Look out for Baby Bunting as the retail sector starts to deliver

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

I have run the ruler across a couple of companies in the retail sector over the last month.

Many retailers appeared to be undervalued after heavy selling due to fears of a sharp downturn in sales as a result of the coronavirus.

However, it is worth noting that a large proportion of companies in the sector had been battered leading up to COVID-19 because of negative sentiment towards bricks and mortar retailers.

As a consequence, I was of the view that many companies in the sector had compelling investment metrics based on share prices relative to their earnings profiles.

Further, the bricks and mortar thesis can’t be applied to all companies as there are some that benefit from that type of model or have an omni-channel approach, a strategy that is generating strong sales growth for many retailers.

The one size fits all approach is a dangerous stance to take, and one that can lead to missed opportunities.

Write off bricks and mortar retailers at your peril

In the last month I’ve written about two companies in the retail space for varying reasons.

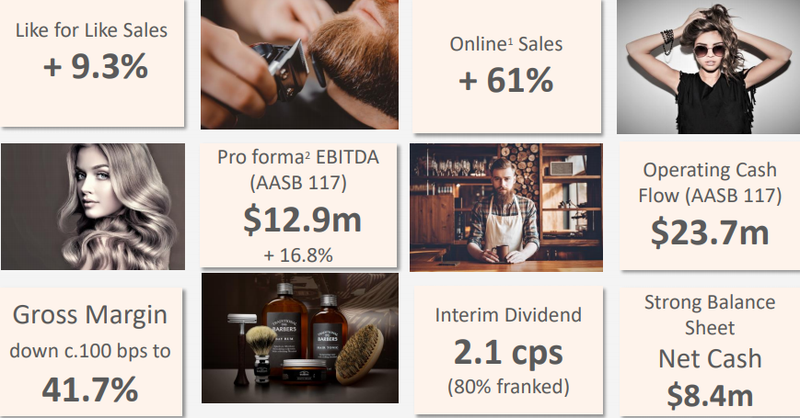

The first one was Shaver Shop Group (ASX:SSG) - I liked it because of its significant share of a fragmented niche market, as well as its achievements to date in terms of managing growth both operationally and financially.

There was also evidence that it had the ability to manage coronavirus interruptions reasonably well, and importantly it had been tracking strongly from a sales growth performance leading up to that point.

Shaver Shop hasn’t disappointed and just last week provided a promising trading update.

Despite the impact of coronavirus, like-for-like sales growth for the period July 1, 2019 to May 10, 2020 was 14.3%.

Because the company had already developed a highly functional omni-channel product sales platform well before coronavirus there was virtually a seamless shift to online sales which increased by 387% during the 6 weeks from April 1, 2020 to May 10, 2020.

Shaver Shop is in a net cash position with substantial undrawn debt facilities available, providing cushioning in case of headwinds, but by the same token giving it the firepower to take advantage of opportunities for expansion.

And on the score of opportunities, this was a good example of doing your homework and not listening to the herd when it comes to investing.

When I wrote about the company four weeks ago its share price was 41 cents, and largely as a result of the trading update it is now trading nearly 50% higher at 60 cents.

A holiday at home winner

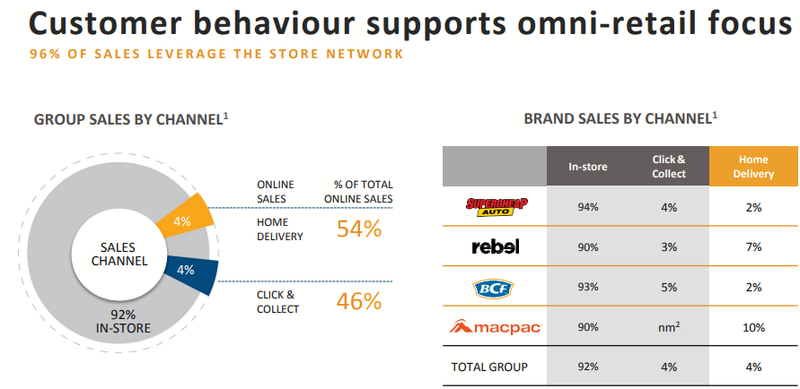

The other retailer I wrote about recently was Super Retail Group (ASX:SUL).

With well-known brands such as Supercheap Auto, Rebel and BCF (boating, camping and fishing), and trading on historically low multiples, the company looked ripe for the picking.

The group’s leverage to holiday at home spending was a real attraction and I am expecting some strong performances from BCF and Rebel in fiscal 2021.

As can be seen below, Super Retail has also demonstrated that it has established a strong omni-channel platform.

Given the movement on the share register there could be institutions thinking the same way with UBS Group AG and its related bodies corporate emerging as a substantial shareholder in mid-April.

Since I featured Super Retail Group as stock of the week its shares have increased 30% from $5.93 to a high of $7.68 yesterday.

Big things come in small packages

Hopefully, today’s stock of the week, Baby Bunting Group Ltd (ASX:BBN) will make for a trifecta.

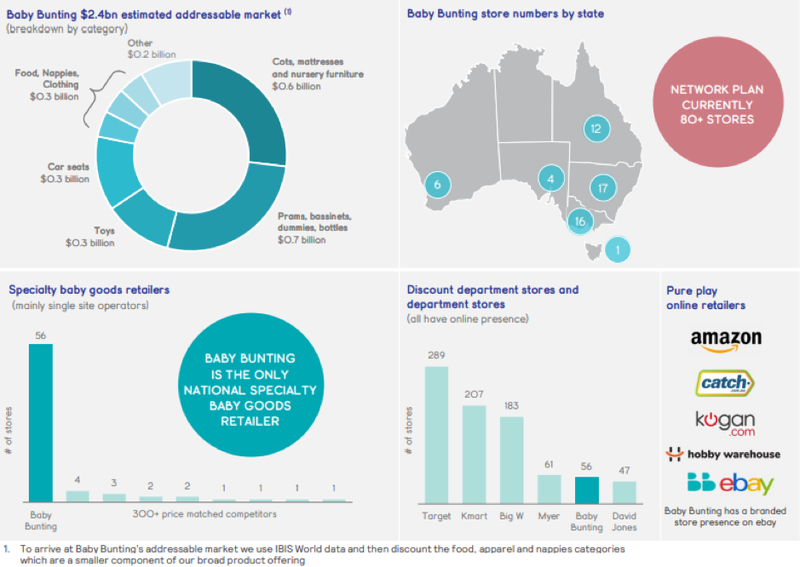

Baby Bunting is the only national specialty baby goods retailer with stores across all states.

Management estimates that there is scope to increase current store numbers of 56 to more than 80, making the group a scalable business that can generate growth through the established business, as well as by executing its store rollout strategy.

The following graphic shows the company’s comprehensive market coverage, while also demonstrating the scope for significant growth through expansion of its store network.

Management provided a positive trading update on May 19, triggering a significant share price run as it increased from $2.67 to yesterday’s high of $3.31.

On one hand, you could say that you may have missed the boat, but for risk averse investors it is useful to have seen a business update as recently as this week to understand how the business is handling the coronavirus environment.

As a snapshot, all Baby Bunting stores have remained open throughout the period, and the company has introduced ‘’no contact’’ click and collect as well as a novel ‘’Helping Hand’’ telephone assisted shopping service, to provide choice in how and when its customers choose to shop.

Baby Bunting’s strong performance in the first half of fiscal 2020, together with the success of the company’s coronavirus strategy is evident in the sales figures management released this week.

During the second half (December 30, 2019 to May 17, 2020), total sales were up 13.2% and same-store sales growth was 8.1%, with the latter being a metric that most retailers would view as an excellent achievement even in a buoyant environment.

For the same period online sales represented 17.3% of total sales, and with year-on-year growth of 66%, it is evident that the company is well advanced in taking advantage of online retailing opportunities.

The company is also in excellent financial shape with $35 million in undrawn debt facilities.

It is important to remember that many of Baby Bunting’s products, particularly those at a higher price point could be considered as non-discretionary spending.

Products such as cots, prams and baby capsules are essential items, and as the baby grows, different types of prams and car seats are a necessity.

Taking into account other consumable items such as nursery furniture, bassinets, bottles, nappies, toys and clothing, the addressable market in Australia is valued at $2.4 billion.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.