SM8 signals wetsuit push with key hire

Published 21-JUL-2016 13:23 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shark Mitigation Systems (ASX:SM8) has signaled its about to ramp up its wetsuit sales game with a key acquisition.

The world’s only listed shark mitigation stock told its shareholders today that it had snagged ex-chief operating officer at surf brand Rusty, Simon O’Sullivan.

He was at Rusty for over a decade, include five years as COO – but was also the WA State Manager for Rip Curl.

O’Sullivan will become SM8’s general manager – with his mandate to increase sales of SM8’s shark-repelling wetsuits, SAMS.

SM8 is looking for further commercialise the technology through licensing agreements, and will also investigate direct to market opportunities – in any case SM8 says O’Sullivan’s experience in surfwear retail makes him uniquely positioned to handle the task.

“Simon brings a significant wealth of experience, having managed multi-million dollar sales, marketing and distribution operations in the surf industry,” SM8 founding director Craig Anderson said.

“We believe there are significant opportunities for our technology in the global wetsuit market and Simon is an ideal candidate to unlock this potential.”

Potential investors should note that there is no guarantee of a ramp-up in sales – this remains an early-stage stock and you should consult a professional before investing.

More on SAMS

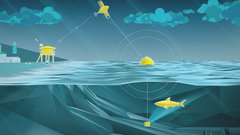

SM8’s proprietary technology, commonly known as SAMS, has been developed in partnership with the University of Western Australia’s Oceans Institute and School of Animal Biology, meaning it truly is one of a kind, with the IP completely in SM8’s hands.

The SAMS technology is based on new molecular science and interpretation of the visual systems of large predatory sharks undertaken by the university.

SM8’s wetsuits simplify the recognition process for sharks i.e. when sharks see a surfer with a SAMS wetsuit on, the design leads the shark to identify the surfer as inedible and not like its ordinary prey.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.