Roots looking to establish a position in the protein-based plants market

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Roots Sustainable Agricultural Technologies Limited (ASX:ROO) has established a new plant-based meats department within the company to capitalise on recent Proof of Concept (POC) study results that show the positive effects Root Zone Temperature Optimisation (RZTO) technology on the yield of protein-based plants, an outcome that has prompted management to pursue opportunities presented in the lucrative plant based meat market.

Root Zone Temperature Optimization (RZTO) optimises plant physiology for increased growth, productivity and quality by stabilising the plant’s root zone temperature.

This significantly increases yields and growing cycle planting options while also improving quality and mitigating extreme heat and cold stress, as well as significantly reducing energy consumption by stabilising and optimising the ROOTS zone temperature.

The Roots plant-based meat department will be focused on collaborating with industry partners and developing go to market strategies that would allow growers and product creators to use RZTO technology for protein-based plants used in the growing artificial meat industry.

Agricultural expert to lead research

World-leading researcher, Professor Zohar Kerem will lead the department on an advisory basis.

Kerem is a professor of food chemistry and he has had a longstanding career in the agricultural sector.

His previous research has covered the chemistry of phytochemicals and harnessing computational tools such as databases, specifically designed algorithms and modelling to predict and elucidate food-drug interactions.

He has been involved in and led a number of international projects that led to the discovery of new biologically active natural compounds in edible plants, and promoting their use by establishing mechanisms of action and designing novel foods.

This has included the discovery and synthesis of novel antimicrobials for food, agriculture, and cosmetics, as well as the development of novel high protein food products.

Kerem has had over 95 published articles in peer reviewed publications and holds five patents relating to food chemistry.

He currently holds a number of prestigious positions in Israel, including roles with the Institute of Biochemistry, The Robert H Smith Faculty of Agriculture Food and Environment and the Hebrew University of Jerusalem.

Kerem is currently deputy chair of the central committee for food standards with the Hebrew University of Jerusalem, a member of the national committee for nutrition security and head of the expert committees for trade standards of olive oil and edible oils at the Standards Institution of Israel.

Increase in weight and pod generation per plant

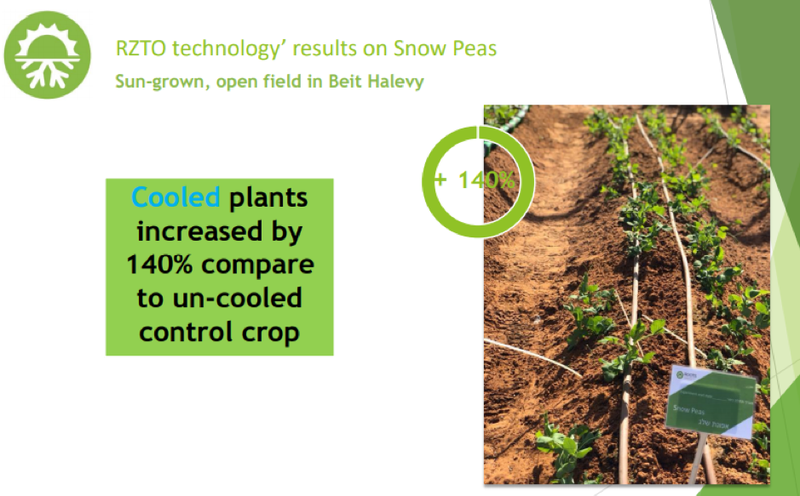

Management chose to establish the department following encouraging results from a POC study at its research and development facility in Bet Halevi, Israel.

The protocol for the POC was completely organic, using no fertiliser or other chemicals.

During the POC pea and bean plant plants were cooled using RZTO technology, which resulted in a 57% - 67% increase in yield per plant for both peas and beans.

Total pod protein content also increased by 77% and 55% in peas and beans respectively in cooled plants, when compared to uncooled plants.

These results clearly highlighted that the RZTO use resulted in weight increase per plant and more pods being generated per plant.

Management is confident that this will have significant benefits for commercial growers.

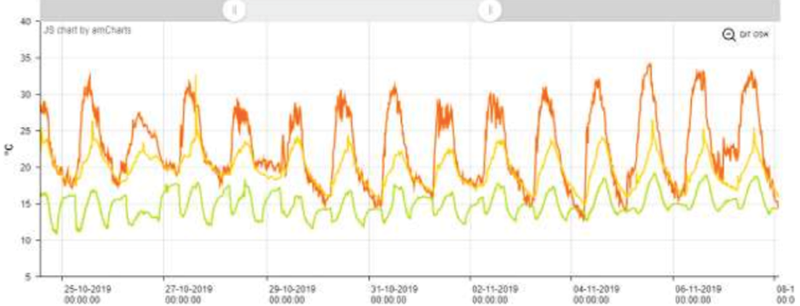

The graph below illustrates that while outside measured temperatures peaked at 30°C (degrees centigrade) during the POC, uncooled root zones peaked at 25°C and cooled root zones didn’t at any stage exceed 19°C.

Roots will shortly conduct another trial with beans and peas for the second stage growing cycle in an open field during which the plants will be heated using Roots’ technology through winter.

Industry metrics indicate that the plant-based meats industry provides a significant opportunity for Roots.

The expected value for the total market in 2019 is US12.1 billion and is expected to growth at a compound annual growth rate (CAGR) of 15%, reaching a value of US$27.9 billion by 2025.

Healthy eating trend driving product demand

Demand for plant-based meat alternatives is being driven by consumers seeking healthier dietary options and R&D efforts from health experts and food manufacturers.

Popularity for the products has also increased following the establishment of NASDAQ-listed Beyond Meat Inc. (market capitalisation of approximately US$7.8 billion), as well as an investment in alternative meat manufacturers by Cargill (America’s largest private company in the sector).

Following Roots’ recent placement to raise $2.5 million, the company is well funded to capitalise on a number of opportunities that it is aggressively pursuing through its plant-based meats department.

Commenting on these developments, chairman and chief executive Boaz Wachtel said, “We are extremely excited to have established a plant-based meat department to explore potentially lucrative opportunities in a rapidly growing sector.

‘’The company is also pleased to welcome Professor Kerem to lead the division, as he will be instrumental in screening opportunities to provide validation of the company’s technology in enhancing protein in plants.

“We have already achieved excellent POC results using the key ingredients for meat alternative products and we will now commence work to aggressively pursue collaboration agreements and partnerships with manufacturers in the sector.

“As food security continues to becoming an increasing concern for developing and established nations, our broader business performance continues to perform well.’’

Roots has a strong pipeline of opportunities in the agricultural and cannabis sectors, and with a number of initiatives in play regarding developing technologies and entry into new markets there are several share price catalysts on the horizon.

The company’s shares have already increased 35% in recent weeks, but further upside wouldn’t surprise, particularly given they are recovering from the coronavirus sell down.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.