Find the sector, follow the money, find the stock - Hansen Technologies (ASX: HSN)

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Even since markets plateaued in late March following the coronavirus fallout, it has been a rollercoaster ride for investors.

Trying to identify a sector to target has been difficult with different market segments falling in and out of favour over the last month.

The energy sector is a good example with investors abandoning even the blue-chip companies in the S&P/ASX 200 energy index (XEJ), resulting in a fall from about 11,000 points in mid-February to 5000 points on 23 March.

While some of those stocks have come back into favour, it has been a two steps forward, one step back recovery, and the index is still 4000 points below where it was three months ago.

Over the last three months, the S&P/ASX 200 index (XJO) has fallen 22% while the XEJ is down 35%.

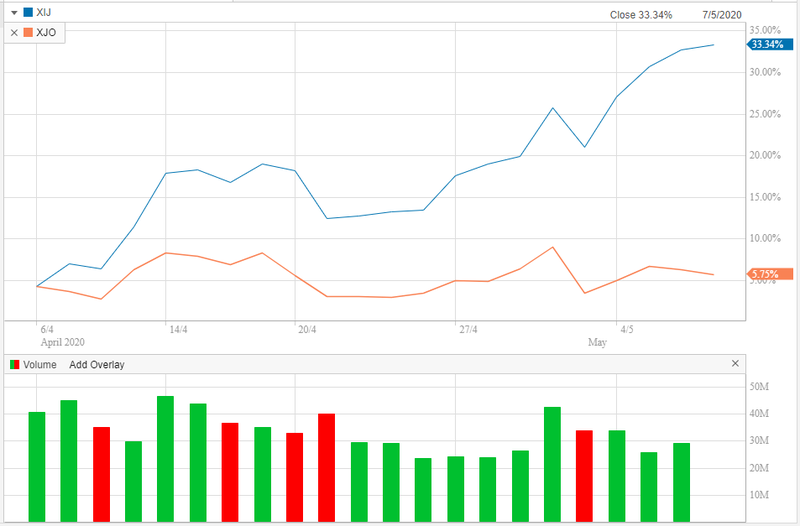

In weighing up the relative performance of various sectors against the XJO, it was the Information Technology index (XIJ) that jumped off the page.

A snapshot of the last month shows that the index is up 33.3% compared with a 6% gain in the XJO.

In a fickle market, finding consistency is important.

Over the last 20 trading days, the XJO has experienced falls on 11 occasions.

By comparison, there have only been five days during the same period where the XIJ hasn’t gained ground.

It could even be argued that our tech stocks are outperforming those in the US on an index basis as the NASDAQ is only up about 10% over the same period.

However, similar to the US our tech stocks trade on demanding multiples and it is often hard to find a good quality stock that hasn’t already run hard.

Track the essential services dollar to identify resilience

Finfeed has drilled below the top tier stocks by market capitalisation in the sector to identify a very promising player that has a long history of under-promising and outperforming.

Importantly, it hasn’t slipped back onto the radar, but that may not be the case for much longer.

With a market capitalisation of $560 million and a compelling valuation relative to its peers, it is likely that Hansen Technologies Ltd (ASX:HSN) will be back in favour very shortly.

One of the key factors why I like Hansen is that it generates all of its revenues from industry segments that for the best part are linked to non-discretionary spending, or more specifically essential services.

Hansen provides tech solutions and services to providers of communications, electricity and water services.

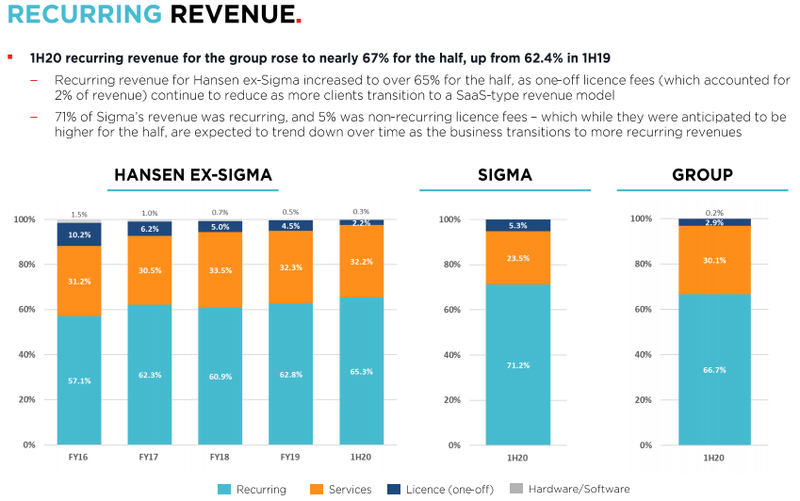

Importantly, a substantial proportion of the company’s revenues are of a recurring nature, providing income and earnings predictability.

In fact, recurring revenues accounted for 67% of first-half fiscal 2020 income, up from 62.4% in the previous corresponding period.

A recent acquisition has the potential to enhance the level of recurring revenues generated by the company as it as a standalone business is generating recurring income of 71%.

When coronavirus hit, demand for water, power and telecommunications didn’t dry up, in fact, there was an escalation in usage and demand for communications services.

With over 40 years’ experience, Hansen is a leading global provider of billing and customer care technologies for energy, water, pay-TV operators, and telcos.

While its headquarters are in Australia, Hansen has offices in North and South America, South Africa, Europe and the Asia Pacific, servicing customers in over 90 countries around the world.

Significance of Sigma

On 1 June, 2019, Hansen acquired the Sigma Systems business.

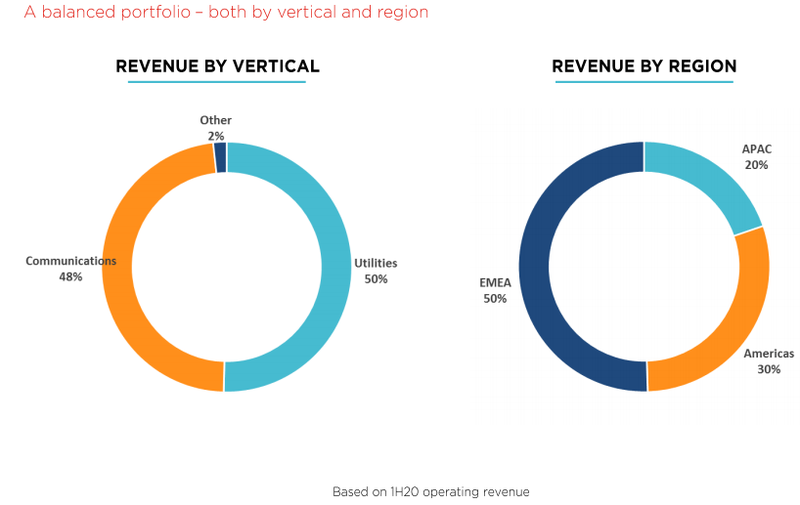

This acquisition resulted in the re-balancing of the group’s market portfolio which, post the acquisition of Enoro in fiscal 2018, was initially weighted towards the utilities sector.

Sigma’s revenues concentrated in the communications sector and the group’s revenue portfolio is now re-balanced to ensure greater diversification across multiple industries, regions and clients.

With Sigma comes cross-selling opportunities, especially given the transformation that is occurring within the utilities sector.

The first of such opportunities have been realised with a cross-sell by Sigma into Hansen’s energy customer base.

Simply Energy in Australia is applying Sigma’s catalogue and other products working in tandem with Hansen’s existing systems, allowing the group to further digitally enable their business in negotiating new complexities in the energy market.

With changes in energy pricing structures and an expansion of product offerings to encompass new energy solutions and services such as solar power, electric car charging and battery storage this has become a fluid industry.

In tandem with the dynamic changes within the utilities sector, there is a proliferation of new communications products which will accelerate as 5G gains momentum.

In the utilities sector, the production of green energy continues to rapidly evolve, with increased awareness and demand for the product, with advances in technology lowering the cost of production, improving grid integration and increasing retail demand for the product.

The more complex, the more dollars

Hansen has continued to ensure that product development is addressing its customers’ ability to add new products to their customer offering and addressing the emerging billing complexity.

The acquisition of Sigma appears timely given the communications market and technology generally continues to accelerate with the world’s reliance on smart devices and the desire to interact with the world increasing the demand for a broader range of innovative offerings.

In recent years, this has presented itself in various entertainment options being delivered on mobile devices together with an explosion in the number of apps.

This is poised to continue as faster platforms like 5G provide connection speeds enabling higher levels of connectivity and complexity.

These developments continue to increase the level of bundling offered by the likes of telcos who are Hansen’s customers.

With increasing levels of complexity required to be addressed by the customer care and billing systems, the need for Hansen’s services is likely to accelerate, as will its recurring revenues.

We spoke earlier about the challenges of identifying value in a sector that is back in favour.

As a guide, Hansen is trading on a forward PE multiple of 14.3, well below the industry average.

It is also worth noting that PE multiples are usually a reflection of a company’s growth profile, and on this note, Hansen is forecast to generate substantial earnings per share growth in coming years as it benefits from a full-year contribution from Sigma, cross-selling opportunities and organic growth within the communications and utilities sectors.

The consensus share price target of $3.95 implies share price upside of 40% relative to the company’s current share price.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.