Victory Mines receives go-ahead from the Bolivian Government

Published 17-AUG-2017 11:06 A.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Finfeed presents this information for the use of readers in their decision to engage with this product. Please be aware that this is a very high risk product. We stress that this article should only be used as one part of this decision making process. You need to fully inform yourself of all factors and information relating to this product before engaging with it.

Victory Mines (ASX: VIC) has updated the market regarding its mining activities in Bolivia. Central to these developments has been the receipt of permission from the Bolivian state mining company, Corporacion Minera de Bolivia (COMIBOL) to commence a feasibility study on a number of its existing tin tailings sites, as well as four new additional sites.

Commenting on this development, VIC’s Non-Executive Chairman Doctor James Ellingford said, “We are now going to focus solely on extracting value from these tailing sites, both old and new, and will aggressively work towards establishing a minerals processing facility to extract, primarily the tin, as well as potentially, silver and tantalum”.

Acknowledging the challenges the company has endured in reaching this stage, Ellingford said, “This has been a long journey but I am confident, as is the rest of the board, that Victory Mines has the right relationships in place and more importantly the right people on the ground to ensure success.”

Looking to the future the company has committed to dealing directly with, COMIBOL and from a strategic perspective focusing solely on the tailings sites which have the potential to generate value for shareholders.

Of course this is an early stage play in a high risk region and investors should seek professional financial advice if considering this stock for their portfolio.

Ellingford said that the current conditions in Bolivia were robust and favourable, noting numerous changes to the mining laws. Despite this changing landscape he is confident that VIC is in an excellent position to be able to finalise all contractual requirements needed to implement its strategy.

Historical data and government reports point to potential viability for development

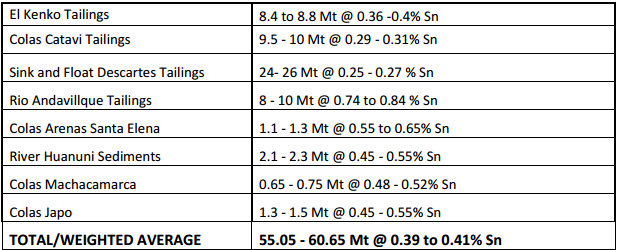

There has been historical exploration work completed on all of the tailings sites, but the results are not sufficient to define a JORC resource. However, the data has enabled the company to define exploration targets. These are outlined as follows.

It is important to note that the potential quantity and grade of these Exploration Targets are conceptual in nature and there has been insufficient exploration to estimate a Mineral Resource. Further, it is uncertain if exploration will result in the estimation of a Mineral Resource.

However, a COMIBOL Monthly Report of Geological Operations, Tin Mines, 1974 formed the basis of the exploration target potential as being between 1.3 million tonnes and 1.5 million tonnes at grades between 0.45% and 0.55% tin.

VIC said these metrics were estimated taking into account plant capacity, years of operation and the grade indicated by assay results. A recent survey of the tailings arrived at an estimated tonnage of 1.4 million tonnes.

A drilling program will commence shortly and the subsequent feasibility study is intended to define the technical and economic description of the tin processing plant over a period of approximately six months. The cost of building the processing plant (CAPEX) and the cost for operating the plant (OPEX) will be estimated in the feasibility study.

The projected cash flow for the period of plant operation and other financial indicators will be calculated to prove the profitability of the project. VIC plans to extract the tin (and other metals – silver and potentially tantalum) by gravity, magnetic separation and the flotation process.

The degree of liberation and grain size of these minerals will dictate the most suitable process and equipment to be considered.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.