Thred’s relationship with Microsoft gains further traction

Published 05-SEP-2016 16:15 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shares in Thred (ASX: THD) look set to maintain their upward trajectory on the back of an announcement on Monday morning regarding its selection by Microsoft to showcase its product and platform at the Microsoft Channel Kick off (CKO) 2016 Partner Conference.

While this doesn’t represent the signing of a contract or a development that one can place a dollar value on, it is significant for the group in that it follows on from the company providing Microsoft with a successful technical demonstration, highlighting the integration of its social media messaging functionality and core system into the Microsoft Office 365 suite of products.

Thred sees a substantial end market for its technology given that it estimates the average person has five social media accounts, representing a fragmented, overwhelming and time-consuming experience in terms of monitoring and managing their progress.

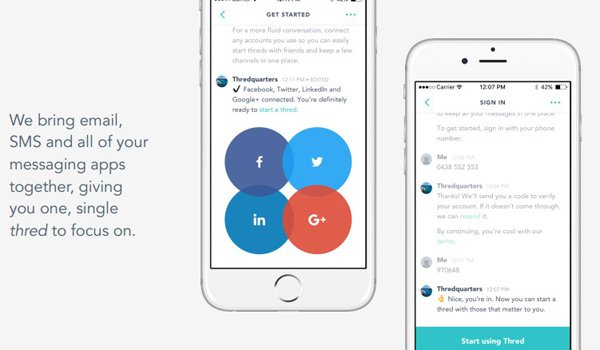

Thred’s technology allows users to centralise all of their social connections into one place, making messaging far more streamlined. The technology also brings email, SMS and messaging apps together.

Strategically, Thred’s technology should gain acceptance by the major social media players given that it is not looking to compete with them, but offer benefits for their users that should potentially assist in maintaining and growing their client base.

Thred’s revenue model revolves around the generation of income from revenue sharing with platform owners, advertising, subscriptions and the potential to clip the ticket on monetary transfers.

How much revenue Thred will be able to generate remains to be seen, so if considering this stock for your investment portfolio, seek professional financial advice.

Participation in the conference will also provide the company with an opportunity to demonstrate the core functionality of the minimum viable product (MVP) release of the Thred platform.

Management highlighted that this is the launch version of the software that allows the Thred team to collect the maximum amount of validated learning about customers with the least amount of effort.

The benefits of Thred’s relationship with Microsoft are far-reaching and include financial offsets to Azure hosting and serving, as well as synergistic opportunities that stem from access to key personnel within Microsoft, including the Office 365 Team and their Cloud Service Systems Integrations Team.

The strength of the partnership has resulted in significant progression into Office 365 with chief executive, David Whitaker noting the smooth integration of Microsoft’s Bing Search Engine into the Thred platform across both consumer and enterprise facing expressions.

Whitaker said he expects these developments to continue to underpin shareholder value as Thred progresses towards commercialisation.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.