Simble deal extension equates to 90% revenue increase

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

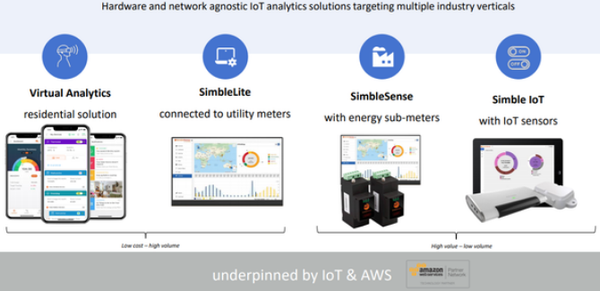

Simble Solutions Ltd (ASX:SIS), an Australian software company focused on energy SaaS and IoT solutions has extended its deal partnership with Australian technology company BidEnergy Ltd (ASX:BID) and UK energy broker UCR Consultants (UCR).

Simble will provide an enhanced technology solution, allowing a material expansion of the company’s existing agreement with UK energy broker UCR.

The introduction of BidEnergy’s Robotic Processing Automation (RPA) platform as a new feature bundled into Simble’s smart energy technology solutions will allow UCR to expand deployment to 60,000 metres ahead of schedule.

The updated deal is worth up to £3.5million (AU$6.4million) over a three-year term, a significant increase on the original deal struck in January which was valued at $3.4 million.

Importantly, this will result in a substantial increase in the group’s recurring revenues, providing financial stability and improved earnings visibility in the near to medium-term.

Targeting fast-growing energy broker market

Simble will target the fast-growing energy broker market in the UK, utilising BidEnergy’s RPA BidBilly platform to manage core data requirements for thousands of SME’s (small to medium enterprises) across the UK.

Through the front-end of BidEnergy’s RPA platform, Simble is able to seamlessly onboard clients, rapidly parse bill information and power Simble’s solution at the sub meter level.

This combined solution will allow UK businesses to reduce their energy consumption and their expenditure.

BidEnergy’s RPA Platform will seamlessly integrate with Simble’s smart energy technology solution and deliver superior value to customers of energy brokers.

The first energy broker to deploy the end-to-end solution will be Simble’s existing partner UCR Consultants, an energy broker with over 60,000 meters under management.

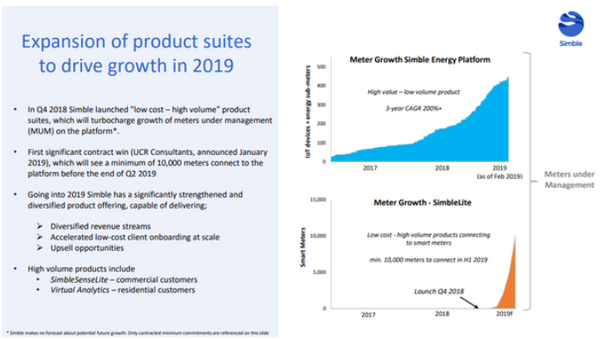

Proof of concept paves way for up to 60,000 meters

Simble’s partnership with UCR has delivered exciting results in the first four months, driven by strong customer demand and fast adoption of Simble’s disruptive energy analytics solution.

Following the successful proof of concept, UCR has signed a material expansion of the existing agreement to roll out the combined Simble and BidEnergy solution to up to 60,000 meters over an agreed timeframe.

The partnership with BidEnergy represents a major growth opportunity for Simble as it enables the company to leverage a growing footprint to cross-sell value-added solutions and acquire customers across a number of industry verticals with a comprehensive and significantly strengthened value proposition.

Recurring revenues as UCR targets 200,000 meters

To fast-track market penetration, UCR Consultants was appointed as a non-exclusive distributor to the UK energy broker channel targeting a further 200,000 meters, a four-fold increase on the initial target market announced in mid-January.

Over 2 million meters are serviced by energy brokers in the UK, highlighting the significant market opportunity for Simble which is valued at approximately $28 million.

As the rollout commences immediately, Simble expects to deliver substantial recurring revenues from this partnership, targeting monthly six figure income streams within the first 12 months.

Additional resources will be allocated towards the UK to maximise value from this partnership and further accelerate business momentum.

Highlighting Simble’s progress to date and the success of its partnership focused strategy, chief executive Fadi Geha said, "Everything we have been working on since our IPO (initial public offering) is coming together in this deal.

“Our partnership focused growth strategy will deliver value and significant revenues to all parties involved and allow us to offer end-customers the best of all solutions.

“We have a head start in the UK and the inclusion of BidEnergy’s solution allows us to scale faster, deliver more meaningful revenues and acquire more customers with a comprehensive and significantly strengthened value proposition."

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.