Simble grows revenues, slashes costs

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

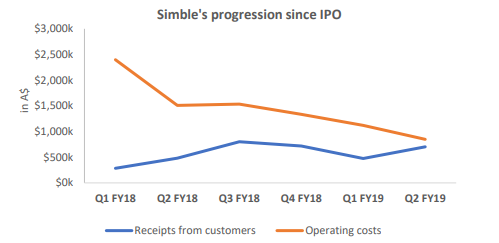

Simble Solutions Ltd’s (ASX:SIS) quarterly result for the three months to June 30, 2019 demonstrates that the company is approaching a significant inflection point with revenues poised to break above the group’s diminishing cost curve.

Particularly in the last 12 months, the company has substantially reduced its operational costs.

However, this hasn’t placed a drag on the company growing the business as evidenced by the sharp uptick in receipts from customers in the June quarter.

As the following chart indicates, receipts from customers grew fairly rapidly off a low base after the company listed on the ASX and then as is fairly characteristic tended to stabilise over the ensuing six months.

Importantly, the company has negotiated significant multi-year agreements in recent months which provide recurring income and earnings visibility.

Commenting on the companys increasingly robust financial position, chief executive Fadi Geha said, “Simble’s operating cash flow improved by almost $1 million compared to the same quarter last year, as we continue to grow the business while simultaneously realising operational efficiencies across all business units.

“Net cash used from operating activities shrunk to $150,000, the lowest level since our IPO and an 86% improvement compared to twelve months ago.

“We have signed deals of up to $7 million of contracted revenue in the last six months as demand for our energy analytics software solutions continuesd to grow.

‘’We will now strategically deploy capital to grow that number significantly through diligent execution of our partner-led growth strategy.’’

Recurring income provides revenue predictability

Simble provides investors with a reasonable degree of revenue predictability as it generates a significant proportion of revenue from providing solutions to the essential services sector.

The Simble Energy Platform or ‘SimbleSense’ is an integrated hardware and real-time software solution that enables businesses to visualise, control and monetise their energy systems.

The company’s Software as a Service (SaaS) platform has Internet of Things (IoT) capabilities and empowers enterprises and consumers to remotely automate energy savings opportunities to reduce their energy bills.

Simble operates in the small to medium enterprise (SME) and residential markets, managing the distribution of its platform through channel partners.

The company has had strong success in the UK, having forged important corporate relationships in that region.

However, it is also represented in Australia and Vietnam.

Preparing to accelerate growth, especially in UK

Management’s outlook statement indicated that the company is ready to step up a gear in terms of increasing its presence in existing markets and breaking into new areas.

On this note, Fadi said, “Moving forward, we will further strengthen our UK presence as our solutions continue to resonate with the utility and energy brokers in those markets.

‘’We have a high-quality pipeline and have put in the work to validate and de-risk these opportunities so that investors can be confident that our growth trajectory will continue to accelerate.

“We have invested in our people and technology to capitalise on the enormous opportunity in the global energy market as technology’s role is only set to expand in coming years.

‘’Our IP sits at the core of this opportunity and we are at an inflection point of our growth strategy.’’

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.