SenSen seizing a substantial market share in South-East Queensland

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

SenSen Networks Ltd (ASX:SNS) has secured a deal to supply an automated parking enforcement solution to Tweed Shire Council, in conjunction with its distribution partner, Duncan Solutions, an Australian-owned company, providing integrated parking solutions.

Tweed Shire Council is a longstanding customer of Duncan Solutions.

Commencing in September 2019, the contract with Tweed Shire Council covers the city’s purchase of an initial SenFORCE mobile parking enforcement unit, with upfront revenue for the systems, software and commissioning of the unit.

SenSen will also earn annual recurring revenues and fees for the software licence, maintenance and support services, under the three-year term of the contract.

This is an important aspect of the contract as it provides predictability of income, as well as multiple ongoing revenue streams from services such as inspection, repair and maintenance.

Tweed Shire Council is the largest Council on the north coast of New South Wales, delivering more than 50 services to 94000 residents over an area of 1300 square kilometres.

The award of the Tweed Shire Council contract follows other recent deals with the City of Gold Coast, Brisbane City Council and Cairns Regional Council.

Outstanding growth in recurring revenue

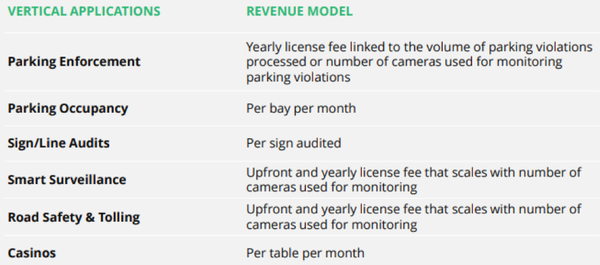

As a backdrop, SenSen is focused principally on the development, commercialisation and supply of innovative, data-driven business process enhancement solutions, designed to assist customers in their business operations and significantly improve business efficiency and productivity.

SenSen provides video analytics and artificial intelligence data analytics software solutions to customers in the intelligent transportation systems and gaming sectors located in Australia, Canada, Singapore, Europe, India, and United Arab Emirates (UAE).

With a large number of qualified new opportunities in the pipeline across the smart city and retail and leisure (casino) verticals, SenSen maintains a positive outlook regarding its capacity to rapidly grow its customer footprint and base of recurring revenue.

It is worth noting that although 2019 revenue was down slightly year on year, recurring revenues grew more than 150% during the year to reach approximately $1.5 million.

It would appear that investors grasped the significance of the substantial increase in recurring revenue as the company’s shares increased approximately 50% in July/August.

While they have retraced slightly from the August high, this can be attributed to negative sentiment in broader equity markets, and may represent a buying opportunity.

As part of its Smart Cities division, SenSen's parking enforcement solution continues to gain favour, particularly with councils across Queensland.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.