Shares in WhiteHawk soar on first Prime Contractor award worth up to US$5.9 million

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

WhiteHawk Limited (ASX:WHK), the first global online cyber security exchange enabling businesses of all sizes to take smart action against cybercrime has been contracted by a US federal government CISO (Chief information Security Officer) to implement WhiteHawk’s Cyber Risk Radar.

This resulted in a substantial increase in the company’s share price as it soared approximately 50% on Tuesday morning — a near 14 month high.

The contract will provide continuous monitoring, prioritisation, and near real-time mitigation of an enterprise’s teammates, vendors, or supply chain’s cyber risks over time, including the identification and prioritisation of a risk mitigation strategy.

As this is the first US federal contract where WhiteHawk has been nominated as the Prime Contractor, it is an extremely important development and Terry Roberts, executive chair of WhiteHawk said, “After a very successful Proof of Value early last year, now we are putting in place our first 5-year Cyber Risk Radar contract with a sophisticated US government CIO, who will work with us to take the capabilities of our platform and virtual services to the next level.”

On three other US federal Department CIO Contracts, WhiteHawk is a Cyber Solution sub-contractor to Accenture Federal, SAIC and Guidehouse (formerly PWC Federal).

WhiteHawk Cyber Risk Scorecards will be provided quarterly, virtually and remotely, for 150 to 300 vendors to this US Federal Government CISO, via an integrated risk management dashboard.

Annualised revenue of $1.2 million

The annual Software as a Service (SaaS) contract, will see WhiteHawk generate base revenues of US$580,000 and up to an additional US$600,000, with up to nearly US$1.2 million each year of the contract, with four additional option years at the same levels.

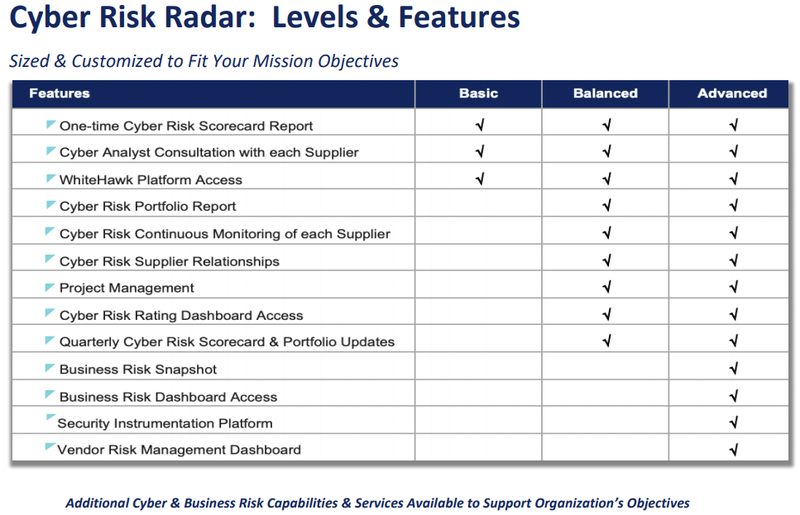

Cyber Risk Radar is an annual SaaS subscription service developed by WhiteHawk consisting of quarterly services that include Cyber Risk Scorecards, Cyber Risk Portfolio Reports, and ongoing conversations with a professional Cyber Analyst.

This contract is the result of a Proof of Value that was implemented early in 2019 across 10 vendors for the same US government agency.

WhiteHawk demonstrated through automation and subject matter expertise, the status and health of suppliers using global publicly available data sources, AI analytics, and custom Cyber Analytics to assess and report on top risk indicators and vectors, areas that may require prioritised attention.

Because the Cyber Risk Radar approach is externally available data and is non-invasive, WhiteHawk does not require access to internal IT assets and configurations in order to deliver its services.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.