPEX, the low case contemplates a lower MAP price which decreases revenues, but because MAP comprises approximately 50% of the operating costs it also decreases the operating costs in the low case. The reverse is reflected in the high case.

Looking forward

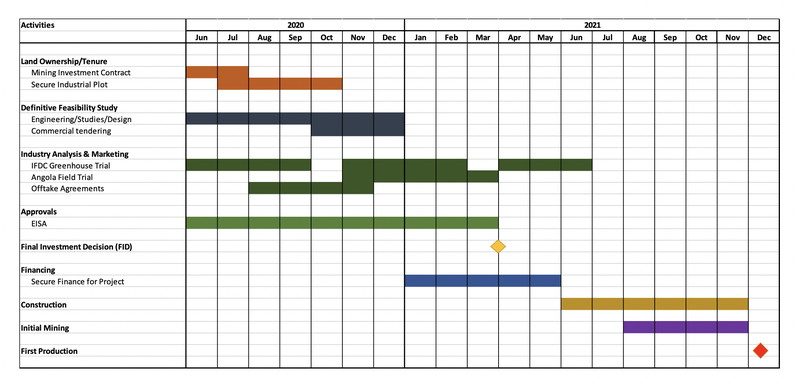

Minbos is currently proceeding with a DFS on the Project. The scope of which includes:

- Mine design and Reserves

- Granulation Plant Design

- Transport and Logistic Studies

- CAPEX and OPEX to +/- 15%

- Marketing Studies, including greenhouse and field trials

- Environmental and Social Impact Assessment (ESIA) including further baseline studies

- Completion of all approvals

- Field trials

Minbos also anticipates signing an off-take agreement with the Angolan Government as part of the DFS before the Final Investment Decision (FID).

Part of these discussions have focused on Minbos’ ability to develop export markets for up to half the product in neighbouring countries in Middle Africa.

Discussions with one possible customer have already taken place.

The DFS is expected to be complete within nine months with several areas currently underway.

Subject to long lead time items associated with the granulation plant which may be ordered prior to the completion of the DFS, construction is expected to take six months with first production estimated to occur shortly thereafter.

It is expected that approvals will be the critical element in the development schedule although global factors such as COVID-19 may also impact the schedule.

Based on the Scoping Study, there are reasonable grounds to believe that the project can be financed, with Minbos highlighting that the initial capital of between US$22 million and US$28 million is modest relative to the company’s $11 million market capitalisation, and the $20 million invested by Minbos in phosphate exploration and feasibility studies in the Congo Basin region.

Minbos has done an enormous amount of work at Cabinda and never gave up the fight, even when it lost the licence under the earlier JV structure.

That kind of dedication to a project is significant.

Minbos could have packed its bags and left Angola, but it decided to stay because while its project economics stack up, it also believes it can make a difference in the lives of sub Saharan Africans.

This is one of the compelling reasons why we have added the company to our long-term portfolio.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.