Is it time to snap up Shaver Shop Group Limited (ASX: SSG) while it is cheap?

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shaver Shop Group Limited (ASX:SSG), is an Australian specialty retailer that tends to fly under the radar. This, along with some exaggerated COVID-19 related selling, now sees the company trading on very attractive fundamentals which may mean its time to snap the stock up while its cheap.

The company sells male and female personal grooming and beauty products through a chain of more than 120 stores across Australia and New Zealand, as well as having a strong online presence which in the first half of fiscal 2020 generated 17.6% of sales.

Consequently, the company is dealing with the shift to online retailing very well, and this is likely to stand it in good stead while bricks and mortar stores are closed for business.

The retail sector copped a hammering in 2019 as many bricks and mortar companies underperformed.

With many market commentators claiming the days of shopfront retailing were over there was a definite knock on the sector.

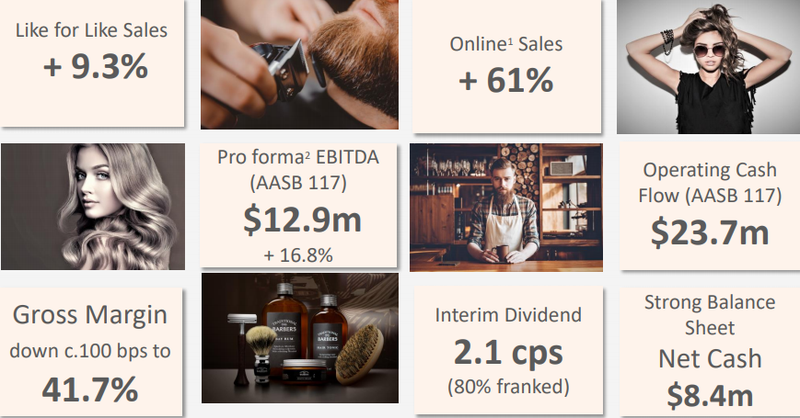

But have a look at these numbers and you will see that Shaver Shop is in a particularly robust financial position with net cash of $8.4 billion, strong sales and earnings growth and gross margins in excess of 40%.

Whenever there are broad-based sector sell-offs you can be sure there are buying opportunities, and in the case of Shaver Shop it is one of those businesses where customers are more likely to want to touch and feel a product before purchasing.

This is definitely a company for contrarian investors as they take advantage of compelling valuation metrics which are to some extent a function of a broader sell down in equities, negative sentiment towards the retail sector and general COVID-19 fears.

As the seriousness of coronavirus took hold, shares in Shaver Shop plunged from 78.5 cents to a low of 23 cents.

While the company was sold down more heavily than many other retailers, it has also recovered much more strongly with Monday’s closing price of 44 cents representing a near doubling in its share price in a month.

It is important though to look beyond the exaggerated fall and the size of the rebound and examine the underlying business, its earnings profile, scope for growth and valuation metrics.

Emergence of new markets presents increased opportunities

Examining the underlying business, it is important to note the change of behaviours of the company’s core markets.

A key trend in recent years has been the increasing acceptance, particularly for the millennial generation, for men to have health and beauty regimes that are similar to those that have existed for women over many years.

Not only does this apply to hair cutting, hair trimming and hair removal solutions for the head and body, but also increasingly relates to skin care and overall health and beauty.

This is leading to increased demand for salon quality beauty and personal care products that can be used in the home, a trend that major global suppliers have responded to in terms of developing innovative products for males and females.

With a track record spanning more than 30 years as a specialty retailer solely focused on this sector, Shaver Shop has established strong brand awareness and reputation with consumers.

The company benefits from the long established relationships that have been forged with its supplier partners.

These facilitate exclusive access to many new product innovations that come to the market each year.

The combination of all of these factors means Shaver Shop is uniquely positioned to gain an increasing market share in a sector that is experiencing increasing levels of activity.

The industry remains extremely fragmented, a factor that works in Shaver Shop’s favour as it provides the company with better buying power and competitive advantages when it comes to product sales.

Robust earnings growth set to continue

Shaver Shop has delivered strong sales growth in recent years through the rollout of new stores, improvements in its range and service offering and growth in its online business.

The company delivered record first half sales in fiscal 2020, up 12.3% to $107.5 million.

Like-for-like store sales were up an impressive 9.3% as the company chalked up its 12 consecutive month of like-for-like store sales growth.

This is an important measure when it comes to examining sales trends as it excludes extra sales that are made through store openings, effectively highlighting the increased capital returns that are being achieved from the group’s established assets.

However, a continuation of the company’s store rollout strategy will also continue to drive strong revenue growth in coming years.

Shaver Shop aims to grow its total store network numbers across Australia and New Zealand to approximately 140 within the next three years.

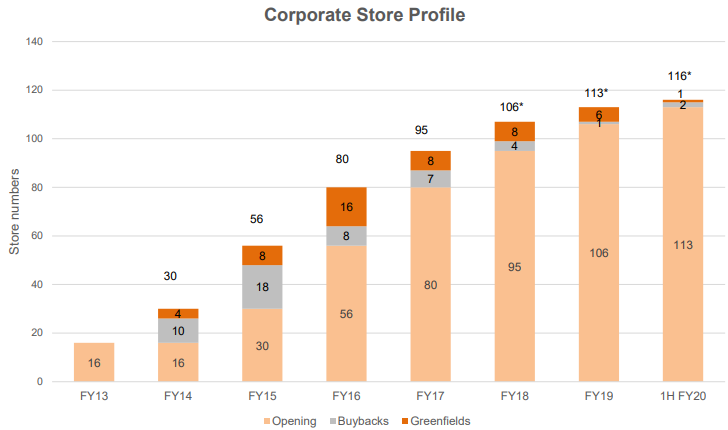

Many retail chains and services groups that involve a franchise model have come unstuck in recent years, and it is comforting to see that Shaver Shop has extremely limited reliance on franchisees.

Step back five years and you will see that eight of Shaver Shops’ 80 stores were run by franchisees.

There is only one franchised store left as management has been buying these stores back at attractive multiples, providing the group with a more robust and predictable revenue and earnings profile, while also positioning itself to optimise efficiencies and operational performances.

Earnings tracking strongly leading up to COVID-19 update

Management provided a comprehensive update of the company’s business as it faces coronavirus challenges.

This was released as recently as late March, providing investors with an up-to-date insight as to how the company is positioned to perform in the three months leading into the end of fiscal 2020.

With restrictions likely to result in some of its stores remaining closed for a good part of that period it was pleasing to see that the company was performing well leading up to the shutdowns.

The group’s trading performance in January and February continued to be strong, with like for like sales up 9.3%.

For the eight months ended 29 February 2020, EBITDA was approximately $14.4 million based on unaudited management accounts.

This compares favourably with management’s fiscal 2020 EBITDA guidance provided on February 21, 2020 which was in a range between $14.25 million to $15.75 million.

The earnings guidance provided at that stage assumed no material impact in the second half from the coronavirus.

While the landscape has changed, it is worth noting that in the space of eight months the company had already generated EBITDA in excess of the bottom end of management’s full-year guidance.

Given the unpredictability, I believe it is best to value Shaver Shop on look through earnings projections for fiscal 2021.

Consensus forecasts point to earnings per share of 7.2 cents which doesn’t look a stretch given that the company generated earnings per share of 5.5 cents in the first six months of fiscal 2020.

Based on these projections, Shaver Shop is trading on a PE multiple of 5.8, extremely conservative for a company that is generating double-digit earnings growth.

The consensus dividend forecast for fiscal 2021 is 4.6 cents, implying a yield of more than 10%.

Consequently, the fundamentals are strong and with a favourable post-coronavirus industry outlook driving growth from new and existing stores, the company has plenty going for it.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.