Thred launches Beta version ahead of schedule

Published 18-NOV-2016 12:23 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shares in social media software developer, Thred (ASX: THD) could continue the upward trend established in November with the announcement on Friday morning that the Beta version of its native app will be released earlier than expected.

This tops off a particularly strong month for the company after it provided a promising trading update on November 4. Since then its shares have increased 35% with investors aware that today’s announcement was imminent.

The Beta release will be available on both iOS and android systems, initially by invitation, but subject to final testing and internal sign off it should be released next week.

This is an extremely important development for the company as it strives towards the commercialisation of a unified social messaging platform and web and mobile app to enable cross-platform communication.

However this is still an early stage play and investors should seek professional financial advice if considering this stock for their portfolio.

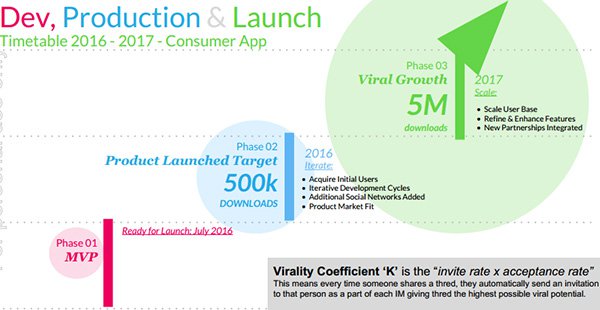

As can be seen below, THD set a number of goals prior to its launch as an ASX listed company. Two of the three goals slated for 2017, being the integration of new partnerships and refinement and enhancement of features, have been substantially progressed ahead of time.

Beta format provides advanced functionality

The Beta format will allow users to experience advanced functionality as a communication and service delivery tool in the global messaging and social media space. As management highlighted in its recent market update, the group continues to aggressively pursue Microsoft channel partners who Microsoft proactively introduce to Thred.

This strategy is important in terms of building market demand for both Core Thred and enterprise versions in advance of working product launch. One of the most significant aspects of the Beta launch is the fact that it will enable commencement of Microsoft plug-in programs to further the integration of Thred into the Office 365 Suite.

In tandem with today’s announcement was news that initial third-party service integrations will be with Uber and Microsoft Office 365.

Management said that both integrations had been brought forward and are significant because THD is now able to illustrate additional functionality with world-class enterprises like Uber and Microsoft that enhance the user value proposition.

Pointing to the significance of this development, THD’s Chief Innovation Officer, David Whitaker said, “This represents a significant outcome both technically, and for the company as a whole that demonstrates our growing capability and technical achievements”.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.