Apollo reaches new heights as RVs take off

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

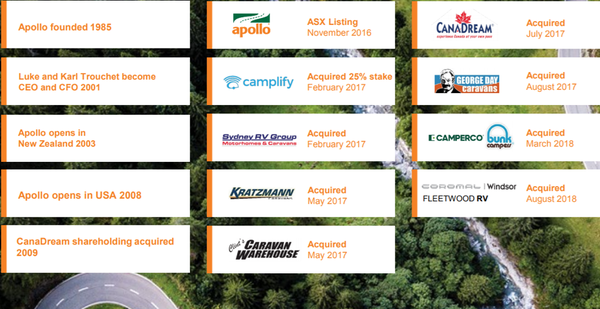

Our tock of the week is Apollo Tourism and Leisure (ASX:ATL), a company that has not only established a strong-track record since listing on the ASX in November 2016, but also stands to benefit significantly from acquisitions and other initiatives undertaken in 2017/2018.

Furthermore, the company, which has been operating for more than 30 years, has some important macro factors working in its favour which should make for positive trading conditions in the next 12 months.

Because Apollo has a broad range of product offerings and an international presence, it is essential to gain an understanding of the markets that it services, as well as its industry positioning and the changing dynamics that are impacting consumer behaviour.

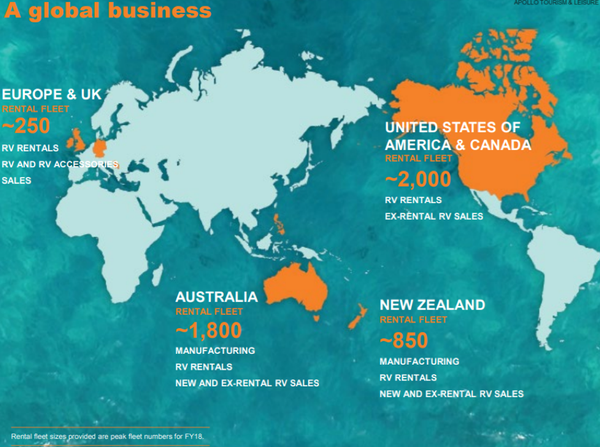

Established in 1985, Apollo is now a leading Australian tourism leisure company, and with operations in Australia, New Zealand, North America, the United Kingdom and Ireland, it is highly leveraged to the increasing number of self-drive travellers.

It has grown into a multi-national company focused on manufacturing, rental, sales and distribution of a range of recreational vehicles (RVs), including motorhomes, campervans and caravans.

International visitor numbers continue to grow in all markets

Apollo's fleet is estimated to be the biggest in Australia and among the largest in all of the other jurisdictions where it is represented.

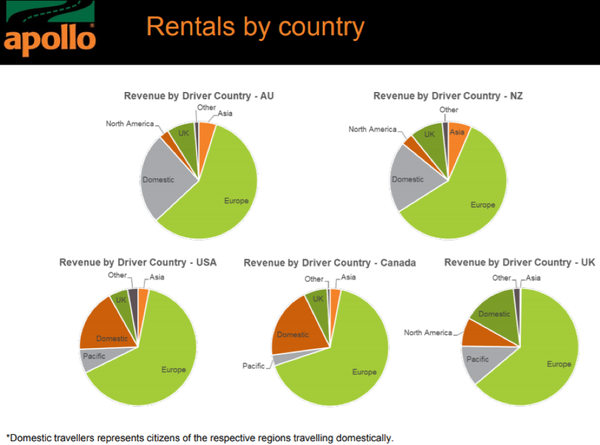

Indeed, the company is experiencing increasing international visitor numbers in each country it operates in, and this supported growth in rental demand during 2017-2018.

Industry forecasts indicate further growth driven by ageing populations in all of its geographical regions, as well as continuing to drive growth in RV sales, with middle to retirement-aged customers remaining the group’s primary sales demographic.

Ageing population and millennials boost sales

With that in mind, management has also seen a significant increase in the number of millennials (aged 22 to 37 this year) buying RVs, with a noticeable drop in the average age of its customers.

With a broad variety of sizes and types of vehicles available, there is now an RV to appeal to all corners of the market, as well as catering for varied budgets.

This is an important factor in terms of the company’s medium to long-term outlook, as millennials mature.

With regard to macro factors, these are particularly relevant to its Australian division which has an 1800 strong rental fleet.

A combination of sustained low wage growth, a depreciation in the Australian dollar and, more recently, a dampening in the property market, are factors likely to support the ‘holiday at home’ option, as opposed to travelling overseas.

Consequently, while Australia experienced strong year-on-year growth in international arrivals in 2018, a trend that is expected to continue in 2019, the domestic market makes a sizeable contribution to rental revenue and earnings from the group’s Australian operations.

From an overall perspective, rental demand grew in all of Apollo’s operations during the year, supported by increasing international visitor numbers in every region, with rental revenue increasing by 66.0% to $136.7 million.

A snapshot of the rental dynamics across Apollo's international markets:

Vertically integrated model addressing all markets

During the last year, Apollo capitalised on opportunities that progressed its strategic goal of becoming an end-to-end global RV solution.

The strong performance for the year was underpinned by the ongoing growth globally in leisure tourism, increasing demand for experiential travel, and growth in the RV segment from both an ownership and rentals perspective.

With expansion in the sales and rental areas of its business, Apollo is well-positioned to benefit from these ongoing trends, continuing its strong growth trajectory.

A glance at the company’s financials tells a story with revenue for the year ended 30 June 2018 of $355.6 million, representing an increase of 107.3% over the previous financial year.

Statutory net profit after tax was $19.2 million, an increase of 122.1% over 2017.

Underlying net profit after tax was $19.5 million, up 40.6% on the previous financial year.

Acquisitions pave the way for retail growth

With industry consolidation and the usual benefits that come from economies of scale, including cost efficiencies and increased market share, Apollo has aggressively expanded its presence through acquisitions.

These have strengthened its position as the largest owned retail sales network in Australia and accelerated management’s strategy to grow retail sales and leverage the Winnebago, Talvor and Adria brands.

The earnings boost received from these acquisitions was not only evident in fiscal 2018, but there should be further traction in 2019.

Earnings Before Interest and Tax (EBIT) from the Australian operations grew very strongly, increasing by 57.1% to $18.2 million.

Increased rental demand and a full year of trading from the Kratzmann and Sydney RV retail sales businesses, acquired in fiscal 2017, supported this outcome.

Further income growth is expected for fiscal 2019, with solid indicators for forward rental bookings and consolidation of Apollo’s retail sales strategy, including the recent post-fiscal 2018 acquisition of the Fleetwood Corporation’s (ASX:FWD) RV, Coromal and Windsor caravan brands.

From early 2019, Apollo will manufacture motorhomes and caravans under these brands, leveraging the capacity of its Brisbane facility to create cost efficiencies.

Apollo’s existing Melbourne rental and retail sales sites will also be consolidated into the Fleetwood Corporation retail location at Campbellfield.

Fleet flexibility a competitive advantage

Apollo’s dynamic fleet model provides the flexibility to lease vehicles over short timeframes to temporarily expand rental fleets during peak period — an important benefit of having a vertically integrated model, unlike most of its competitors.

This boosted rental revenue in Australia during the year and will be expanded in fiscal 2019 with the introduction of new vehicle types to the fleet.

EBIT from the New Zealand operations increased by 15.3% to $8.9 million, driven by Apollo’s strong brand presence and a number of strategic initiatives to capitalise on the exceptional performance of the country’s tourism industry.

Rental revenue increased by 9.2%, and current forward bookings indicate another strong year of rental performance in fiscal 2019.

US and UK expansion to gain traction in 2019

The acquisition of CanaDream and its integration with Apollo’s operations in the US provided a significant boost to Apollo’s North American presence.

The company opened new Apollo rental branches in New York and Orlando, and re-located its Toronto and Halifax locations.

North America is almost synonymous with RVs, with Robert De Niro’s armour-plated special stealing the show in the Meet the Parents movie franchise.

EBIT from Apollo’s North American operations was $13.7 million, turning around a $2.2 million loss in the prior year, reflecting the inclusion of a full year of US earnings and the CanaDream acquisition from early in the fiscal year.

In March this year, Apollo acquired Camperco Group Limited, one of the largest independent motorhome rental operators in the UK and Ireland.

Camperco has an established brand and broad market coverage with operations in Belfast, Dublin, Edinburgh, Glasgow, London, Birmingham and Leeds.

This presence will support continued growth for Apollo in the UK and Ireland, a cornerstone for its expansion into Europe.

Camperco contributed $370,000 of EBIT from the UK and Ireland over approximately three months after it was acquired by Apollo.

Rental bookings for Camperco’s Bunk Campers brand grew by 44% in the three months since acquisition, relative to the corresponding period in 2017.

Apollo expects significant growth in RV rentals in the UK and Ireland in fiscal 2019, supported by strong forward bookings, with the rental fleet to be expanded by 25% to 250 vehicles to accommodate additional demand.

Gearing up for the digital age

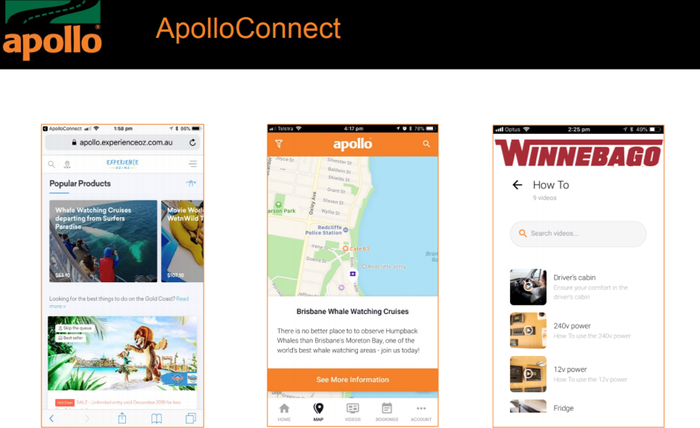

Apollo has developed a number of digital assets to enhance guest experience and increase its share of on-trip revenue, creating ongoing relationships with its customers and generating income from the RV sharing economy.

The company’s guest engagement app, ApolloConnect, was launched in Australia in April and New Zealand in June this year, allowing guests to search and make real-time bookings for holiday parks, attractions and experiences.

The app was downloaded more than 5,000 times in a matter of months, generating strong growth in transaction value for guest bookings.

The North American, UK and European versions of the app are planned for release during fiscal 2019.

Apollo has a 25% interest in Camplify, an online sharing community that connects caravan and RV owners with people looking to rent these vehicles.

Camplify has achieved strong growth in the Australian market, with more than 2,500 RVs active on the platform, and was launched in the UK in September last year.

Strong growth over the next three years

Management provided a positive outlook statement with regards to fiscal 2019, saying forward rental bookings for all regions in the 12 months to June 30, 2019 were ahead of the prior corresponding period.

Other growth initiatives include the establishment of new Australian retail sales locations in Adelaide, Geelong and Newcastle, the integration of the Fleetwood RV, Coromal and Windsor brands, and commencement of manufacturing at the Brisbane facility.

Apollo will also be establishing a new flagship rental and retail sales store in Auckland, as well as opening two new US rental branches in preparation for the 2019 summer peak season.

The European rental business should also receive a boost with the opening of a rental branch in Hamburg, Germany, in readiness for the European summer.

In terms of financial guidance, management has forecast net profit after tax to be in the range of $22 million to $24 million for the year ending 30 June 2019.

Morgans analyst, Josephine Little, has set her projections at the top end of that range, forecasting a net profit of $23.5 million, representing earnings per share of 13 cents, in line with consensus forecasts.

With the company trading in the vicinity of $1.30, this implies a PE multiple of approximately 10, which appears modest, given that the company is forecast to generate compound annual earnings per share growth of about 12% over the next three years.

The consensus 12 month price target of $1.79 appears to be on the money, although Little sees this as slightly conservative with her price target sitting at $1.94.

In any case, there is significant upside of about 40% implied by a price target of $1.79, suggesting upward momentum could be sustained following a bounce off a 12 month low towards the end of November.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.