Adversity breeds opportunity, so consider Super Retail Group (ASX: SUL)

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

I can come up with plenty of good reasons why shares in Flight Centre Travel Group (ASX:FLT) have tanked in the wake of COVID-19.

Of course, there are the financial implications which based on analyst forecasts are extremely severe and long-standing.

Even looking through fiscal 2020 to 2021, consensus forecasts point to earnings per share of approximately 70 cents, less than a quarter of what the company achieved in fiscal 2019.

Unlike most ASX 200 stocks, Flight Centre has been unable to recover along with the broader rebound that started in late March.

In fact, the company struck a new 12 month low of $8.56 as recently as last week.

Not only did this represent a massive decline from the 12 month high of $49.14, but it is a level only matched by the sharp GFC related slide in the group’s share price.

Maybe Flight Centre is cheap, but too many uncertainties

While I could weigh up Flight Centre’s profile as an oversold stock ripe for the picking for contrarian investors, particularly given the 12-month consensus price target implies more than 20% upside from its current levels, there is another stock which I feel is worth considering.

If you look at all the reasons why Flight Centre’s earnings have come under pressure, there is arguably one common denominator - post Covid-19 consumer behaviour.

Even well after we are considered largely virus-free and borders are reopened, albeit not for a very long time, there are numerous question marks hanging over the global travel industry.

For starters, the deflated level of disposable income and the increased personal debt that will be a hangover from the crisis will leave little money to spend on overseas holidays.

Superannuation funds that have traditionally been used by retirees to assist in travelling have not only copped a hit through the downturn in investment markets, but investors may well have had to take advantage of the drawdowns available to them during the coronavirus crisis.

The dream holiday becomes a nightmare scenario

European countries such as Spain and Italy, as well as the UK had massive death tolls, and the inability of their health systems to cope with such events was clearly highlighted.

China and the broader Asian region tend to be the source of pandemics.

Then you have the US, arguably taking the prize for the worst performance in managing the virus from inadequate testing, severe shortage of medical equipment and overcapacity hospitals and morgues (who could forget bodies piled up in refrigerated trucks).

Then there was the President who started to go through the seven stages of grief before the death toll really started to accelerate.

Shock and denial - our country will be back in business by Easter.

Pain and guilt - it‘s China’s fault.

Bargaining - maybe a spoonful of antiseptic will make it go away.

Reflection - well, maybe we’ll be back in business by May - I don’t think so.

Loneliness - it’s that fake media again - I’m not doing any more interviews

Acceptance and hope - I am lousy at dealing with this - where’s my Press Secretary?

Would anyone want to be in the US rather than Australia if there was another breakout?

Which brings me to my stock of the week.

A super stay at home holiday option

Other factors working against holidaying overseas include the significant weakening in the Australian dollar against overseas currencies, undermining purchasing power across everything from food to restaurants and accommodation.

It would appear that flights are going to become considerably more expensive, particularly if there isn’t any competition.

So what about returning to the good old days where we holiday at home?

Surfing, camping, fishing, trekking and just generally sucking in the local COVID-free fresh air is hard to beat - ironically, the latter is a product that was successfully marketed in China and the broader Asian region.

Consequently, believers in that adage that adversity breeds opportunity may like to consider Super Retail Group (ASX:SUL), a company that generates substantial income from good home-grown fun, sports and hobbies.

Even though the company is predominantly a bricks and mortar retailer, looking at the immediate state of play, it doesn’t appear to be faring too badly.

Providing an update in late March, management said that less than 20% of the group’s stores are located in large shopping malls where foot traffic has declined significantly.

The company also noted that the essential nature of many products supplied by Supercheap Auto, Rebel, BCF (boating camping and fishing) and Macpac remained important to the day to day safety and well-being of consumers.

These items include portable gas and fuels, camping stoves, batteries, gas refills, generators, refrigeration equipment, hygiene products (sanitisers and wipes), water filters, water-purifying products, portable toilets and solar energy panels.

While apparel sales in Rebel have been impacted, there has been an uplift in sales in personal fitness and gym equipment following the government’s direction to close gyms in Australia.

Anticipate significant sales as the quarantine period ends, as children’s feet for example don’t stop growing when they are in lockdown.

Super Retail combined the 65 Amart Sports outlets that it acquired and brought them under the Rebel brand, providing the company with a significant position in the sporting shoes arena.

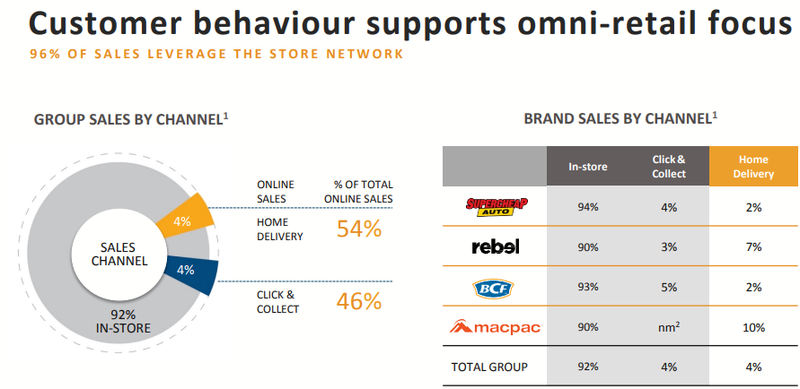

The group’s online business is operating normally with customers continuing to utilise home delivery and click and collect services.

As at week 38, the company had delivered online sales growth of 21 per cent, and this area of the group’s business accounts for approximately 9 per cent of sales.

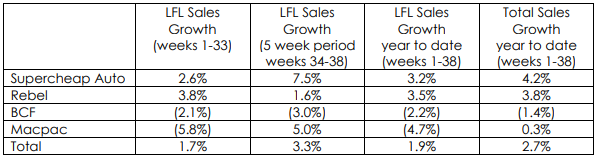

This was the state of play across Super Retail’s businesses as at 21 March, 2020.

Note the solid sales growth across the auto and sports businesses, the flat Macpac performance and a decline in BCF sales.

This business division is arguably most leveraged to the holiday at home theme, and a significant boost in fiscal 2021 would greatly benefit the company.

UBS gets in on the ground floor

Interestingly, UBS Group AG emerged as a substantial holder with a stake of 5.1% a fortnight ago, perhaps suggesting they see the company as a healthy comeback prospect.

However, there has been more than UBS wading into the stock with the company’s shares having increased from $3.58 six weeks ago to a high of more than $6.50 on Thursday, representing a gain of more than 80%.

Notwithstanding the significant rerating, the company is still trading at a substantial discount to the 12-month consensus price target of $7.80.

Trading on historically low multiples

Super Retail also looks strong based on fundamentals.

Analysts have been running the ruler across the stock at various times over the last month and it would appear that broker downgrades made to forward earnings have now been factored in.

The revised forecasts point to earnings per share of 54.1 cents and 60.3 cents in fiscal years 2020 and 2021, with the latter implying a PE multiple of 10.9.

Analysts are tipping a return to fairly normal dividends in fiscal 2021, forecasting 38.5 cents which represents a yield of nearly 6% based on the company’s current share price.

To provide perspective, Super Retail has traded on an average PE of 15 over the last 10 years, and if that multiple were applied to consensus forecasts for fiscal 2021 it would imply a share price of about $9.00.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.