YPB continue to grow revenues in China

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Product authentication and consumer engagement solutions enterprise YPB Group Limited (ASX:YPB) has provided a financial and strategic update, particularly focusing on the group’s China operations which are likely to materially benefit the company in fiscal 2020.

On the score of capital investment and ongoing overheads, YPB China is the group’s largest cost centre due to the size of the infrastructure needed to pursue the Chinese market and proprietary tracer production facilities being located there.

Consequently, an improvement in YPB’s China result can have a material impact on YPB’s margins, and on this note the company expects to cut costs by 20% by March 2020.

Refined sales strategy

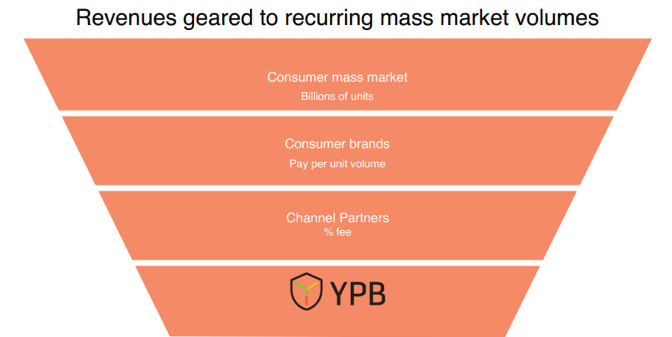

YPB revised its group sales strategy in the second half of fiscal 2018 to more emphatically leverage channel partners which are typically prominent suppliers to consumer goods brands.

In addition, key markets were emphasised, being primarily wine, dairy, pharma and health and beauty.

In the second half of 2018, YPB China’s adoption of this strategy secured 3 new channel partners with 4 new clients – each partner being a supplier to, or assembler for, global major clients in auto components, lubricants and consumer electronics.

YPB’s T2 tracer is used by the channel partners to mark critical components to ensure the authenticity of components in the brands’ products.

These new channel partners have led to YPB China’s revenue almost doubling in 2019 (to end November) over the prior period.

Partners to continue to drive growth in 2020

Each of the China channel partners is having success in encouraging wider adoption of YPB’s original authentication solutions amongst both existing and new customers.

One prominent recently secured high volume end user will be marking swing tags on toys of a global household name entertainment group.

Another important development related to the marking of infant formula tins for one of China’s largest dairy companies, and the securing of these recent contracts are expected to significantly benefit volume growth in 2020.

In addition, PanPass Inc, China’s largest security label producer, is continuing commercial trials of MotifMicro on security labels and today announced an extension to these commercial trials.

In November, the first commercial print run was successfully achieved on flexo printing, and a second commercial print run on an offset printing line is planned prior to Christmas.

YPB still expects revenues in the March quarter of 2020 to follow the successful conclusion of these trials.

Together, the momentum with the existing channel partners and the intent being demonstrated by PanPass is likely to result in further strong growth in China in 2020.

More definitive guidance regarding China’s revenue prospects is not presently possible due to the rapid evolution of opportunities there.

Material profit delta probable in China

In tandem with this revenue growth, management expects the success of the China channel partner strategy will allow a further 20% overhead reduction in YPB China on an annualised basis.

First reductions are imminent with the program expected to be fully implemented by end March 2020.

Due to the expected continuation of the significant revenue growth in China together with a lower cost base, YPB China is well placed to greatly reduce or even eliminate its significant cash and profit drag on the group at some point in 2020 depending on the timing and quantum of revenues.

The successful execution of YPB China’s present opportunities by a leaner, more focused team can result in a favourable turnaround in YPB Group’s financial results.

Discussing these developments, chief executive John Houston said, “China has proven an extremely difficult nut to crack for YPB but the channel partner and client meetings during my just concluded operational review in Beijing are encouraging.

"Revenues in China are far below where they should be but the progress in 2019, flowing from our focused, partner-led strategy, is bearing fruit as demonstrated by the near doubling of 2019 revenue to end October and a key channel partner just signing two new high profile, high volume users of YPB’s T2 authentication solution.

"In reality, YPB China should be able to accelerate its successes as we and our partners work more closely and effectively to protect brands from the counterfeit pandemic in China. Our financial results are leveraged to further progress in China and I’m optimistic the momentum we are building there can contribute to improved YPB Group results in 2020.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.