Velpic signs up 50th enterprise client

Published 20-DEC-2016 14:18 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

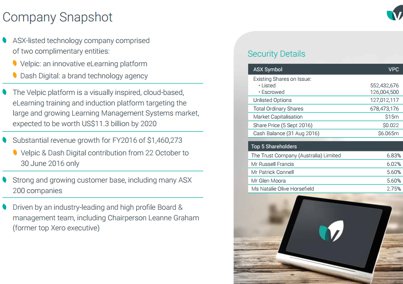

Christmas has come a couple of days early for Velpic (ASX: VPC) with management announcing on Tuesday morning that it has recently signed its 50th client to the company’s e-learning platform, confirming strong client growth which is expected to be the precursor to future increases in revenue.

On this note management highlighted the fact that the company has achieved an average of 22% quarter on quarter recurring revenue growth from SaaS clients since December 2015.

In response the group has expanded its sales team and product offering, which in turn is expected to assist in generating further growth in 2017.

There are other initiatives in the pipeline with platform innovation and new projects and collaborations expected to go live in the next 12 months.

VPC has made outstanding progress in just over 12 months since it listed through the International Coal shell in October 2015.

Having brought new products to market and built a strong presence across the east and west coast markets of Australia, the company is now focused on replicating the success on the international scene, beginning with New Zealand, the UK and the US with further strategic partnerships to be established in 2017.

Baillieu Holst sees Velpic as an impressive medium-term story

Baillieu Holst analyst Luke Macnab has been impressed with VPC’s ability to bring on board important new clients, as well as entering into mutually beneficial collaboration agreements.

He sees the release of the small to medium enterprise (SME) version of Velpic as instrumental in spearheading the group’s offshore strategy, particularly in the US and the UK.

In summing up the group’s prospects, Macnab said, “Velpic already has a number of large companies as customers and the management team has proven expertise in growing SaaS businesses and as such remains a Speculative Buy with the potential for significant upside in the medium term”.

On this note, he is forecasting VPC to generate earnings before interest and tax (EBIT) of $1.2 million from revenues of $10.2 million in fiscal 2019, translating to earnings per share of 0.2 cents. This implies a PE multiple of 8.5 relative to Tuesday’s opening price of 1.7 cents.

Potential investors should not make assumptions regarding past or future share price fluctuations, nor should they use forward-looking statements provided by the company or brokers as the basis for an investment decision. IBG is a speculative stock and independent financial advice should be sought prior to investing in this company.

Velpic poised to tap into strong global industry growth

While VPC has experienced significant growth in its own right, management noted that global growth of the learning management services market has shown no signs of slowing down and this year it was predicted to be worth US$5.22 billion.

With an estimated compound annual growth rate of nearly 25% this translates to a US$15.7 billion industry by 2021.

Chief Executive, Russell Francis, also noted that VPC had been ranked globally in the top 20 LMS enterprises on a number of criteria with its flexible and scalable solution providing a significant competitive edge. This is a factor that he believes will continue to attract new customers, both domestically and internationally.

New products in 2017 aligning with interactive learning methods

VPC is also planning to launch new products in 2017 and Francis commented that the emergence of technology trends such as Virtual Reality, Artificial Intelligence and Machine Learning, along with the overall Gamification of digital learning were exciting developments.

Relating these developments to the group’s product development initiatives, Francis said, “Interactive learning methods are becoming increasingly popular and are more effective than traditional learning techniques, and it is this shift that continues to drive our product strategy in 2017”.

He also highlighted the fact that VPC maintains a global first mover advantage by incorporating video content creation into a single, simple, engaging platform with other LMS features, and this competitive advantage will be further advanced in 2017.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.