Victory Mines releases promising exploration results from Laverton project

Published 27-JUL-2017 15:13 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Only days after releasing high grade zinc and lead assay results from its Bonaparte project, Victory Mines (ASX: VIC) has released encouraging results from an exploration program at its Laverton project located in Western Australia.

The company’s E 38/3075 tenement lies to the north of Laverton and only a short distance east of Leonora. Previous exploration conducted in 2013 within E38/2374 (in which E38/3075 is situated) defined several areas which were anomalous for gold, nickel and copper.

Most of these anomalous regions were aligned with geological structures which were defined from a low level of circa 25 metres, and with the subject of a close spaced (50 metres) combined aerial radiometric and magnetic survey. A total of 1,239 samples were collected from within E38/2374, with samples taken every 50 metres on lines spaced 400 metres apart.

VIC acquired E38/3075 early in 2017 and immediately planned an infill geochemical soil sampling programme to either infill the previously defined anomalous areas on a 200 x 25m pattern or to sample areas not previously tested.

A total of 810 samples were designed to be collected, but unsuitable weather conditions affected access to one area, limiting the number of samples to 758. These were sent to ALS Laboratories where they were fine ground so that 95% of the sample was less than 75 micron.

Various means of analysis were used to examine the samples, and the results were encouraging as they demonstrated that values in the top 5% were strongly anomalous, and values within the top 10% were viewed as moderately anomalous.

Of course it is early stage in the development of this project, so investors should seek professional financial advice if considering this stock for their portfolio.

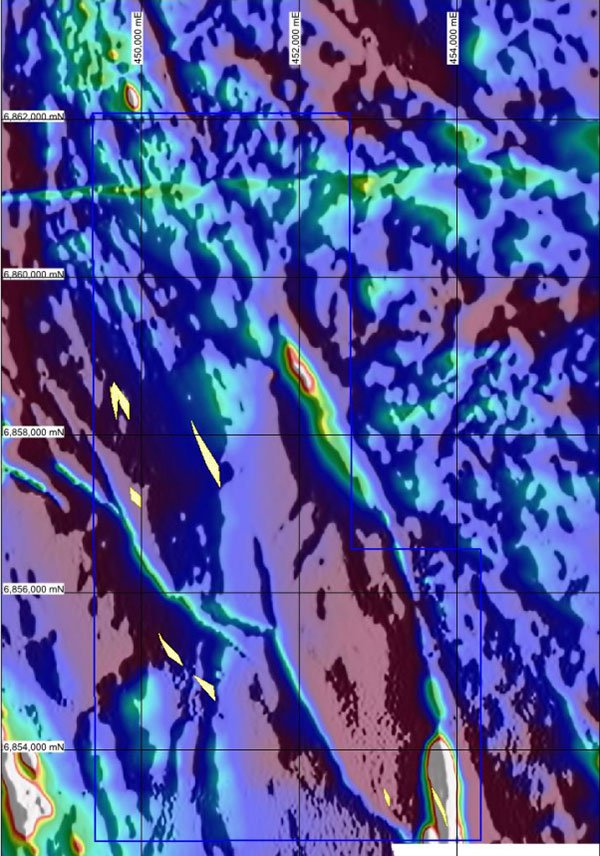

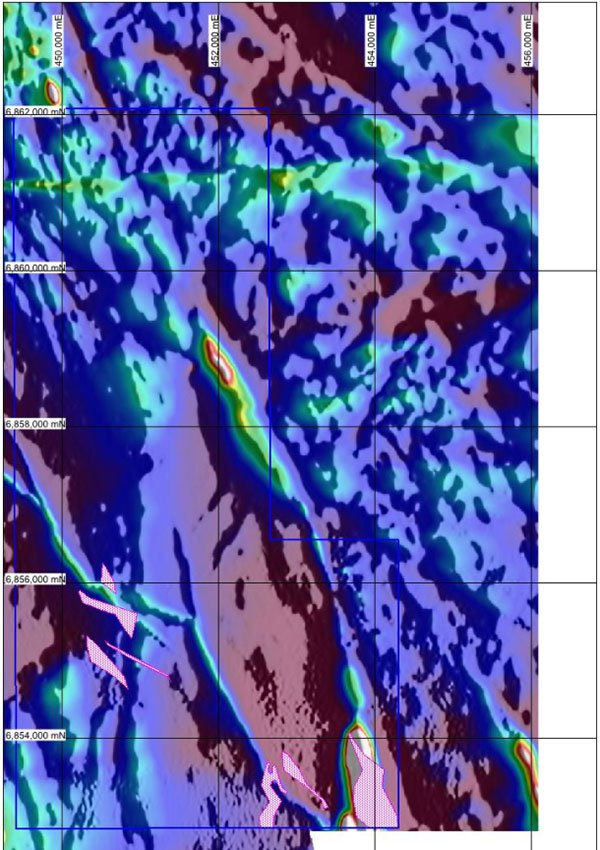

The gold anomalies overlying the TMI (total magnetic intensity) magnetics can be seen below. The most northern anomaly is open along strike and across strike. The other 2 anomalous regions are up to 900 metres in length.

The nickel anomalies are also draped over the TMI magnetics. There is a large anomaly defined in the south of the tenement, which is approximately 1.25 kilometres in length and is situated along a prominent geological structure, while the nickel anomaly in the north is again coincident with the northerly extension of this structure.

The copper anomalies are shown below, with the largest anomaly being over the same geological structure which contains the nickel anomaly. The other copper anomalous regions are again aligned with or close to, other geological structures.

Management is preparing to conduct a geophysical ground electromagnetic survey which would potentially assist in the definition of suitable drill targets.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.