Stargroup boosts revenue by 50%

Published 11-JAN-2016 10:14 A.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Payments player Stargroup (ASX:STL) has recorded its eight quarter of record revenue in a row, and says all the signs are pointing towards a ninth.

STL told its shareholders this morning in a pre-open release that it had quarterly revenue of about $750,000, which was a 24% jump on gross revenue quarter-on-quarter, and more than double on a year-on-year basis.

The result was driven by a 50% hike in ATM revenue for the quarter on the back of a 51% increase in ATM transactions.

STL said ATM revenue reached almost $350,000 for the quarter, but there would be more to come in the next quarter.

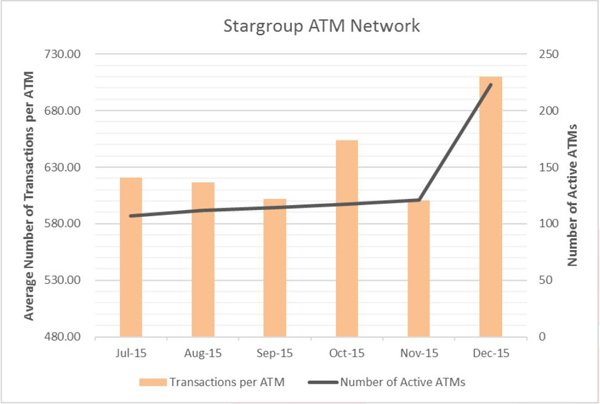

Chart showing growth in STL’s ATM network and transactions.

In October last year STL announced that it would acquire Cash+ and its network of 109 ATM machines.

The latest quarterly result, STL said, only contained one month of contribution from the new 109 machines.

STL currently has 230 active ATM machines in the field.

“This quarterly result has only incorporated on month’s results of the recently acquired ATMs from Cash Plus and therefore we will also see a significant improvement in our results in the next quarter,” STL CEO Todd Zani said.

Average transactions per machine reached 667 per month during the quarter, a 9% increase quarter on quarter.

STL said it was focused primarily on the transactions per machine metric as an indicator of growth as it’s “the best as to how well we are investing our shareholders’ capital”.

It said its result of 667 transactions per month put more established players in the space in the shade, including Canadian-listed DC Payments, over which STL enjoyed a 20% premium.

About STL

Back in September STL merged with iCash Payment Systems to create a combined ATM and EFTPOS company.

It has a network of ATMs around Australia, taking a clip on each transaction, but it also has longer term plans to get into the EFTPOS game, adding another source of revenue for the combined company.

STL is also the only listed ATM company which has a direct stake in the manufacturer of its ATM machines, namely NeoICP in South Korea.

It has estimated the stake helps reduce the costs of manufacturing machines by about 30%, saving $1.1 million in capital expenditure each year.

It has also sought to diversify into other areas such as ‘cash recycler’ ATMs and PayWave Technology.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.