Game changing acquisition positions Uniti, our Stock of the Week, for share price growth

Published 19-JUN-2020 11:06 A.M.

|

5 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

It was just this week that analysts at Bell Potter ran the ruler across diversified telecommunications company Uniti Group (ASX: UWL), making earnings upgrades and increasing their price target to $2.25 following the $532 million acquisition of Opticomm, a transaction that will drive substantial growth in the near to medium-term.

Bell Potter’s price target implies share price upside of 32% relative to Thursday’s closing price of $1.70

Uniti’s share price traded strongly during late-April and throughout May to hit a high of $1.72, but when the Dow plunged more than 1800 points last week it retraced to $1.54.

While the share price recovery that occurred this week can be in part attributed to a recovery in equities markets, it was the game changing acquisition that should be the focus when assessing the company’s growth profile, scope for further expansion and underlying valuation.

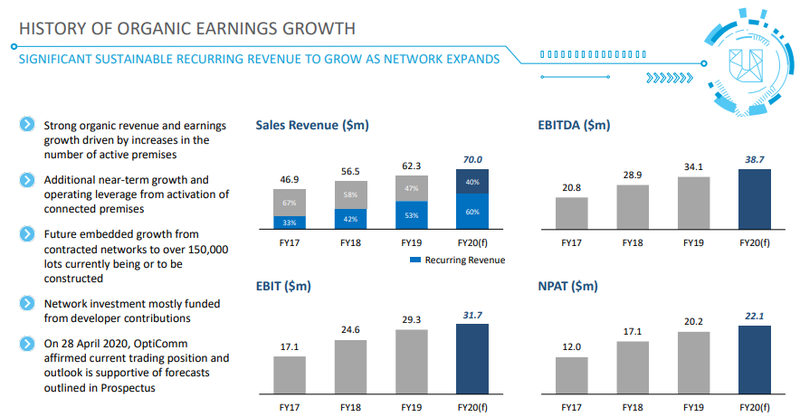

As a backdrop, Opticomm is one of the largest private providers of telecommunications infrastructure networks in Australia, and the group is expected to generate revenues of $70 million in fiscal 2020.

Importantly, it is a high margin business, underlined by EBITDA projections of $38.7 million in fiscal 2020.

Highlighting the potential earnings boost that Opticomm provides, Uniti’s pro forma post-acquisition EBITDA is $86.7 million.

One of the other key benefits of Opticomm is the earnings predictability that it brings to the group because of the significant proportion of recurring revenue.

Vocus, TPG, M2 team at the helm

Management estimates that the acquisition will be immediately earnings per share accretive to the tune of 23% with increasing incremental growth to occur as synergies are realised.

However, it is one thing to make projections regarding anticipated synergies, but another to actually realise these expectations in the form of increased revenues and earnings.

The good news for Uniti is that the company already has established a track record of successfully integrating acquisitions, but arguably of more importance, it has high profile executives including managing director Michael Simmons who has taken other ASX listed telcos down this path before.

Simmons has nearly 40 years of experience in the media and telecommunications industry as a CEO, Director or CFO over this period.

He was the founding chief executive of TPG Telecom (formerly SP Telemedia Limited/NBN Enterprises Pty Ltd), a non-Executive Director of M2 Telecommunications Limited, managing director of Terria (the industry bid to build NBNCo) and chief executive of Vocus Group.

TPG, M2 and Vocus all delivered outstanding shareholder returns on the back of growth by acquisitions.

The following chart shows the outstanding share price performance of TPG Telecom (ASX:TPM) that was largely attributed to the substantial earnings growth that stemmed from acquisitions during the period.

As M2 acquired approximately 20 companies over the course of 15 years, it transitioned from a mere minnow to a group valued at about $1.3 billion, and another Uniti executive in Vaughan Bowen played an active role in the process.

Bowen has held various directorships over the past 10 years, was the founder of M2 Group Limited, previously chairman of Vocus Group Limited and is currently the chairman of the Telco Together Foundation.

While M2 was acquired by Vocus, the following historical share price chart shows its strong acquisition led performance between 2006 and 2016 with the last leg up being its response to the Vocus takeover.

Bowen joined Uniti Group Limited in the role of Executive Director in March 2019 to lead the company's mergers and acquisitions activities.

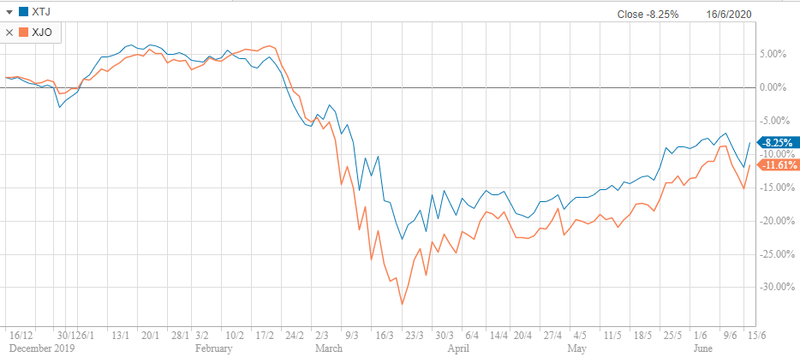

Before examining the operational benefits of the Opticomm transaction, it is worth noting the performance of the broader S&P/ASX 200 Communication Services index (XTJ) throughout the recent period of volatility.

With communications services being of an essential nature, the sector has historically been a defensive area to park your money.

This is still the case, as evidenced by the following chart (as at 16/06/20 - date Opticomm acquisition announced), which shows the degree of outperformance by the XTJ (blue line) over the last six months, but more importantly the significantly shallower trough at the bottom of the downturn demonstrates the sector’s resilience and stability.

Opticomm has dominant positions in niche markets

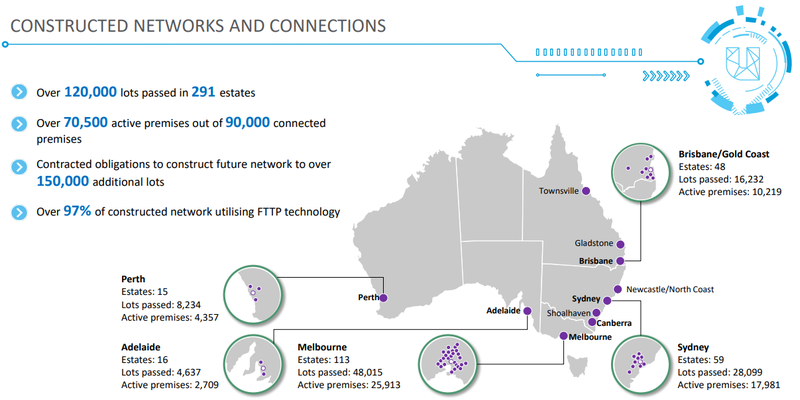

Opticomm is a designer, builder, owner and operator of wholesale open access telecommunications infrastructure networks.

The group is a national provider of fibre-to-the-premises telecommunications networks to new residential, commercial and retail developments.

It has a particularly strong competitive position in greenfield sites, and management has made good progress in targeting markets such as retirement living and community precincts.

With growing demand for high-speed Internet connectivity, the company’s products and services should be highly sought after, and there is a legislative requirement for fixed line fibre telecommunications infrastructure to be made available in new housing developments, effectively providing regulatory support.

While we already emphasised the importance of Opticomm’s business model in terms of earnings visibility from its established businesses, it is also worth noting the growth transparency that is evident when considering that it has a current combined order book of nearly 190,000 contracted lots for future delivery.

Opticomm has 39 retail service providers on its network, as well as long-term relationships with developers.

The company’s success in expanding its presence, particularly on the eastern seaboard is demonstrated below.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.