Western Power awards large contracts to Empired

Published 29-APR-2020 11:09 A.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

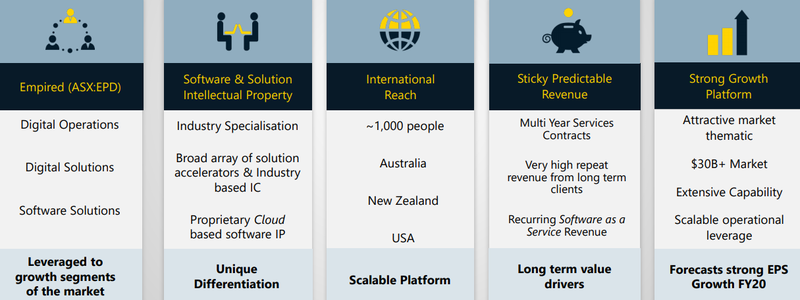

Shares in Empired Limited (ASX: EPD) surged from the previous day’s close of 27 cents to a high of 43.5 cents on Tuesday after the company secured two contracts with Western Power to provide a diverse range of digital services for up to seven years.

Western Power operates the majority of power distribution in Western Australia.

Collectively the two contracts have an estimated value of $61 million over the initial five-year term.

An infrastructure managed services contract with an estimated value of $31 million over five years will see Empired provide end-user computing services to more than 3,300 Western Power staff and contractors.

This will provide 24/7 service management leveraging Empired’s state-of-the-art service desk and national operations centres, managing all data centres and cloud operations, as well as coordinating more than 2,000 network devices across 30 sites.

Transition of these services will commence immediately and is expected to be completed by early August 2020.

Not only is this contract a substantial boost to Empired’s revenues, but it is also an endorsement of the company’s ability to manage large projects on behalf of a major infrastructure group.

Awarded preferred Master IT Supply contract valued at $30 million

In addition, Empired Limited has been awarded a preferred Master IT Supply Contract with an estimated value of $30 million over five years for the provision of a technology enhancement program in support of the managed services scope.

Empired has partnered with global giant HCL Limited to provide leveraged offshore resourcing and access to world-leading intellectual property in the energy and power distribution markets.

The energy market is a rapidly changing and increasingly competitive industry, suggesting that there may be further work of this nature in the pipeline for Empired.

Underlining the importance of this contract win, Empired managing director Russell Baskerville said, "This contract win is testament to Empired’s extensive capability and its ability to compete and win against the largest Australian and international competitors.”

Empired’s shares retraced throughout the afternoon to trade in the vicinity of 33 cents as the broader market declined, perhaps providing a buying opportunity.

It is worth noting that the 12 month consensus price target prior to the award of these contracts was 37.5 cents.

One would expect both earnings upgrades and an upwardly revised share price target following this news.

As a guide, analysts were forecasting Empired to generate earnings per share of 4.4 cents in fiscal 2020, indicating that the company is currently trading on a PE multiple of approximately 7.5, a conservative implied value for a company that is forecast to generate earnings per share growth of 25% in fiscal 2021.

Empired also offers sound earnings predictability due to the recurring revenue generated by certain parts of its business.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.