Vonex delivering outstanding growth with more to come in fiscal 2021

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Diversified telecommunications group Vonex Ltd (ASX:VN8) released its June quarter update on Thursday, featuring the strongest operational and financial quarter that the company has delivered since listing on the ASX.

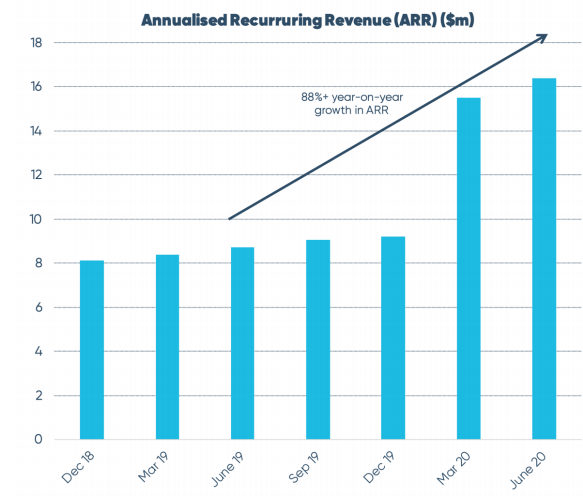

From an operational perspective, one of the key takeaways was the 88% increase in annualised recurring revenue during fiscal 2020, and this now stands at $16.4 million.

While reflecting Vonex’s extremely impressive growth trajectory, this also demonstrates the company’s stability and resilience with recurring revenue providing forward earnings predictability.

The acquisition of 2SG has been one of the key achievements of fiscal 2020, and while it has already provided substantial sales momentum, a full year contribution in fiscal 2021 will see the company generate robust growth in the next 12 months.

The 2SG acquisition has been seamlessly executed, and Vonex is already reaping the benefits of the transaction.

Just recently, 2SG negotiated an agreement to supply business grade mobile broadband to ASX 300 company, Data#3 (ASX:DTL)

When the acquisition of 2SG was made, management anticipated that fiscal 2020 annual recurring revenue would increase to approximately $14 million, highlighting the significant outperformance that has occurred since the acquisition was completed in March.

Expansion through direct integration to NBN interconnection points

From a broader perspective, 2SG Wholesale has brought a new dimension to the company’s business, allowing Vonex to expand its offering to small and medium enterprise (SME) customers with new products.

These new products include fleet mobile, mobile broadband and NBN with 4G backup.

2SG’s multi-year investment in a sophisticated network environment is now contributing to a meaningful relationship with Optus Wholesale, helping to build traffic on the Optus network by quickly deploying complex solutions for a broad base of customers.

Vonex plans to expand its network through direct integration to NBN points of interconnect in strategic national locations via 2SG Wholesale.

Building upon its existing points of interconnect and those it activated during the June quarter, Vonex will further improve its network quality by adding more direct interconnects with the NBN throughout fiscal 2021.

Through 2SG, Vonex is responding to strong interest in the market by enabling a direct NBN relationship for key existing and new wholesale partners.

This streamlined supply chain provides customers with reduced lead times and enhanced assurance while positioning the company with the best possible commercial structure to leverage future wholesale NBN growth.

New business provides platform for growth

Vonex’s expanded model is yielding new customer wins by partnering with organisations of national scale as evidenced by the DTL win which related to the group’s Discovery Technology subsidiary.

This agreement involved the supply of business grade layer 2 mobile broadband to Discovery Technology which delivers bespoke public Wi-Fi solutions to a broad range of industries including shopping centres, airports, universities, councils, smart cities, hotels, transport, retailers, supermarkets and stadiums.

2SG is partnering with Discovery to enable the delivery of 4G and 5G network services, powered by Vonex, through to Discovery and the wider Data#3 customer base.

Vonex’s smooth integration of 2SG Wholesale has been accompanied by growth in new customers and order value.

The company added 5 new wholesale customers in May and June 2020, while also achieving an increase of 75% in mobile broadband orders in the June quarter compared to the same period in FY19.

This promising growth reflects achievement of the cross-selling opportunities which Vonex identified prior to acquiring 2SG Wholesale.

The Company has also scoped and commenced its plans to integrate 2SG Wholesale’s billing with Vonex’s existing platform, with completion expected in the December quarter.

Vonex will continue to pursue both organic and acquisition-led opportunities to grow its wholesale business in FY21.

Strong growth in retail

Vonex’s retail operations are also cranking with new customer additions running at elevated levels through the depths of the COVID-19 crisis.

The company achieved Total Contract Value of new customer sales in the six months from January to June 2020 of $3.7 million, an increase of 65% on the previous corresponding period, with growth accelerating in the June quarter.

Management noted that Vonex’s value proposition is resonating with its target market of Australian SMEs, many of which have been attracted by the company’s ability to rapidly provision scalable cloud-based business phone systems.

Vonex focuses on providing an excellent customer experience as a core component of its differentiated service offering.

In early July, Vonex expanded upon the Qantas Business Rewards offering, adding mobile plans to the suite of services on which Qantas Points can be earned, with a view to gaining further market share with Australian SME customers.

After a successful capital raising in June, Vonex is well-placed to pursue a variety of growth initiatives as it had zero debt and cash of nearly $5 million as at June 30, 2020.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.