Vulcan achieves impressive lithium recovery rates

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Vulcan Energy Resources (ASX:VUL | FWB:6KO) has successfully completed initial bench-scale test work on Upper Rhine Valley geothermal brine using adsorbent-type direct lithium extraction (DLE) technological approaches.

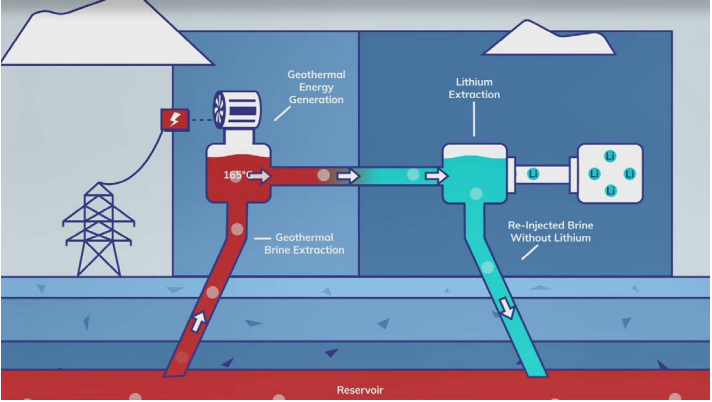

By way of background, Vulcan is aiming to become the world’s first Zero Carbon LithiumTM producer by producing a battery-quality lithium hydroxide chemical product with net zero carbon footprint from its combined geothermal and lithium resource, which is Europe’s largest lithium resource situated in the Upper Rhine Valley of Germany.

The company will use its unique Zero Carbon LithiumTM process to produce both renewable geothermal energy, and lithium hydroxide, from the same deep brine source.

Vulcan has a resource which can satisfy Europe’s needs for the electric vehicle transition, from a zero-carbon source, for many years to come, but just as importantly, it has proprietary technology that provides a competitive advantage and significant barriers to entry.

Looking specifically at the successful test work, lithium chloride (LiCl) concentrates were produced from real geothermal brine that was supplied at ambient pressure from Vulcan’s area of focus in the Upper Rhine Valley.

Two different, pre-selected DLE adsorbents were tested and in both cases the lithium recovery rate exceeded 90% on first pass.

This is an important first step to demonstrate that LiCl can be extracted from the geothermal brine without the need to evaporate the water, or remove the calcium, sodium, or large quantities of other salts.

The Upper Rhine Valley brine is a unique geothermal brine that contains both high grades of lithium and lower impurities compared to other lithium-rich geothermal brines.

Use of renewable power and heat from geothermal brine would make Vulcan the lowest carbon dioxide equivalent footprint supplier of lithium hydroxide for electric vehicles in the world.

Another step towards pre-feasibility study

Materials and techniques used during the extraction process are similar to those already used in other commercial and near-commercial lithium brine projects.

The tested DLE adsorbents are of a type already used commercially on lithium brines worldwide, which reduces development risk, in line with Vulcan’s strategy of utilising established technologies.

The demonstrated DLE process will result in much reduced water usage and environmental footprint compared to traditional, evaporative methods used by producers in South America.

For example, the evaporative processes used in South America create major waste streams, and also may disturb freshwater aquifers connected to brine aquifers if brine is not reinjected.

Results will inform Vulcan’s pre-feasibility study (PFS) towards achieving the world’s first Zero Carbon LithiumTM Project.

Lithium chloride concentrate to be increased using renewable energy

The concentration of LiCl concentrate produced from geothermal brine will be further increased using reverse osmosis and mechanical evaporation.

The power and heat needed for these processes will come from renewable geothermal energy which Vulcan will co-produce alongside lithium chemicals.

Different, industry-standard downstream process flowsheets are then available to produce battery-grade lithium hydroxide, with a focus on carbon-neutral processing and minimal environmental and physical footprints.

Results from this test work will be used in Vulcan’s pre-feasibility study.

Results to assist in upgrading lithium resource

The results will also be used in tandem with the acquisition and interpretation of exploration data, towards upgrading confidence categories of Vulcan’s JORC lithium resource.

Vulcan has the largest lithium-brine resource in Europe, at 13.95 million tonnes contained LCE at 2 of 6 licences, of which 13.2 million tonnes LCE is currently in the Inferred category on its 100%-owned Ortenau license.

Further control of brine chemistry and optimisation of operational parameters will be carried out, both at bench-scale, and in a ‘live’ pilot study which will include controlling parameters such as pressure and brine chemistry.

In doing so, Vulcan will ensure that the needs of the geothermal plant (avoiding formation of scales) and the lithium plant (optimising lithium recovery) are properly balanced during the development scale-up.

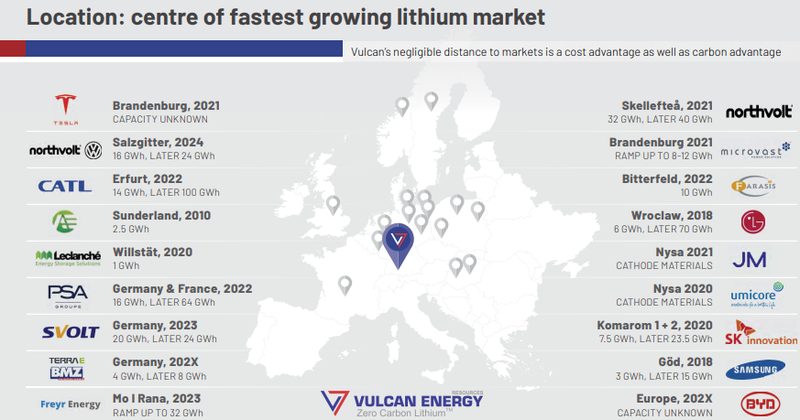

These developments represent further progress in Vulcan’s mission to supply the growing lithium battery market in Europe, linked predominantly to the electric vehicle (EV) market.

Although Europe is the fastest growing centre for EV battery production in the world, there is no local supply of battery quality lithium chemicals with 80% of the current supply of high carbon footprint lithium hydroxide coming from China.

Such a heavy reliance on China at a time when the country’s government is placing increasing strains on established trading partners could be viewed by battery producers as carrying significant risk.

Consequently, they are likely to opt for a product that is better from an environmental perspective, as well as being less likely to carry supply interruptions due to political instability within the country.

Further, there are obvious logistical benefits in terms of proximity to markets with many major auto manufacturers situated in Germany and nearby manufacturing hubs.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.