VUL Boosts Total Indicated JORC Resource by 131% Ahead of PFS

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

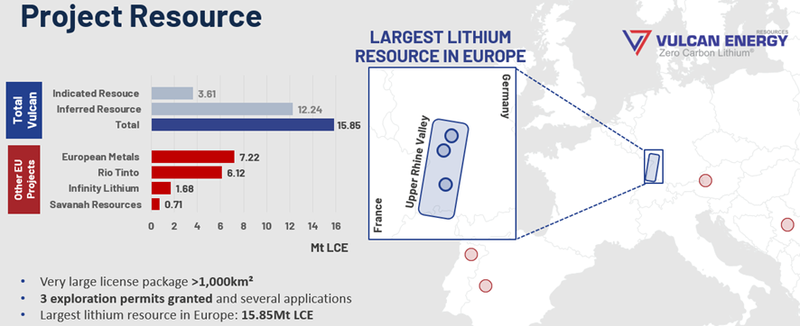

In a materially significant development, Vulcan Energy Resources (ASX: VUL| FRA: 6KO) has released an updated and reclassified Ortenau Indicated JORC Resource Estimation of 2.06 Mt contained Lithium Carbonate Equivalent (LCE) at a grade of 181 mg/l Li.

This resource estimate for its Ortenau License in the Vulcan Zero Carbon LithiumTM Project area in the Upper Rhine Valley represents a 131% increase in the total Upper Rhine Valley Project (URVP) JORC Indicated Resource Estimate.

Importantly, 23% of Vulcan’s total URVP lithium-brine (Li-brine) Resource is now in the Indicated category.

This development comes approximately one month after the company upgraded the Taro Resource, an initiative that was also facilitated by advancing newly acquired and reinterpreted seismic data to advance the 3-D geological model, along with other aspects of the proposed project.

The Indicated Resource portion of Ortenau – along with Taro – is being integrated into Vulcan’s Prefeasibility Study (PFS) which is approaching completion.

Ortenau’s Inferred JORC Resource Estimation has been revised to 10.8 million tonnes contained LCE at a grade of 181 mg/l Li and the updated total URVP Inferred and Indicated Resources are now 15.85 Mt LCE at a grade of 181 mg/l Li, the largest in Europe.

The large resource size is significant in that it gives Vulcan the potential to become a major supplier of Zero Carbon Lithium® chemicals into the European Union (EU) market, leveraging the recently announced regulations to set CO2 limits for lithium-ion battery production in Europe.

Will Vulcan be a 20-bagger by year-end

It is worth noting that when Vulcan revised the Taro resource along similar lines, shares in Vulcan surged.

Given this is further information that will feed into the PFS due in January 2021 it could well provide share price momentum for a company that is currently trading at about 16.5 times where it was 12 months ago.

Commenting on the updated and reclassified resource estimate, as well as the highly beneficial implications of regulations made by the European Commission last week, Vulcan managing director, Dr Francis Wedin said, “As with Taro, at Ortenau we have used newly acquired and reinterpreted seismic data to advance the 3-D geological model, and well data to advance fault zone hydro-dynamics, allowing us to upgrade a significant portion of the Ortenau Resource to the “Indicated” category.

‘’This higher confidence resource area will form an important part of our PFS, further validating our strategy to become a supplier of Vulcan’s unique Zero Carbon Lithium® hydroxide to the European battery electric vehicle market.

‘’The European Commission regulations announced last week, setting limits on CO2 footprints for lithium-ion battery production in Europe, places Vulcan in the prime position to be a lithium supplier of choice for the European market.

''With the majority of the PFS work completed, we expect final review to be concluded by January, so we look forward to an exciting start for shareholders in 2021.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.