Simble gears up for a big 2020

Published 06-NOV-2019 09:49 A.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Simble Solutions Limited (ASX:SIS) has updated the market on several initiatives it has taken as 2019 comes to a close, with 2020 now looming as a year of rapid growth.

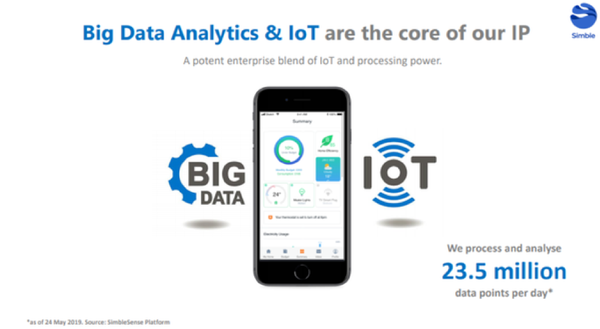

Simble is an Australian software company focused on energy management and Internet of Things solutions.

The Simble Energy Platform or ‘SimbleSense’ is an integrated hardware and real-time software solution that enables businesses to visualise, control and monetise their energy systems.

The initiatives outlined by the company were well received with the company’s shares surging in early morning trading under the fourth highest daily trading volumes recorded in the last 12 months.

While the record shows that the group’s shares rose to 4.4 cents and retraced to close at 4.1 cents, this isn’t an accurate record of trading on the day.

Based on the number and value of shares traded, the average price was 4.4 cents, highlighting the fact that it was only minimal selling in the afternoon that led to the lower closing price.

As a result of the initiatives we will outline below, Simble will enter 2020 as a more financially robust group after raising $1.1 million through a placement of 22 million ordinary shares at 5 cents per share to raise $1.1 million.

The placement price represented a 22% premium to the 3-day volume weighted average price (VWAP) and 13.6% premium to the 10-day VWAP.

This is a particularly strong show of faith in the company given that placements are usually priced at a discount to the prevailing share price prior to placement.

This further underlines the potential for the company to trade well above yesterday’s closing price of 4.1 cents per share.

The placement was made to sophisticated and wholesale investors, including an existing substantial shareholder.

The funds will be utilised to strengthen the company’s balance sheet, support growth in revenue in the UK market and for general working capital.

New CEO to strengthen financial capabilities

Following a detailed strategic review by the Board, Simble has made changes to its executive leadership team to broaden leadership roles and capabilities as the company increases its focus on efficient financial and capital management controls and targeted revenue generation.

The Board has determined that current chief executive Fadi Geha will hand over the CEO role to Ronen Ghosh, currently chief financial officer.

Ronen Ghosh is a finance executive with more than 25 years of experience in blue chip organisations operating globally in the fields of intellectual property, entertainment & media rights management, and investment management.

The company is looking for Ghosh to utilise his depth of experience and appropriate skill set to focus on resetting the company’s financial footing.

This will involve the implementation of strong financial and capital management controls and restructuring initiatives to ensure Simble is well positioned to exploit its growth potential in a unique space.

Simble also expects Ghosh to instigate sustainable cost controls, and with the anticipation of increased revenues, lower costs and higher margins, 2020 is shaping up as a transformational year for the group.

The Board and Ghosh have implemented a range of aggressive cost-cutting initiatives that will deliver in excess of $700,000 in annualised cost savings for calendar year 2020.

This would have a material impact on underlying earnings when you consider that it represents about 70% of the group’s $1 million in operating revenue for the last six month period.

While administration costs for the six months to 30 June, 2019 reduced from $4.1 million to $2.4 million, management’s recognition that there is still too much fat relative to underlying revenues demonstrates that they have a realistic grasp on what is required to transition the business from a ‘fast growing’ entity to a ‘profitable fast growing’ company that can consistently deliver robust shareholder returns.

Simble well positioned to rapidly grow revenues

As Finfeed outlined only a fortnight ago, top line growth should not be a problem for Simble, particularly following the negotiation of a collaborative agreement between it and digital energy group Wattwatchers.

In a multi-pronged approach, Simble and Wattwatchers will target business, residential and utility metering in Australia and internationally, with a significant position already established in UK.

Approximately 53 million utility smart meters are scheduled to be rolled out in the UK by the end of 2024.

Simble Solutions has partnered with leading energy service provider Utiligroup to access all energy data via the government-owned Data Communications Company (DCC) to develop the Virtual Analytics App, a consumer-facing energy management application that can be white-labelled for electricity and gas retailers.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.