YPB Confirm US Patent Allowance, Strengthening MotifMicro’s Position

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

There has been a promising development for authentication and consumer engagement solutions provider YPB Group Limited (ASX:YPB) with the US patent regulatory body opening the way for the group to generate further income from its MotifMicro authentication technology.

In formal terms, the US Patent and Trademark Office has issued a Notice of Allowance for MIT Case No: 15231L “Rare Earth Spatial/Spectral Microparticle Barcodes for Labelling of Objects and Tissues, under US Application No.: 15/387,889”.

With MotifMicro having an existing family of patents granted in the US, there are significant benefits from having key additional claims allowed by the US Patent and Trademark Office as this extends the coverage of the patent family.

The novelty and power of MotifMicro is illustrated by the allowance’s coverage of, amongst other aspects, biological materials such as nucleic acids.

The extension is highly commercially significant as it confirms MotifMicro’s serialisation capability, one of its primary commercial benefits along with smartphone readability.

Consumers and governments to push for serialisation

Serialisation, or unique digital identities for every item produced, will eventually become widespread due to government fiat in certain sectors and/or consumer demand for authenticity and provenance.

The extension of the patent coverage also supports the exploration of alternative funding plans for the development of MotifMicro.

Many industries are interested in preventing spoofing or counterfeiting of a wide range of materials.

For example, one of YPB’s China clients currently marks glue used in global brand consumer goods with YPB technology to prevent substitution.

Discussing the significance of this development from an operational perspective while also reflecting on the potential opportunities for exploring alternative development funding plans, chief executive John Houston said, “This Formal allowance by the US Patent and Trademark Office is a vital step towards confirming MotifMicro’s power to securely mark products and packaging globally, cementing its commercial value and possibly opening value-creating funding sources for its second generation development.”

This news comes on the back of other important developments in November, including the negotiation of a new contract and FDA certification for MotifMicro.

These events have been the catalyst for a 40% increase in the company’s share price during the month, and this momentum could be sustained on the back of today’s news.

YPB provides the full package

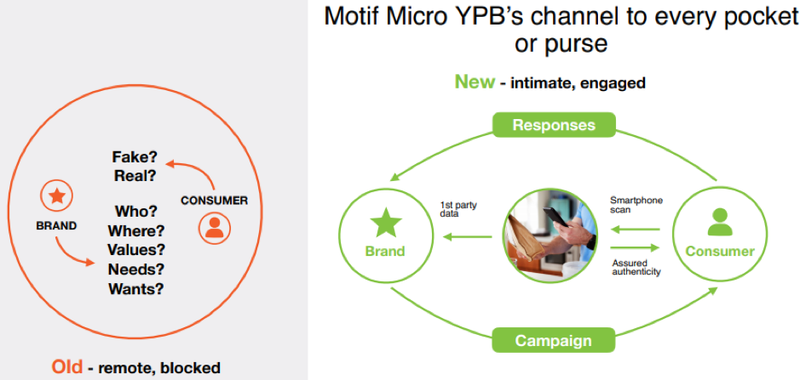

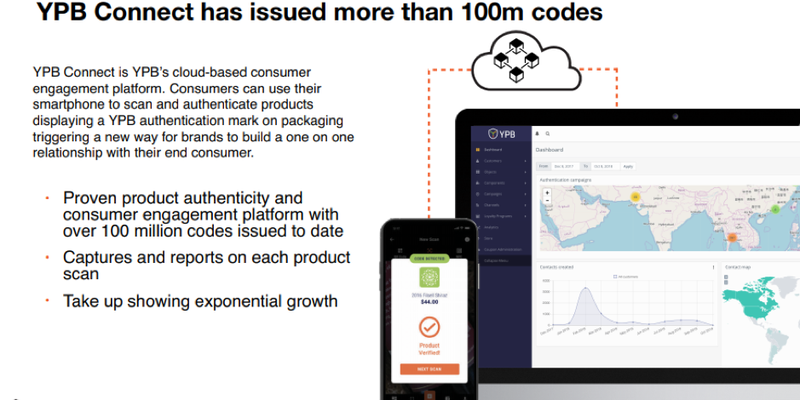

MotifMicro is an extension of an end to end solution whereby YPB’s smartphone authentication solutions and its SaaS Connect platform, creates ‘smart’ product packaging, opening cost-effective, digital and direct marketing channels between brands and their consumers.

Connect gathers actionable data on consumer preferences, allowing the hosting of tailored marketing campaigns directly back to the scanning smartphone.

YPB’s technology is trusted by the world’s largest passport issuing nation to ensure the authenticity of its passports.

Management is currently focused on the rapidly growing Australian, South East Asian, and Chinese markets.

Particular areas of focus are dairy, cannabis, alcohol and cosmetics where the viral growth of fake products, especially in Asia, affects brand value and endangers consumers.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.