VIC identifies excellent cobalt/scandium mineralisation potential at Husky and Malamute

Published 05-DEC-2017 11:52 A.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Victory Mines (ASX:VIC) this morning announced that expanded desk top analysis, by its newly appointed geology team, has confirmed excellent potential for discovering cobalt and scandium mineralisation at two NSW tenements.

The review on the four highly prospective primarily cobalt and scandium project areas, including the Husky and Malamute tenements, is part of its expanded Cobalt Prospecting acquisition due diligence. The WA project areas will be covered in due course.

The news follows an announcement on November 14 that VIC is acquiring four highly-prospective primarily cobalt project areas in NSW and WA by acquiring 100% of Cobalt Prospecting Pty Ltd.

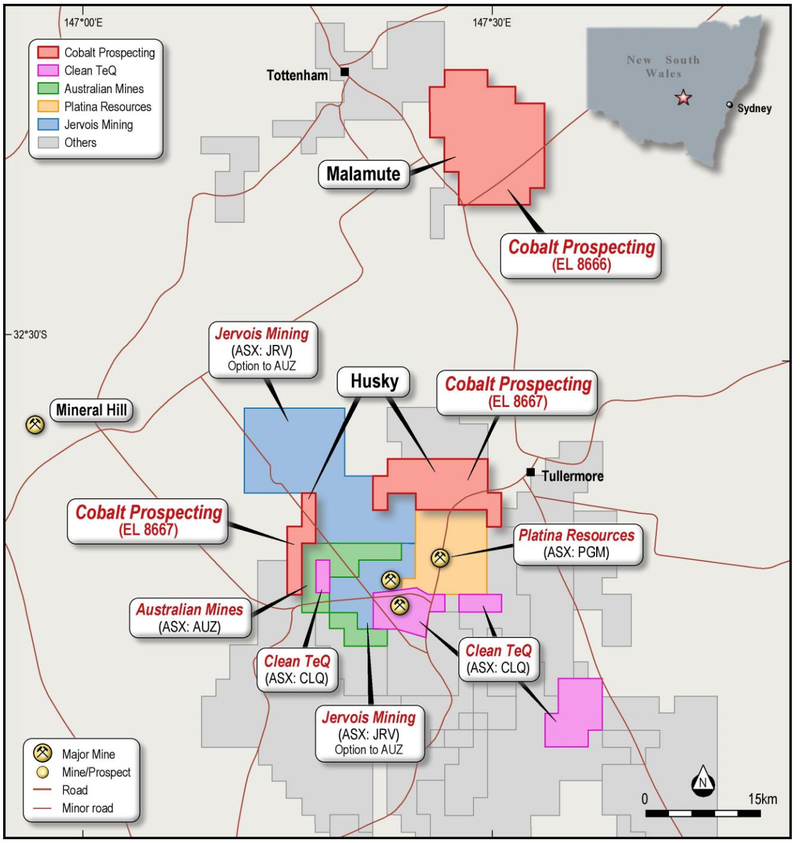

The two NSW tenements, Husky and Malamute, are 150 kilometres west of Dubbo and very near tenure owned by Clean Teq (ASX:CLQ) and Australian Mines (ASX:AUZ) which have demonstrable high-grade cobalt and scandium mineralisation.

These conclusions were drawn by carefully reviewing magnetic imagery for peers — Clean Teq (ASX:CLQ), Platina Resources (ASX:PGM) and Australian Mines (ASX:AUZ) — tenements then comparing them with Husky and Malamute.

Overall this is an early stage play and as such any investment decision should be made with caution and professional financial advice should be sought.

One of the key attractions that acquiring Cobalt Prospecting brings to the table is the two NSW tenements, Husky and Malamute, given their proximity to high profile cobalt/scandium groups CLQ, PGM and AUZ, as seen on the map below.

This proximity is the main reason why the recently appointed geology consultancy is focusing its efforts on further understanding the geology, starting with a more thorough review of comparative magnetic imagery.

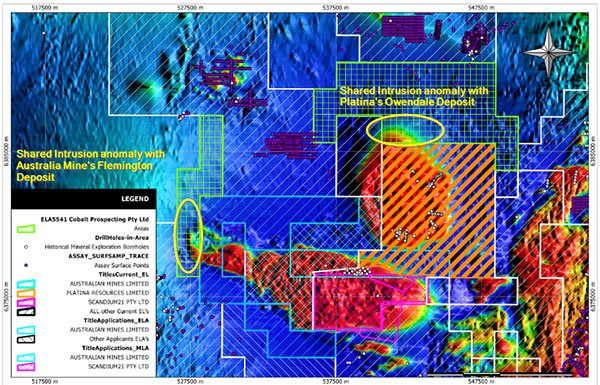

For the Husky tenement, which is contiguous to AUZ and PGM tenures, a magnetic imagery comparison — in combination with mapping outcropping of weathered Alaskan style intrusive geological features — provides a strong indication that lateritic mineralisation is present.

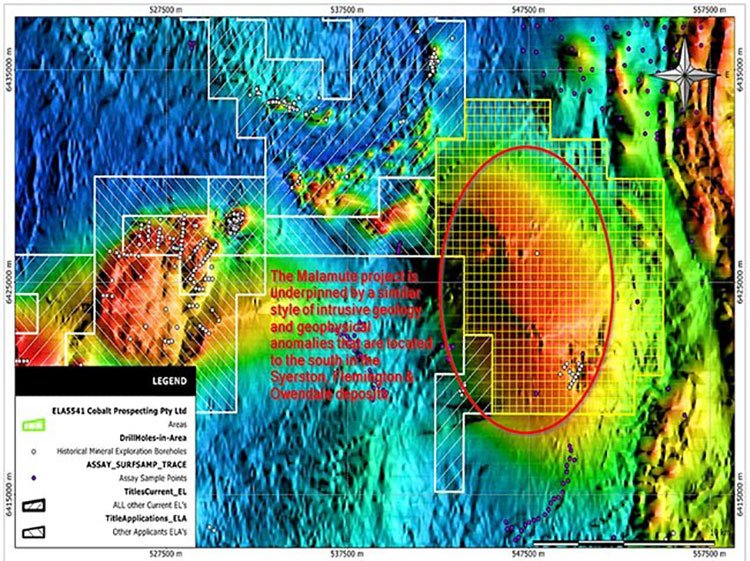

For the Malamute tenement, the comparative magnetic imagery indicates the possible area of lateritic mineralisation could equal or exceed the area of laterites that are derived from the weathering of Alaskan type intrusions in nearby peers’ tenures.

VIC used magnetic imagery to see how Husky and Malamute ranked relative with their immediate high-profile peers.

Husky

Husky is adjacent to PGM and AUZ’s deposits which are similar in geology and metal recoveries for cobalt laterite mineralisation. Interestingly, AUZ’s deposit overlies a magnetic anomaly, this is the source rock for the laterite.

Drilling results from a recent AUZ drilling programme doubled cobalt and tripled scandium mineralisation footprints, that were within the boundary of the magnetic anomaly. The results showed the mineralisation was open in multiple directions which is a positive upside indicator for the Husky tenure. AUZ noted that Flemington deposit and the CLQ Syerston Deposit are a single continuous geological feature.

The Husky prospect is expected to contain similar geological traits to CLQ’s deposit, implying it could produce cobalt sulphate, nickel sulphate and scandium oxide.

Magnetic imagery of Husky tenement:

Malamute

VIC highlighted that the Malamute tenure likely contains a geological analogue to CLQ, AUZ and PGM’s deposits, as there are similar geological traits exposed by historic drilling, geological mapping and geophysical signature.

The key difference to CLQ, AUZ and PGM’s deposits is the scale of the intrusive body underlying the Malamute prospect and that the intrusive body underlying Malamute is entirely within the boundary of a single exploration tenement, held solely by Cobalt Prospecting.

At this early stage it appears that the Malamute prospect potentially contains lateritic mineralisation that may equal or exceed the area of both CLQ and AUZ’s deposits. However, further desktop and field work are required to determine the full extent of prospective mineralisation.

Dr James Ellingford, VIC Chairman commented: “The Board is delighted with the comparative magnetic imagery results as they clearly confirm excellent potential cobalt and scandium mineralisation within the Husky and Malamute project areas in NSW. While further work needs to be done to complete the due diligence process, the Board has decided if the Cobalt Prospecting acquisition completes, VIC’s strategic orientation will be on proving up cobalt and scandium JORC complaint resources across the four new assets.”

The next phase for the geology team is getting a team to site to ramp up the field work and follow up analysis.

From a strategic perspective, VIC has determined if the acquisition of Cobalt Prospecting proceeds, its key focus will shift toward proving up JORC compliant cobalt and scandium resources.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.