Velpic cuts the corner to Version 3.0 targeting SMEs

Published 18-APR-2016 15:53 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Velpic (ASX:VPC), an Australian eLearning company, has said that its highly anticipated platform update will be delivered late this month as opposed to Q3 2016 as previously expected.

VPC is a cloud-based Learning Management System (LMS) provider helping businesses to educate and train their staff. The company listed on the ASX in November last year courtesy of an RTO deal with International Coal, a coal-exploration company.

VPC’s eLearning platform provides a unique solution to train and induct staff using interactive and dynamic training tools based on video and staff interaction. VPC’s own designers have dubbed its platform as ‘PowerPoint on steroids’. This type of offering helps both small and large companies organise and execute huge training initiatives that span thousands of employees spread out across the globe.

VPC said that Version 3.0 of its eLearning platform is “tracking well ahead of schedule with the process now entering the final testing phase,” according to an update to shareholders.

The new platform includes several new features: streamlined workflows, updated administrator dashboards and consolidated reporting features. It also features enhanced training capabilities for SMEs. Version 3.0 will be finalised “within the next two weeks” which is significantly earlier than the previously advised launch date of Q3 2016.

The much earlier than expected completion could potentially improve VPC’s market valuation once announced and further commercialisation deals come into view.

“This new platform will significantly enhance Velpic’s ability to grow its client base by providing a fully automated interface for SME clients to sign up to the Velpic platform. This provides the opportunity to significantly scale the Company’s [VPC] client growth with minimal additional overheads,” said VPC.

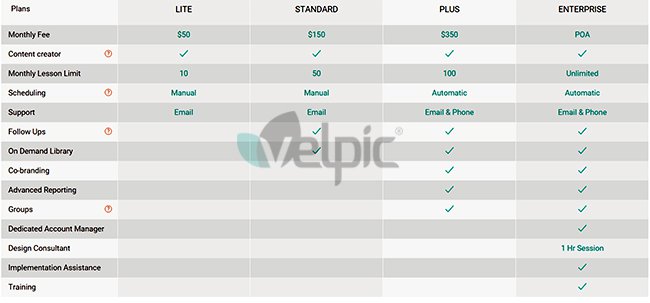

Earlier this year, VPC published provisional pricing information for its new SME-focused offering.

The accelerated time to marketing its new Version 3.0 targeting SME’s positions Velpic to emulate the success of other highly acclaimed cloud-based SaaS businesses such as Xero (valued at US$2.9 billion) and Atlassian (valued at US$4.7 billion) respectively.

VPC also says that Version 3.0 will complete the final third pillar in its Sales strategy. Since its inception, VPC has executed a business plan comprising of enterprise sales and reseller partnerships to generate initial sales revenue growth and will soon activate its SME-focused channel targeting businesses directly.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.