Roots’ management team geared for cannabis focus

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Roots Sustainable Agricultural Technologies Limited (ASX:ROO) has advised that Boaz Wachtel has been appointed chief executive and executive chairman, effective immediately, with Sharon Devir assuming the role of executive director and business development.

Wachtel is a pioneer and one of the global leaders of the cannabis industry who co-founded two ASX-listed cannabis-related companies during the past five years.

The change in leadership roles has been planned for some time and coincides with Roots placing much greater emphasis and focus on pursuing opportunities in the global cannabis sector, a market that presents considerable upside and more near-term revenue opportunities for the company.

The company’s success in this area was evidenced as recently as December when it signed a collaboration agreement with Tel Aviv Stock Exchange Listed medicinal cannabis producer, Seach Medical Group Ltd (TASE:SEMG) to research the effect of Root’s patented Root Zone Temperature Optimization (RTZO) technology on cannabis crops.

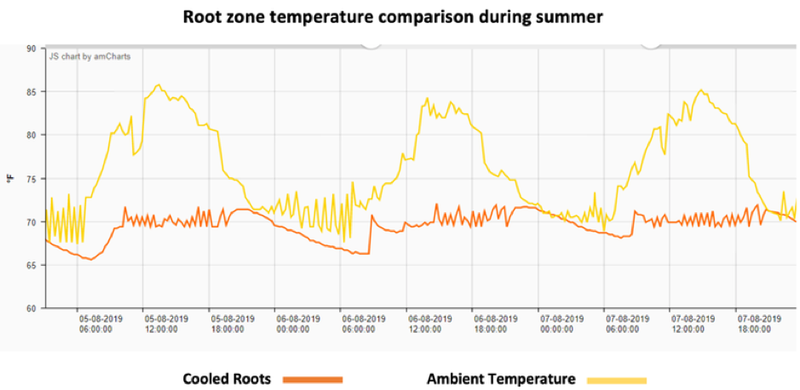

The company’s upgraded cooling system was used to stabilise the roots of cannabis plants at an optimal temperature of 21 degrees Celsius (70°F), despite ambient air temperatures within the greenhouse reaching 30°C (85°F) and outside temperatures topping 43°C (120°F).

Increases of 30 per cent and 118 per cent were achieved during the US summer on two cannabis strains of 400 and 200 cooled plants respectively within a climate-controlled greenhouse utilising wet mattresses and fans.

These results follow an initial sale to premium cannabis producer Canndescent in May with the installation completed in early June 2019.

Seach one of Israel’s prominent medical cannabis company’s

Seach is one of Israel’s preeminent medicinal cannabis companies that has been growing top quality medicinal cannabis since 2008 and supplying various forms to patients with a medical cannabis licence issued by the Israeli Ministry of Health.

Not surprisingly, news of the collaboration with Seach resulted in a substantial surge in Roots’ share price, and Monday’s high of 5 cents, which also represents a positive response to the aforementioned management changes, implies an increase of 85% in less than a month.

Wachtel was previously chief executive and chairman of one of the first ASX-listed cannabis companies.

He was also partly responsible for formulating the legalisation for medical cannabis in Israel and he is involved in various other global medical cannabis initiatives.

Wachtel is the inventor of Roots’ RTZO technology which is the core technology of the company and he has been intimately and actively involved in Roots for over a decade.

More opportunities pending

Commenting on the management changes, Wachtel said, “The RTZO technology has outstanding potential in the agricultural sector.

‘’As shareholders are aware, Roots has been actively pursuing opportunities for the deployment of RTZO in the cannabis sector and it is the market that presents the most upside for us.

‘’It makes good commercial sense that we therefore strengthen our efforts here, and I will be drawing on my contacts, network and expertise in the sector to do so.

Wachtel confirmed that more opportunities are pending in saying, “The Board is very grateful to Sharon for his ongoing commitment to the company.

He is a co-founder of Roots and been a successful and committed chairman and chief executive for the past seven years and we look forward to him playing a key role in Roots’ future at Board level and operationally.”

Consequently, it would appear there are catalysts on the horizon that have the potential to maintain the group’s recent share price momentum.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.