Looking for diversification? Here’s three stocks to consider

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Companies in the engineering, procurement and construction sector (EPC) can experience significant growth depending on the health of industries such as mining and essential services infrastructure development, but they can also come unstuck.

Not surprisingly, they were hammered during the GFC as activity in the mining sector came to a grinding halt.

During the mining boom many investors jumped on board companies that had a wish list rather than a workbook – a dire mistake.

Margin pressure can also weigh heavily and is an issue that traditionally comes into play when there are too many players vying for a slice of a shrinking pie.

A swag of new companies entered the mining services sector in the midst of the mining boom, but many have fallen by the wayside.

Reasonable sized engineering and construction groups that performed civil work in the CBD thought they could cash in on the mining boom by simply turning up at a mine site with a tractor and a dump truck.

However, the influx of inexperienced cowboys who generally quoted for work at commercially unviable pricing levels resulted in well-credentialed players in the sector either missing out on work or quoting at barely breakeven margins.

So what to do?

Focus on revenue visibility and margins

The good news is that there has been substantial industry consolidation, the failed entities have washed through and the mining industry is extremely active without looking like a boom/bust story.

The mining industry is, however, unpredictable as it is swayed by myriad factors including global economic growth and stability, commodity prices and exchange rates.

In consideration of this, the stocks we have focused on this week for Trifecta are companies with diversified revenue streams where income is generated from areas outside of the resources sector.

We also looked to identify companies operating in niche areas where margins tend to be better as a result of limited competition.

One of the other factors we focused on was revenue visibility, and on this note we took into account work in hand, the most reliable forward indicator, while also considering tenders in the pipeline which could be a share price catalyst.

The latter is considered a bonus, as tenders are more aligned with the unpredictable wish lists that tend to lull investors into a false sense of security.

On this note, Trifecta identified three stocks that fit the aforementioned criteria.

NRW Holdings Ltd

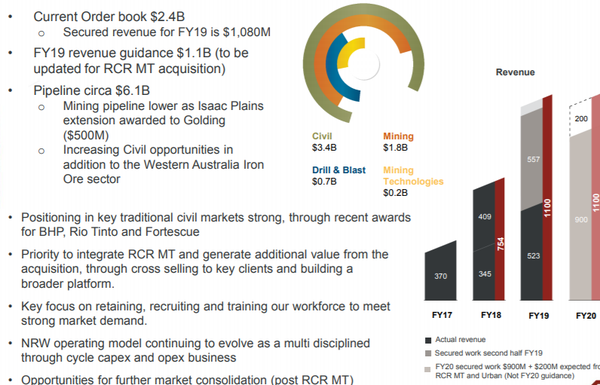

NRW Holdings Ltd (ASX:NWH) is a good example of what happens when you get it right, and the company certainly fits the bill in terms of providing diversification as a provider of contract services to the resources and infrastructure sectors in Australia with extensive operations in Western Australia, South Australia, New South Wales, Queensland and Victoria.

NRW’s areas of expertise cover a wide range of areas including civil engineering, bulk earthworks, concrete installation, contract mining and drill and blast.

Another point of difference is the group’s design capability, as it offers original equipment manufacturing of innovative materials handling products, complemented by a division that handles the refurbishment and rebuilding of heavy duty equipment.

The group generated EBITDA of $74.3 million from revenues of $521 million in the first half of fiscal 2019.

This represented underlying earnings growth of nearly 90% compared with the previous corresponding period.

Orders received during the six month period totalled approximately $1 billion, increasing work in hand to $2.4 billion.

In relative terms, the company finished the half year with minimal debt and cash of $82.7 million, up from $58.8 million as at June 30, 2018.

Capacity for further acquisitions

NRW has demonstrated a thirst for acquisitions in the past, and given the robust nature of its balance sheet management could use this as a strategy to harness growth.

Setting aside acquisitions, developers of large mining or civil infrastructure projects generally favour companies with strong management, robust financials and a demonstrated track record of delivering on expectations.

NRW has proven itself on all three counts.

While the company has the capacity for further growth, it is important to note that this impressive set of numbers has been building over a period of time as evidenced by the following three-year share price chart, demonstrating the company’s recovery from tough times following the GFC.

Trading at discount to industry group average

NRW’s order book suggests that revenue predictability over the next few years his strong and on this note the company chief executive Jules Pemberton provided a little more detail in saying, “Following the Eliwana and Koodaideri contract awards we already have over $900 million of work secured for fiscal 2020 which currently excludes contributions from the Golding Urban and RCR MT (acquired in February 2019) businesses.

“These businesses have consistently delivered $200 million of revenue per annum in prior years.”

This suggests that Hartleys analyst, Trent Barnett may not be far off the mark with his fiscal 2020 projections. Of course that is speculative and time will tell.

Barnett is forecasting NRW to generate EBITDA of $156.1 million from group revenue of $1.34 billion, equating to earnings per share of 24.8 cents, which implies a PE multiple of 9.3 relative to the company’s current share price.

Given that the average PE multiple for the sector is 15.7, Hartleys’ 12 month price target of $2.61, implying share price upside of 13% appears achievable.

Empired Ltd

Empired Limited (ASX:EPD) is a technology services provider with a broad range of capabilities targeted at delivering solutions that improve efficiency, productivity and competitive advantage for its clients.

This type of product offering is often advantageous during periods when companies are tightening the purse strings.

While those looking to cut costs will be keen to make that truck last longer rather than buy a new one, they will invest in technology if it is going to improve efficiencies, productivity and earnings.

Empired’s clients are medium to large corporate and government organisations within industries such as energy, natural resources, finance, insurance and transport.

The company also provides services for federal and state instrumentalities, as well as utilities which cover areas such as essential services, reinforcing the group’s exposure to non-discretionary spending.

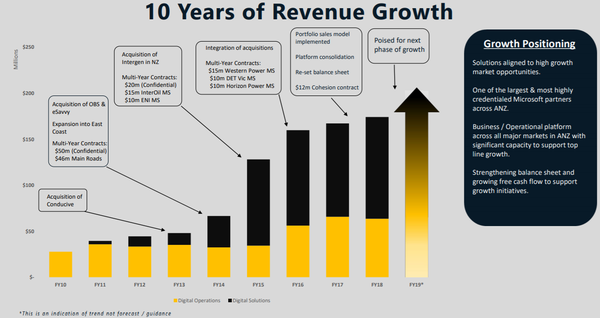

As indicated below, Empired has a strong track record of growing revenues, with the group’s digital solutions business growing exponentially since 2014.

The company achieved better gross margins in fiscal 2019 compared with the previous corresponding period, and management said that it expects this trend to continue as a large proportion of revenues are generated by the digital solutions division of the business.

Year-on-year EBITDA growth was strong, increasing 23% to $8.2 million.

Analysts at Bell Potter expect a significant skew in earnings towards the second half, demonstrated by their fiscal 2019 EBITDA forecast of $20.2 million.

The broker is expecting strong earnings per share growth of 65% in fiscal 2019, followed by growth of between 15% and 20% in 2020 and 2021.

The award of a Main Roads Western Australia contract is imminent, and the company’s success or otherwise in winning this contract could impact its share price.

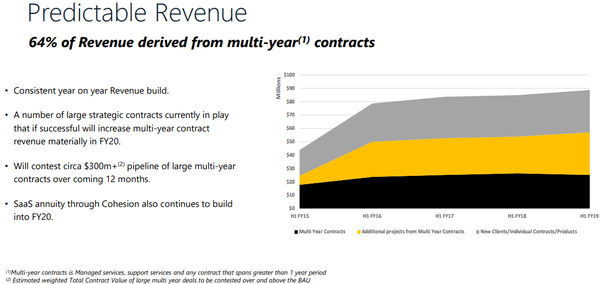

As indicated below, multi-year contracts account for more than 60% of group revenue, providing a sense of revenue predictability.

Bell Potter has a buy recommendation on the stock with a 12 month share price target of 65 cents, implying upside of approximately 40% to Monday’s closing price.

Primero Group Ltd

Primero Group (ASX:PGX) could be the dark course as a recently listed company in the sector, although it should be noted that the group was founded in 2011 and has an established reputation across a number of EPC disciplines.

The company’s shares hit an all-time high of 48 cents less than a fortnight ago, representing a three month gain of nearly 50%.

The recent retracement to approximately 42 cents may represent a buying opportunity, particularly given the consensus 12 month price target of 63 cents implies upside of 50%.

Primero provides engineering design, construction and operational services to the minerals, energy and infrastructure sectors.

The company has specialist expertise in project implementation and delivery with a complementary service offering comprising civil, structural, mechanical and electrical solutions.

Primero provides these services to a diverse client base, ranging from mid-sized companies through to international mining and energy groups.

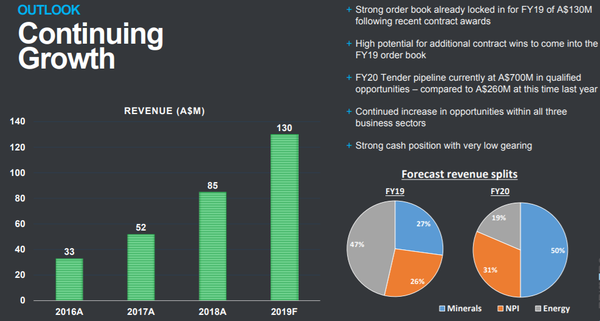

Having listed on the ASX in July 2018, the company outperformed prospectus forecasts for fiscal 2018 when delivering its results in August last year.

EBITDA of $8.9 million was slightly ahead of the prospectus forecast of $8.6 million.

In fiscal 2019, management expects to deliver substantial earnings growth, saying last week that it anticipates EBITDA to be in a range between $10.5 million and $12 million.

Another pleasing development was a recent revenue upgrade for fiscal 2019 from $130 million to $140 million.

The company may not be able to boast the billion-dollar workbook that some of the big players have, but importantly this isn’t factored into its share price, given that the company has net cash of $22 million and a market capitalisation of approximately $60 million.

Consequently, should the company be awarded some of the $200 million in projects where it has been shortlisted, one would anticipate a fairly sizable share price boost.

The following is a snapshot of how the group looked in December 2018, prior to management upgrading revenue forecasts to $140 million.

The other impressive feature of the business is that it is generating solid margins with the first half result and the full-year guidance both reflecting EBITDA margins of approximately 8%.

Primero has particular expertise in the construction of battery materials projects having been involved in developing projects for Galaxy Resources (ASX:GXY), Pilbara Minerals (ASX:PLS), Northern Minerals (ASX:NTU) and Tawana Resources (formerly ASX:TAW).

The group has completed several projects for majors such as Rio Tinto and Fortescue Metals Group in the mining sector and BP Australia and Chevron Australia in the oil and gas sector.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.