Upcoming webinar to discuss Spirit Telecom's growth trajectory

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Spirit Telecom Limited (ASX:ST1) is a growth by acquisition story with the group taking advantage of opportunities where it can deliver custom designed cloud-based technology and internet solutions for high growth markets such as schools, hospitals, aged care and medium sized businesses. This, along with the company's growth strategy will be the subject of a company webinar to be held on Friday 15 May.

In February, the group completed the acquisition of the Trident & Neptune Group (TBG), a transaction which is directly aligned with strengthening Spirit’s share of these designated markets.

The acquisition of TBG saw Spirit create a new business division in Trident IT Solutions, providing the group with opportunities to cross sell to the markets it has identified.

These types of clients are moving through a major generational technology change as they migrate to the cloud and require high speed internet and specialised tech services which Spirit can now provide nationally.

The rapidly changing environment that is being caused by the COVID-19 virus presents Spirit with additional traction to drive an accelerated growth agenda through mergers and acquisitions.

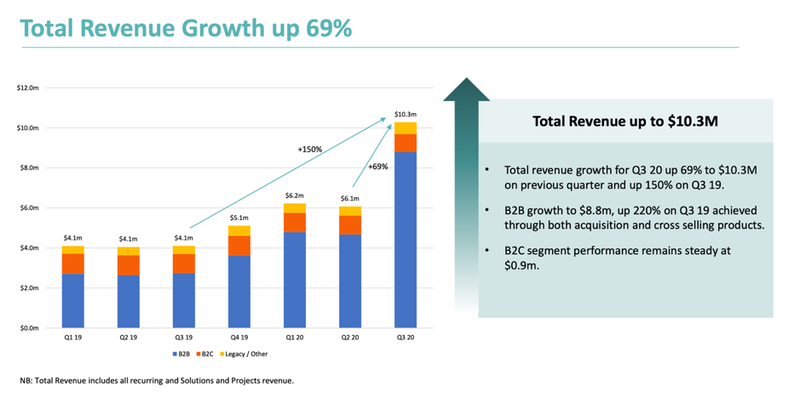

One can already see the revenue impact of acquisitions over the last 12 months, these include TBG following the acquisition of BCT in January.

There has also been a significant uptick in gross profit over the last 12 months as it increased by approximately 50% from $5.9 million in the first half of fiscal 2019 to $8.9 million in the first half of fiscal 2020.

Commenting on recent developments and the group’s strategy going forward, Spirit’s managing director Sol Lukatsky said, “This is a transformational period for Spirit and through the acquisition of these businesses, Spirit will build and strengthen cloud, security, data and managed IT services capabilities whilst providing entry into target growth verticals including schools, health (hospitals) and aged care.

‘’The existing Spirit information technology and telecommunications division will continue to focus on the SMB (small to medium sized businesses) sector with the new Trident IT Solutions Division targeting higher value complex segments.”

Acquisitions to create increased revenues

Not only do the acquisitions provide strategic advantages, but they will offer a significant boost to revenue and earnings.

Spirit is currently focused on acquiring cashflow positive businesses that have a core customer base with a low probability of customer default – sectors such as education and healthcare fit this profile.

Trident and Neptune generated combined revenue of $34 million in fiscal 2019, which is sure to boost Total Contract Values (TCV) over the coming months.

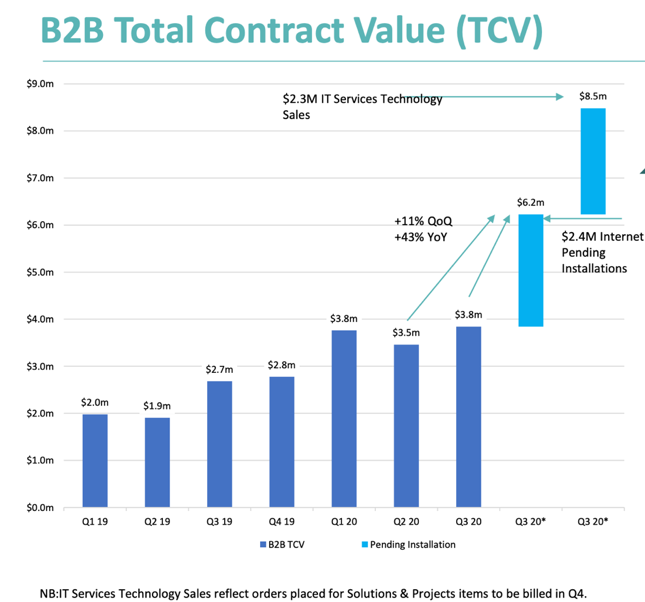

TCV numbers are already strong at $3.8 million for the quarter, up 11% on Q2 and 43% to Q2 2019. Furthermore, Total Data and IT services including pending installations valued at $2.4 million for IT services and $2.3 million for technology sales, total $8.5 million for Q3 2020.

The uplift in TCV is attributed to B2B telco sales and managed services, as well as maintenance of its Average revenue per user (ARPU) value and contract length.

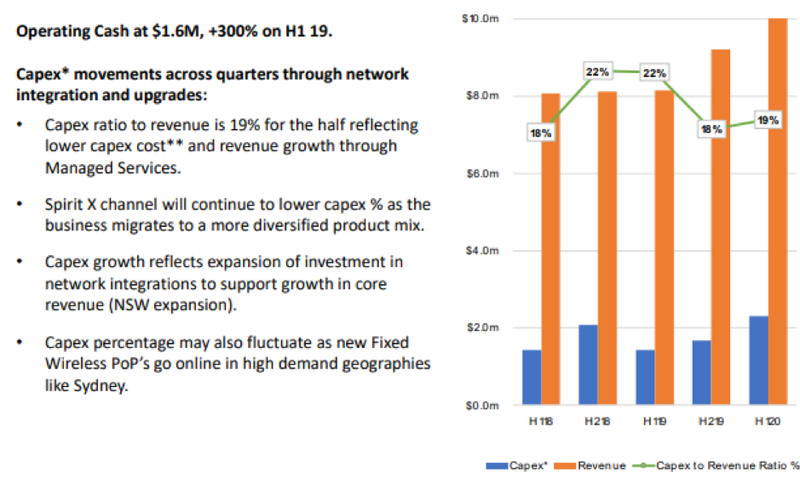

It is also worth noting that capital expenditure has also been reduced, in line with Spirit’s strategy to move to cash flow positive status. The Trident acquisition (along with the rollout of Spirit-X) is key on this as the company continues to migrate to a more diversified product mix.

Management’s ability to negotiate value adding acquisitions should come as no surprise given that the group integrated four new businesses in 2019, spanning the sales, marketing and billing areas.

Likewise, the company is demonstrating its ability to optimise the earnings and strategic value offered by these businesses.

The aggregation of new businesses under the one banner is set to continue with management recently flagging that it is conducting due diligence regarding potential acquisitions.

Further, the group recently expanded its debt facility to $10.9 million, extending a further $2.9 million over the past two months.

This along with proceeds from a recent $9.2 million capital raising will assist in funding new acquisitions in the MSP and Telco space.

Funds will also be used to expand Spirit X – the company’s telco digital sales platform- which generated 3200 service qualifications in its first 3 months of operation across the third quarter of 2020.

March quarter growth accelerated

It is one thing to make acquisitions, it is another to fully capitalise on the benefits of increased revenues and improved efficiencies while maximising earnings.

Even larger companies have bitten off more than they can chew, and some have failed to successfully integrate acquisitions.

However, Spirit Telecom has demonstrated its ability to realise improvements at all levels.

This was particularly evident in the March quarter market update released in mid-April.

The graph below demonstrates the nominal increase in capital expenditure compared with significant increases in revenues that have been achieved over the last two years.

Notably, capital expenditure in the second half of 2018 is broadly in line with the first half of 2020, but during that period the company has increased revenues by about 25%.

Is there share price upside in ST1?

When companies are growing at this pace and it is difficult to forecast the quantum of upcoming transactions on the merger and acquisition front, it can be difficult to arrive at a valuation.

As a guide, consensus forecasts for 2021 are based on revenues of $46 million with EBITDA expected to be the vicinity of $3.2 million, representing earnings per share of 0.9 cents.

However, it is worth noting that management expects to be generating revenues at a run rate of circa $80 million per annum by the end of calendar year 2021.

Consequently, there could be significant upside to consensus forecasts.

Notwithstanding the potential for earnings upgrades, the consensus share price target is 30 cents, implying share price upside of 100% based on Thursday morning’s opening price of 15 cents.

It is worth noting that there was good support for the company this morning with its shares up about 15% despite a 30 point decline in the All Ordinaries index.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.