White Rock rapidly advances high-grade zinc project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

White Rock Minerals (ASX:WRM) has identified a number of high-priority geochemical anomalies within its recently expanded high-grade Red Mountain zinc-silver-lead-gold-copper volcanogenic massive sulphide (VMS) project in Alaska.

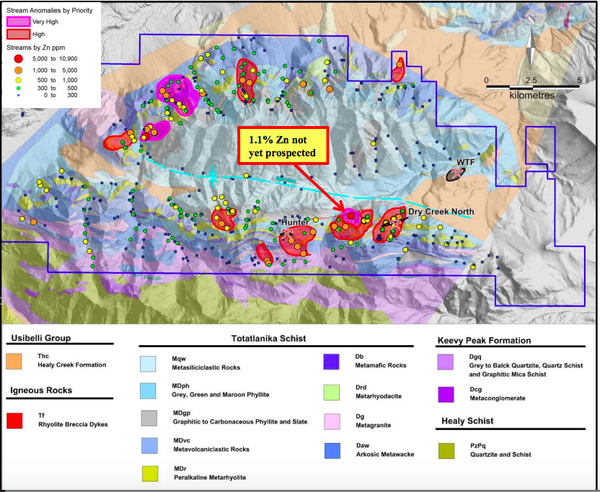

During the 2018 field season, WRM completed a detailed regional stream sediment program over prospective stratigraphy within the Red Mountain project area. This part of the comprehensive 2018 exploration program was optimised based on the geochem orientation survey completed across known mineralisation at Dry Creek.

The survey provided a geochemical signature of base metal and precious metal elements, together with other pathfinders to use for future exploration of the VMS prospective stratigraphy on both the northern and southern limbs of the regional Bonnifield syncline.

WRM’s 2018 reconnaissance program has identified a number of extensive alteration features for future exploration. Some of these extend on surface for several kilometres of strike.

The results from the detailed regional stream sampling program have successfully highlighted eight priority anomalies within the area of alteration, providing areas for immediate focus through follow-up ground reconnaissance, surface sampling and the application of electrical geophysics prior to drill targeting.

The significance of some of the geochemical anomalies is illustrated by the tenor of anomalism with one stream sample returning 1.1% zinc in an area towards the top of the VMS prospective stratigraphy to the west of the Dry Creek deposit.

No previous exploration has prospected the immediate catchment area, indicating how prospective the immediate surrounds remain. In addition, the area of the northern limb known as Glacier Creek displays footwall sulphide alteration that extends for over 10km of strike.

The stream sediment survey has identified four discrete high-priority targets within the area of alteration. Follow-up work will now be able to focus on these discrete areas of anomalism to enable rapid advancement to drill testing next year.

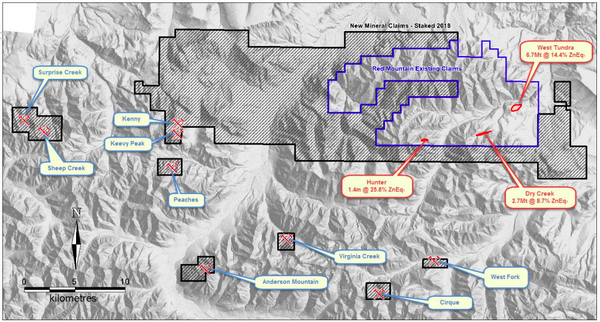

CEO, Matt Gill, commented on today’s news: “We recently expanded our tenement footprint three-fold, to now hold a strategic land package of some 475km. This expansion follows a successful first year of field activities for White Rock, where drilling intersected multiple high-grade intervals of zinc-silver-lead-gold-copper mineralisation at Dry Creek and West Tundra.

“With some drill hole results returning in excess of 17% zinc, 6% lead, 1,000 g/t silver, 6 g/t gold and 1.5% copper, the 2018 field season also saw three reconnaissance crews out in the field mapping and sampling.

“The culmination of this work encouraged White Rock to expand its strategic tenement holding to take in more of what has been identified as a highly prospective geological setting.

“In addition to this successful drilling campaign, including a new discovery of high-grade zinc-rich VMS mineralisation at the Hunter prospect, we now have the results from our regional stream sediment sampling campaign.

“These results reinforce our belief that the Red Mountain project could yield a camp of VMS deposits in the year ahead. Together with the expansion of the tenement package to 475km2 and coverage of multiple new VMS occurrences throughout the Bonnifield district, White Rock is now poised to advance the project rapidly in 2019 through a second year of aggressive prospecting and drilling,” Gill said.

Last month, WRM more than tripled the scope of its Red Mountain Project, staking an additional 524 new mining claims and mineral locations. As well as giving WRM a dominant landholding, this provides the small cap with a first mover advantage in an underexplored area which has already delivered positive exploration results.

WRM's strategic JV partner, $1.08 billion-capped Sandfire Resources NL (ASX:SFR), supports these acquisitions.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.