Simble poised to achieve strong revenue growth in 2020

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Simble Solutions Limited (ASX:SIS), an Australian software company focused on energy SaaS solutions released a very positive March quarter business update at the end of February, but it was overshadowed by the wave of coronavirus news.

As a provider of hardware and software solutions requiring little face-to-face contact with clients, the company shouldn’t be unduly affected.

Furthermore, its core business revolves around the supply of essential services, leaving it less exposed than many companies that rely on the sale and supply of discretionary goods and services.

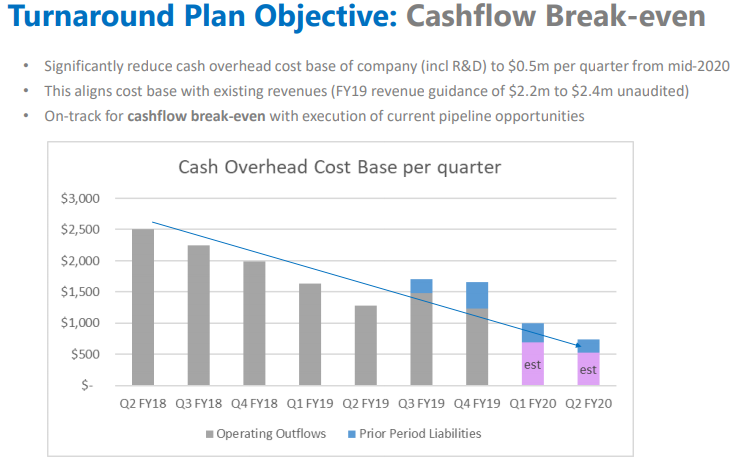

From an operational perspective, the company achieved a 5% increase in revenues for the 12 months to December 31, 2019.

Importantly, net cash used in operating activities in fiscal 2019 reduced from $5.9 million in the previous corresponding period to $3.3 million.

This was reflected in the significant reduction in cash burn that was achieved in every quarter, an important factor for companies that invest heavily in product development ahead of revenue generation.

Management noted that the significant reduction the group’s cost base could be attributed to operational restructuring and diligent fiscal management, indicating that the cost outs are sustainable.

While the company is yet to move to profitability, the underlying EBITDA loss of $2.4 million represented a 32% improvement on the previous year’s loss of $3.5 million.

New partnerships and products to drive growth in 2020

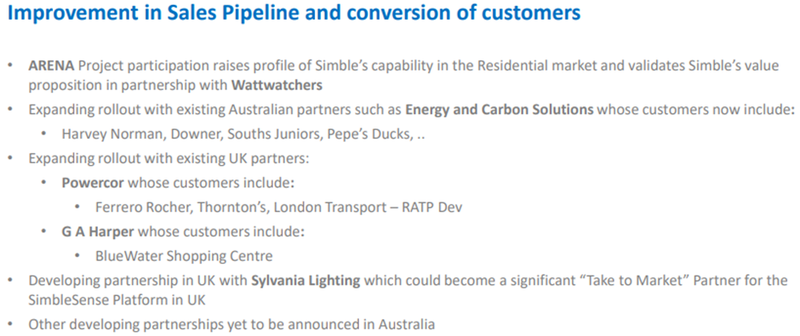

Simble has forged partnerships that have the potential to drive revenue growth over the next 12 months.

Meters under management supporting the SimbleSense platform grew by 50%, which has continued into 2020 with the recently announced BlueWater contract, ARENA rollout and Sylvania Lighting partnership.

Interest in CarbonView, Simble’s carbon and sustainability platform has increased as a result of an increased focus by corporations across the globe and specifically in the markets that Simble operates in.

This has potential to drive additional SaaS revenues over the coming months.

Subsequent to the year end, growth of meters under management supporting the SimbleSense Platform and subscriptions has continued with the growth rate increasing by a further 10% in two months.

Subsequent to year end Simble announced a three-year agreement with Sylvania Lighting to incorporate the SimbleSense Platform into all lighting projects to commercial customers, commencing in the UK, France, Germany, Spain and Italy.

Not only does this provide a robust platform for revenue growth, but it represents a strong endorsement of Simble’s products.

SimbleSense energy analytics platform will be embedded into Sylvania’s turnkey solution, providing “energy intelligence” to customers.

First app provider in smart energy rollout

The March quarter also saw Simble appointed as the first app provider in the ARENA-funded national smart energy rollout.

Australian Renewable Energy Agency (ARENA) is subsidising part of the estimated $8.2 million total cost of installing 5,000 homes and small businesses, plus 250 schools, with a grant of $2.7 million.

Simble and Wattwatchers will be targeting a broader roll-out in the Australian domestic market beyond the ARENA-backed project.

Government bodies and large corporates have been approaching Simble to assist them in in developing energy-efficient programs, as well as determining and understanding their actual energy footprint.

These groups have included the Department of Health and Human Services in Victoria, the RACV and a construction group with operations in Australia and the UK.

Synnex launched a new marketing campaign to promote the SimbleSense platform to its large reseller base including an online presence at Kogan.com and TrinityConnect.com.au.

Simble also expanded into New Zealand with the first installation of its SimbleSense platform occurring via its New Zealand channel partner Optimal Group.

While management didn’t provide quantitative guidance for 2020, chief executive Ronen Ghosh said, ‘’Our focus in 2020 will shift from foundation building to execution as we start to regrow our presence in UK and Australia through market opportunities, an improved commercial model and a world-class product offering.

‘’We have already started to see some good activity in the first quarter and believe that 2020 will be an exciting year in Simble’s journey.’’

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.