Vonex reports 9% increase in total revenues

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Vonex (ASX:VN8) chairman Nicholas Ong has released the company’s interim financial report for the half year ended 31 December 2018.

Among the highlights are:

- VN8’s continued development and growth of its established cloud hosted PBX system and customer base. Total group sales revenues rose by 9% during the reporting period

- The Retail division achieved a 9% increase in total revenues, along with a 10% net increase in customer accounts from July 2018 to December 2018

- The Wholesale division has also continued its progress, increasing its direct sales revenue by 12%, while registering a 24% increase in user numbers hosted by VN8.

Ong noted that the company has made strong progress across the board, attributing much of the success to its Channel Partner re-engagement program and its national online marketing campaign, a joint initiative between the company and CounterPath.

In October 2018, VN8 successfully launched the Vonex Phone App for iOS and Android mobile devices as well as Windows and MAC.

On the 28th November 2018, the company also commenced its beta testing of Oper8tor Conference, the first pillar of its minimum viable product (MVP) for its Oper8tor aggregated communications app. Oper8tor aims to seamlessly link all voice calls and communications across various platforms and devices around the globe.

Beta testing is now complete, with the initial release of the Oper8tor app expected in Australia via the App Store and Google Play in March 2019. The soft commercial launch of Oper8tor in Europe remains on track for July 2019.

To supplement these developments, VN8 also introduced its sales software, Sign on Glass (SOG), and has continued to recruit staff and increase resources in anticipation of further growth in 2019.

In the December quarter VN8 recorded monthly billing of more than $740,000, the first time in company history. It also accrued 26,000 registered Private Branch Exchange (PBX) users as of January 2019 (now over 27,000) – with PBX annual user growth tracking at around 22%.

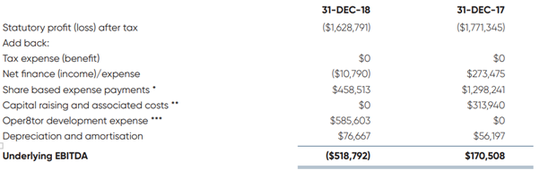

VN8’s sales growth of 9% (in comparison to the same period last year) generated sales revenue exceeding $4.27 million and a statutory loss of $1.63 million. This figure excludes $313,000 from the company’s latest R&D tax rebate, which was received on the 9th of February 2019.

The company recorded an underlying EBITDA loss of $518,792 (excluding the Oper8tor development).

A breakdown of the statutory and underlying results is below:

VN8 remains on track to acquire 100 channel partners by the end of the 2019 financial year, having added 45 to date.

In addition, it remains well positioned to capitalise on the continued roll out of the NBN. There are currently 4.1 million premises that are ready for connection, with NBN Co. reporting that the NBN is on track for 100% rollout to 11.6 million properties by 2020.

VN8 is well placed to capitalise on this news. Thanks to the NBN, the Australian telco industry is expected to grow from $44 billion to $47 billion between now and 2020.

To read further about VN8, visit https://www.vonex.com.au/

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.