Johns Lyng a beneficiary of extreme weather events

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Though it may not appear to be the best time to be investing in stocks that generate revenues from construction activity, there is a ‘for all seasons’ company with a proven resilient business model that can withstand cyclical conditions in the building industry.

Furthermore, the group stands to benefit from extreme weather conditions and catastrophic events that have occurred in recent months, and the company’s involvement in rebuilding and repairing property damage during cyclones and storm events in Queensland and New South Wales is expected to generate substantial income in 2019.

Our Stock of the Week is Johns Lyng Group Ltd (ASX:JLG), a provider of integrated building services including restoration works.

The company services most areas of Australia with its core business built on its ability to rebuild and restore a variety of property and contents after damage by insurable events such as impact, weather and fire events.

Since 1953, Johns Lyng has grown into a national business with over 550 employees servicing a diversified client base comprising major insurance companies, commercial enterprises, local and state government and retail customers.

The company has continually broadened its areas of expertise through the addition of new businesses, and it continues to evaluate acquisitions which will add scale to its established businesses and/or provide the company with the capacity to generate new income streams from delivering complementary services.

Adding to Johns Lyng’s appeal was its interim result for fiscal 2019 which was only released yesterday, but was well received by investors with the company’s shares closing up 3.2% at $1.28 after trading as high as $1.33.

BAU and CAT both looking good

Johns Lyng generated revenue growth of 15.8% in its business-as-usual (BAU) operations, an important income stream as this provides consistent earnings as opposed to those generated by the likes of extreme weather events (CAT) where revenues are less predictable.

That said, the latter is where Johns Lyng has a significant market share, and the earnings boost from events such as the one in 500 year flood that affected Townsville and surrounding regions should be substantial.

This combined with the catastrophic New South Wales hailstorms which occurred during December 2018 largely contributed to management’s decision to upgrade its EBITDA forecasts for fiscal 2019.

Given the widespread devastation in Townsville and the early stage inaccessibility of some areas where replacement and repairs are required, revenues from this event could even flow into fiscal 2020.

On this note, chief executive Scott Didier said, “The strong performance in core activities was particularly pleasing given that non-forecast CAT events would drive a significant upside in earnings for the full year.

“Our core “business-as-usual” segments have consistently delivered over many years and they have yet again performed well during the half, in line with expectations.

“These are the reliable central plank of our business, based upon the strong relationships we own and the reputation we’ve built within the industry.”

These strong relationships are particularly important in being awarded CAT work.

Insurance companies have stringent criteria in relation to companies that are on their approved supplier list, and with Johns Lyng having long established ties with major entities such as insurers, loss adjusters and brokers there are strong barriers to entry.

With regard to the specialised services that the group offers, there needs to be a comprehensive understanding of the policies/claims industry, a demanding aspect of the work that is difficult for would-be entrants to replicate.

Johns Lyng is in fact the only fully integrated service provider with a national presence, and simply having the capacity to quickly mobilise equipment and personnel nationally in response to sharp demand/volume fluctuations is particularly important in terms of securing CAT work.

The company’s range of brands and the insurance building and restoration services division’s first half financial performance is detailed below.

Though Johns Lyng has proven its ability to generate organic growth, while creating new revenue streams through acquisitions, the company also has important macro-economic dynamics working in its favour.

Core population growth combined with the positive impact of immigration is a natural driver of new property development.

Insured property values continue to increase, a natural inflationary factor that works in the company’s favour.

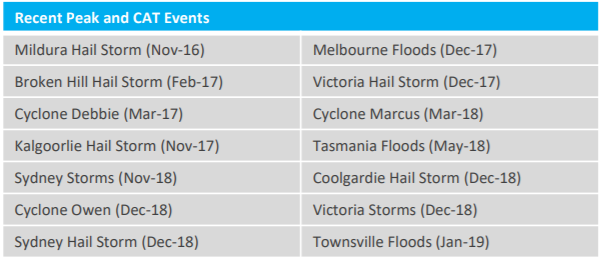

As is widely documented in reports addressing the issue of climate change, the frequency and magnitude of CAT events is increasing.

The following is a snapshot of major CAT events that have occurred just in the last two years.

Interstate expansion

Management is looking to respond to market growth drivers and adequately position itself in areas of high activity by expanding its presence in New South Wales, Queensland and Western Australia.

On this note, the company entered into a new service relationship agreement with a major Western Australian-based insurer in December.

This insurance group provides repair work on up to 1000 properties per quarter.

The agreement will take effect from February 1, 2019 for an initial 12-month term, with provision for a further five years.

It covers both business-as-usual claims, and claims made during peak events such as storms and floods.

Based on the timing of the agreement, it should have a significant impact on fiscal 2020 earnings.

JLG forges new relationships

Organic growth in 2018 was supported by the award of several new contracts with major national insurers.

These included the group’s appointment as a preferred supplier for strata building claims in New South Wales and strata large-loss (more than $50,000) in New South Wales and Queensland.

Johns Lyng established a designated Strata Services Building division in February, initially available throughout New South Wales, ahead of a nation-wide rollout.

The new division will focus on building and restoration repairs for strata insurers, adding to the group’s existing suite of services across the Australian insurance building and restoration industry.

Discussing this initiative, Didier said, “With an estimated 2.5 million strata lots nationwide, (at an insured value of around $995 billion), a dedicated strata division presented a compelling new opportunity for JLG.

“With the ongoing residential apartment construction boom along the east coast, continued population growth in major cities, and more people choosing strata apartment living, this is a real opportunity to introduce JLG’s expertise into this sector.”

One of the most significant developments for the group in terms of relationship building occurred in early December as it entered into an exclusive master services agreement with Suncorp Group.

This arrangement will see Johns Lyng facilitate all domestic property repairs for insurance claims estimated at greater than $100,000.

The nationwide agreement is for a minimum two year period with provision to extend for a third year.

Given the negotiation of the agreement required a successful trial period covering both business-as-usual claims, as well as CAT work, this represents a strong endorsement from a major insurance group.

The company also one a large contract towards the end of 2018, with a $26 million redevelopment project awarded by the Yarra Ranges City Council.

Management establishes record of outperformance

It is always a good sign when companies underpromise and deliver on the upside.

Johns Lyng only listed on the ASX in October 2017, but the company has been quick to establish such a record.

This has generally been reflected in its share price which traded as high as $1.58 less than six months after listing, a significant premium to the IPO price of $1.00.

Although the group generated underlying EBITDA of $23.5 million in fiscal 2018, comparing favourably with the prospectus forecast of $20.8 million, a disappointing performance by the commercial building services division (CBS) appeared to dampen investor sentiment.

CBS returned to profitability in the first half of fiscal 2019, recording EBITDA of $1.1 million.

The fiscal 2018 result was delivered at the end of August just as the capitulation in global equities markets unfolded, resulting in an exaggerated sell-off which saw the company’s shares briefly trade in the vicinity of 80 cents.

However, the company is now trading back in line with consensus price targets, and having delivered a strong first half result there could be more upside to come.

It is worth noting that management has flagged normalised EBITDA growth of 8% for the full year which would see it beat Bell Potter’s fiscal 2019 projections made prior to the interim result being released.

Consequently, as brokers crunch the numbers it wouldn’t be surprising to see an increase in forecasts which could result in share price momentum.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.