Vonex acquires part of Direct Business arm of $400 million MNF Group

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Telecommunications innovator Vonex Limited (ASX:VN8) emerged from a trading halt on Monday morning, informing the market of a highly strategic development in the way of the negotiation of a conditional, non-binding term sheet with MNF Group Limited (ASX:MNF) for Vonex's acquisition of part of MNF's Direct Business.

MNF has been a highly successful telco, having itself delivered substantial shareholder returns through strategic acquisitions as its market capitalisation increased some 50% over the last two years to about $420 million.

During the same period, Vonex’s market capitalisation has doubled to nearly $30 million, and the group is shaping up as an attractive emerging player in the telco space.

Step back 10 years and you will see that MNF was just trying to find its way in the telco space with a market capitalisation of less than $10 million.

For investors that missed that 40-fold ride, perhaps this is an opportune time to target an emerging player such as Vonex.

Vonex has demonstrated its ability to integrate acquisitions

Importantly, management has demonstrated its ability to identify and integrate value adding acquisitions, and today’s announcement that the company is poised to effectively acquire 5250 new business customers and more than 100 new Australian telco channel partners is nothing short of transformational for the group.

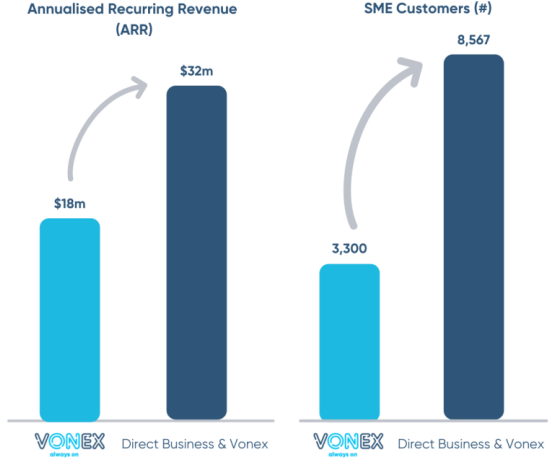

This transaction will also elevate Vonex’s investment appeal as it will provide earnings growth and predictability, doubling the group’s annualised recurring revenue on a full year basis.

Assessing the metrics, the segment of the ‘Direct Business’ to be acquired by Vonex in the Proposed Transaction delivered revenue of $15.6 million in calendar year 2020 of which approximately 89% was derived from the business division and approximately 11% could be attributed to the residential sector.

This business reported an EBITDA of approximately $5 million in calendar year 2020.

Vonex’s decision to fund the transaction predominantly via its debt facility and existing cash should be welcomed by shareholders as there won’t be any considerable earnings per share dilution.

The following graphic shows the big picture metrics that are so important for Vonex.

Acquisition provides big boost to already robust recurring revenue

The Direct Business sells cloud, phone, internet and mobile services directly to SMEs (small to medium enterprises) and residential customers in Australia, as well as dedicated audio and video conferencing business.

Approximately 86% of total revenue has been characterised by MNF Group as recurring and 81% of total revenue is from Voice.

Vonex's demonstrated capability in migrating and servicing hosted PBX customers makes the company a natural owner of the Direct Business.

A strengthening of Vonex's channel partner network will also enable the company to reach new customers.

The Direct Business segment would add to Vonex’s existing Sydney presence and provide the opportunity to leverage its proven sales and marketing processes in Melbourne.

It would also introduce a number of cross-sell opportunities for complementary products, as well as providing a solid base for the group to enter a new untapped segment of residential Internet and mobile phone services.

Discussing the proposed acquisition and its fit with the current telco landscape where work from home has not just become essential at certain times, but has now been adopted as a practical and beneficial option, managing director Matt Fahey said, "We would be delighted to welcome MNF's Direct Business and its customers to the Vonex group.

"As the new 'work from home' paradigm has become part of life for more Australians, we have increasingly focused on providing Australian SMEs with telco services that are reliable, affordable, flexible and scalable.

"Migrating and integrating the Direct Business with our own will bring us a meaningful national footprint and help us to gain the scale through which we can continue to deliver strong value to customers and investors."

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.