Velpic’s Version 3.1 poised to capture greater market share

Published 05-SEP-2016 15:57 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

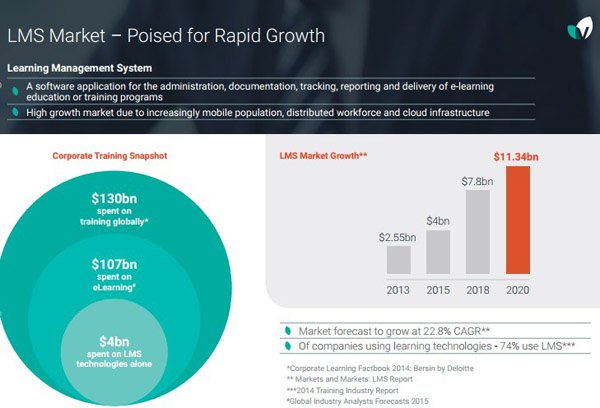

Velpic’s (ASX:VPC) much anticipated release of Version 3.1 of its e-learning platform sees not just the launch of a new product, but the adoption of a new strategy by the company which should result in enhanced client retention, as well as the potential to compete more effectively in the learning management systems (LMS) industry.

As a backdrop, Velpic Group consists of two related entities, a cloud-based video e-learning platform and Dash Digital, a brand technology agency. The group has developed a unique online platform that provides a scalable cloud-based training induction and education solution for businesses.

Velpic’s platform allows businesses to create their own training lessons and distribute them to staff and contractors who can access the Velpic platform on all devices including mobile phones and tablets.

Its technology has already been adopted by many ASX 200 companies, and with the announcement today that the company has transitioned to a ‘per active user’ charging regime there is added incentive for more regular use of its platform, as well as the potential to grab a greater market share of the burgeoning LMS industry.

How much market share Velpic could grab remains to be seen. If you are considering VPC as stock for your portfolio, use this information in conjunction with all other related information and seek professional financial advice.

In terms of platform changes, Version 3.1 includes new features that allow users to create lessons via uploading existing training content in a variety of standard document formats including, but not limited to PowerPoint, Microsoft Word and PDF.

This allows clients to quickly and efficiently compile their existing lessons on Velpic’s e-learning platform and start to use the platform immediately from the day of signup.

Prior to Version 3.1 being launched, lesson content had to be recreated by the client as videos using the Velpic Editor which often delayed the rollout of lessons to staff.

With the new system clients can upload existing content, allowing staff to immediately commence lessons. In tandem with these operations users can design and build replacement video based lessons.

One of the key benefits of Version 3.1 is that it facilitates the fast tracking of training while still complementing Velpic’s existing video content creation lesson functionality.

The improved functions and change in pricing structure are consistent with management’s recognition that learning management systems are no longer viewed as a tool to use for the occasional lesson, but a platform that becomes part of the day-to-day operations of all staff and management across an organisation.

Staff training is no longer considered as an onerous function of compliance, but a means of improving efficiencies and productivity within an organisation.

Velpic chief executive, Russell Francis said, “Trends in the workplace such as continuous learning and knowledge sharing mean that access to training content and a company’s core knowledge within the LMS is a daily activity for most staff”.

With regard to the functionality provided by version 3.1 Francis said, “The platform as a whole remains ahead of the competition by allowing content to be ultimately developed into video lessons, and the user seat pricing is an exciting evolution that meets the day to day training needs of modern businesses.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.