Diversification delivers dollars for Decmil

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Earlier this week Finfeed ran the ruler across three stocks that provide engineering and construction services, stressing the benefits of diversification in terms of industries and clients serviced.

Decmil Group Ltd (ASX:DCG) offers a diversified range of services to the Australian and New Zealand resources and infrastructure industries, and it continues to broaden its areas of expertise, making it our Stock of the Week.

The company’s divisions specialise in civil engineering and construction, accommodation services and maintenance.

Renewable energy capabilities

Demonstrating the extent of its diversification, just yesterday the company was awarded a $72 million contract for the balance of plant works undertaken at the Warradarge Wind Farm in Western Australia.

The contract will be with leading global wind energy group Vestas, with the project located 200 kilometres south of Geraldton in Western Australia.

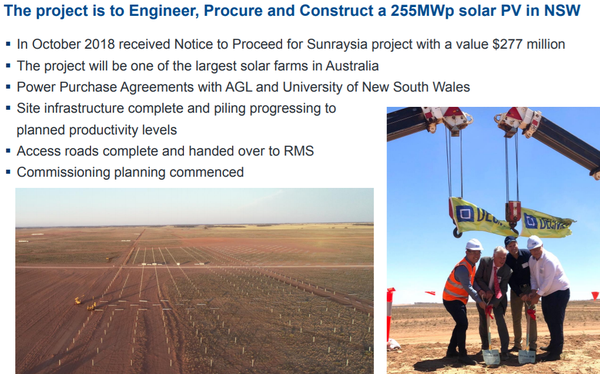

Decmil is carving out a niche for itself in the renewable energy space having been awarded a $277 million solar contract for Sunraysia which will be one of Australia’s largest solar farms.

Power Purchase Agreements in relation to the project have already been negotiated with AGL and the University of New South Wales.

Decmil looks like it could be in the early stages of a substantial comeback.

If you look at the following 12 month chart you will notice that the company made its most decided break above the trendline at the start of February as it pushed up to levels of approximately 80 cents.

The fact that it has gone on to consolidate this position and even trade as high as 92.5 cents last Thursday following the release of its interim result for the six months to December 31, 2018 suggests that it may be in for a sustained recovery.

Analysts see significant upside

Analysts at Argonaut believe there is further upside to come, having recently increased their price target from $1.10 to $1.20 in response to the group’s interim result released last Thursday.

The broker noted on Thursday morning that Decmil had been awarded an ‘early works package’ in relation to the construction of the Mordialloc Freeway Victoria.

While the value of this contract was $25 million, the company has a strong track record when it comes to contract extensions and renewals, and with this being a $375 million project there is scope for further involvement.

Decmil has also been awarded important new transport infrastructure construction work, including an $86 million project with the Major Road Project Authority in relation to the design and construction of the Drysdale Bypass in Victoria.

Analysts at Hartleys are bullish on Decmil, attributing a 12 month price target of $1.33 to the stock. Of course this, and any broker price target, is speculative and may not come to bear.

Institutional support from value investors

The recent share price strength can also be attributed to the group’s positive outlook, referenced in management’s upbeat guidance in late November that included the following comments by managing director, Scott Criddle:

“We are currently exposed to a strong tender pipeline with continued focus on the Resources, Infrastructure and Renewable Energy sectors across Australia and New Zealand.

“These sectors are experiencing strong market conditions and accordingly our pipeline extends revenue visibility to FY20 and FY21.

“Consistent with this, our outlook is strong, with FY19 revenue now expected to exceed $600 million.

“Our recent $50 million capital raising has added financial capacity to the balance sheet to support bigger projects.

“The group continues to see strong market conditions across a number of its key sectors.”

Highly regarded institutional investment house, Thorney International topped up its holding during the capital raising, increasing its stake from 9% to 10.2%.

Thorney is traditionally a conservative investment group, strongly focused on finding value in stocks that are under-priced.

Given the placement price was 80 cents per share, it is fair to say Thorney would be expecting substantially more upside from current trading levels.

Strong revenue and earnings growth

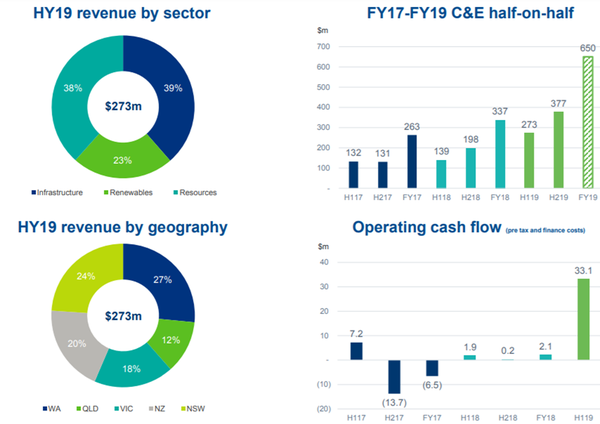

Decmil’s interim result featured a near doubling of revenues to $276 million with underlying earnings from continuing operations of $9.3 million, up from $1.3 million in the previous corresponding period.

The company is generating robust cash flow, and had net cash of $95 million as at December 31, 2018.

This is important for companies in the engineering and construction sector as it enables them to bid for high-value projects.

As the company gets into its stride it may well return to its past strategy of paying stronger dividends than are generally available in the sector.

Management reaffirmed its revenue outlook in February with approximately $650 million of committed revenue for fiscal 2019 and more than $400 million of work in hand in fiscal 2020.

Decmil offers geographical diversification through its New Zealand business which has been involved in the construction of a NZ$185 million Corrections Project.

The following shows the fairly even distribution of revenue by sector and geography.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.