WhiteHawk delivers impressive quarterly result

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

WhiteHawk Ltd (ASX:WHK), the first global online cyber security exchange enabling small and mid-size enterprises (revenue of $1 million to $1 billion) to take smart action to identify and address Cyber Risk, has provided an update on its progress for the June quarter 2019 in conjunction with the release of its quarterly result.

It has been a busy quarter for the group having made substantial progress in terms of technological developments while it reaped the rewards of having best in class cyber security products through multiple contract awards.

These included contracts with high security government instrumentalities in the US, including a top 12 US defence industrial base (DIB) group, as well as sub-contracts with a US$2 billion federal government department.

WhiteHawk also continues to execute contracts with a top 10 financial institution.

For reasons of confidentiality, specific company names cannot be released, but suffice to say these are large tier 1 organisations, and there decision to adopt WhiteHawk’s cyber security technology is a strong endorsement of the group’s products that bodes well in terms of sustaining robust revenue growth.

There are also several opportunities in the pipeline with the company continuing to advance its Risk Framework pipeline of five manufacturing and DIB Fortune 1000 companies.

Development of global sales channel

Global sales channels have been developed through integration with EZShield/Sontiq, and there are currently three contract discussions with financial institutions and insurance groups as a result of this partnership.

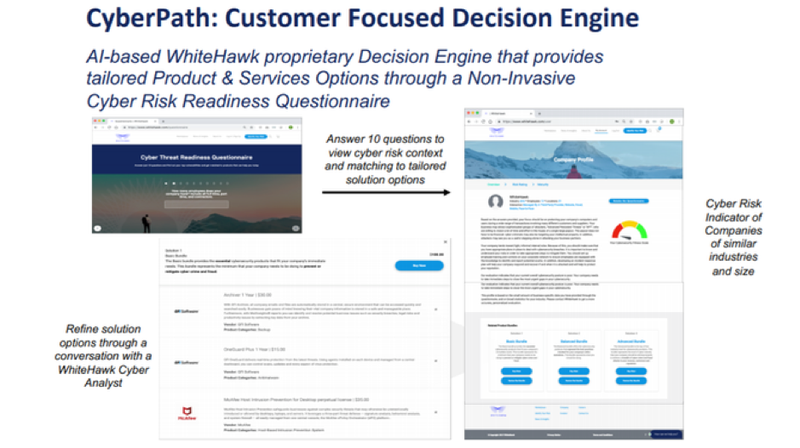

The WhiteHawk CyberPath AI Questionnaire used by customers to create a cyber risk profile and maturity assessment is now integrated into the EZShield Small Business Suite online platform.

EZShield is a pioneer and innovator of identity theft and mobile cybersecurity solutions with 18 years of history, over 27 million US consumers, and the benefit of strategic partnerships with financial institutions.

Another key development in terms of opening up international opportunities was the forging of a new partnership with Global Cyber Alliance (GCA).

GCA’s mission is to eliminate cyber risk and improve the connected world by securing Internet of Things (IoT) devices and technologies.

It reduces cyber risk by developing and deploying practical, real-world solutions that measurably improve the world's collective cybersecurity.

WhiteHawk will work with GCA to provide affordable and easy-to-implement cyber risk mitigation solutions to small and mid-size businesses (SMBs).

The partnership opens the door for WhiteHawk to proceed with its international expansion plans as it seeks to explore opportunities to enable SMBs on a global scale.

Continued progress in product development

While making substantial progress in terms of bidding for new projects and forging collaborative agreements, WhiteHawk hasn’t taken its eye off the ball with regard to continually improving its product offering.

WhiteHawk advanced the development of the 360 Cyber Risk Framework technology platform by automating generation of SMB Cyber Risk Scorecards.

This includes the redesign and implementation of the group’s cyber threat questionnaire.

There has been a migration from content management system authentication to platform authentication.

User management has also been remodelled, resulting in improved tracking and management.

The separation of the client portal from open marketplace and insights website has provided improved security, stability and usability.

From a financial perspective, WhiteHawk finished the quarter in a strong position with cash of US$1.9 million.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.