Refocused Victory Mines’ acquires zinc cobalt project

Published 19-JUL-2017 13:42 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

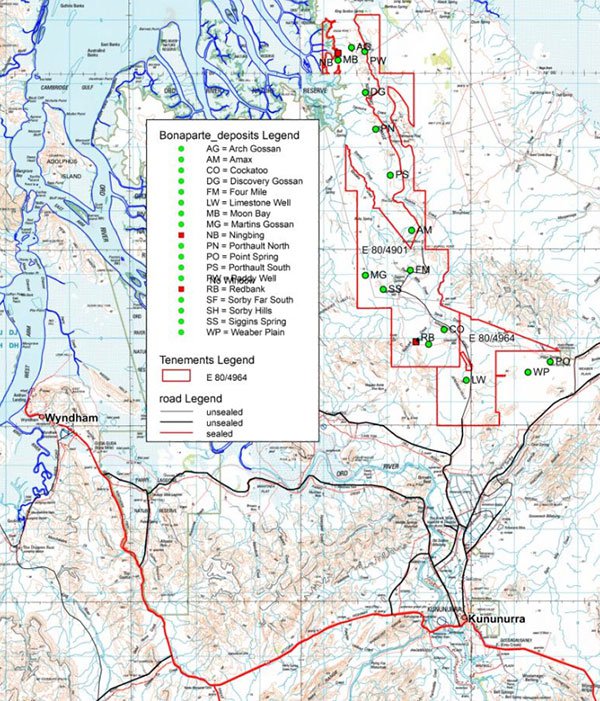

Shares in Victory Mines (ASX: VIC) surged more than 30% to an intraday high of 1.6 cents on Monday, July 18 after the company announced that it had entered into a Heads of Agreement to acquire a polymetallic asset situated on the western margin of the Bonaparte Basin, which is located just 30 kilometres north of Kununurra in Western Australia.

More than 50 million shares were traded in the day, representing all-time record volumes.

It should be noted that share trading patterns should not be used as the basis for an investment as they may or may not be replicated. Those considering this stock should seek independent financial advice.

The acquisition is known as the Bonaparte Project, a high grade cobalt, zinc-lead-silver mineralisation with samples of up to 4.1% cobalt in soft rocks.

From a base metals perspective, the region has been compared to the high grade deposits within the soft sedimentary host rocks commonly found along the Mississippi River in the US, otherwise known as Mississippi Valley Type (MVT), or in the Lennard shelf in Australia.

Interestingly, MVT zinc mineralisation is also widespread in Ireland where another ASX listed group in Zinc of Ireland (ZMI) has had recent exploration success, also prompting strong share price support.

Of course, with zinc being the best performing base metal in the last 12 months, and in recent weeks pushing up towards its long-term high of circa US$1.35 per pound, companies with exposure to the metal are in favour.

Bonaparte acquisition marks the beginning of a new era for Victory

The Bonaparte Project is VIC’s first acquisition since being recapitalised and repositioned as a focused mining group. The company has adopted a strategic low-cost acquisition strategy, targeting cobalt, zinc, copper and gold projects in highly prospective areas.

The Bonaparte Project not only ticks the ‘highly prospective’ box, but it also benefits from ready access to essential infrastructure including port facilities. With immediate access to power and a reliable transport route to the mine, management expects to be in a position to commence exploration in the near term.

Looking more specifically at the geological characteristics of the area, it is known for the occurrences of carbonate hosted base metal deposits such as Sorby Hills (WA) and Sandy Creek (NT), with previous work highlighting zinc-lead soil anomalies, spatially associated geophysical anomalies, and the presence of mineralised gossans and carbonate breccia zones.

Though VIC will have the benefit of previous exploration data compiled by other various parties that have worked the area, this will be the first focused exploration campaign at Bonaparte.

High grade zinc and cobalt mineralisation evident in historical data

The tenements not only offer the opportunity to discover MVT style zinc-lead-silver deposits, but the preliminary sample package has indicated strong cobalt and zinc results, requiring further analysis and follow-up exploration.

The grades quoted in the above map for the rock chip samples have been measured using a handheld analyser, and as such are indicative grades only.

VIC intends to explore the entire tenement area targeting fault corridors that mineralising fluids have used to travel up from deep in the basin.

Drilling to date has focused on the stratigraphy up dip of the extensional normal fault structures that host Lennard shelf style mineralisation.

This interpretation suggests mineralisation identified to date is just leakage from the more significant mineralisation within the extensional normal fault structures. VIC plans to acquire gravity mapping and undertake soil sampling with a targeted drilling campaign to be conducted in the near future.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.