REFFIND completes $2 million capital raising after appointing new CEO

Published 07-DEC-2017 11:36 A.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Sydney-based Software as a Service (SaaS) solutions provider, REFFIND Limited (ASX:RFN), this morning announced that it has successfully raised $2,004,750 in a placement to new and existing investors. RFN plan to use the funds for additional working capital and technology investment.

RFN has a product focus on enterprise to employee solutions including rewards, loyalty and recognition, employee communication and engagement.

Its key WooBoard product offering is aimed at meeting growing enterprise demand to provide employees and potential customers with rewards and recognition to drive loyalty and key behavioural objectives. It has built its growth to date through both organic growth and acquisition.

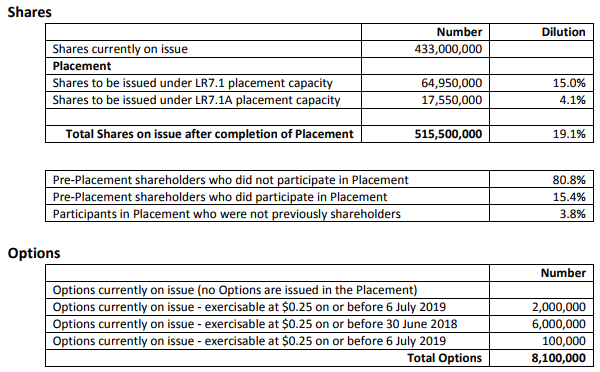

Source: REFFIND Limited

The company will issue 82,500,000 ordinary shares at 2.43 cents per share. Funds from the placement are expected to be received on 8 December 2017 with an expected quotation date for the new shares of 11 December 2017. The shares were issued as a placement to sophisticated and professional investors as RFN consider that to be the most expedient way to raise funds quickly.

Back in June, RFN offered shareholders an equity participation opportunity, where $118,010 was raised from $400,000 available.

Overall this is an early stage play and as such any investment decision should be made with caution and professional financial advice should be sought.

News of the capital raising follows an announcement last week that RFN had appointed a new Chief Executive Officer. Blockchain industry leader Tim Lea accepted the role of CEO, effective 1 December 2017.

Lea brings 20 years of senior executive and corporate leadership experience to RFN with a focus on banking and commercial finance in the UK and Australia with GE Capital, HSBC and Lloyds Bank followed by hands-on experience building web and blockchain based solutions in Australia and key international markets.

Lea is ideally suited to help RFN execute on its strategic growth plan through expansion of its existing enterprise customer base and acceleration of new customer growth through further development of its WooBoard platform, supported by investment in synergistic blockchain based technology.

Lea is also a director of film and digital media based blockchain platform Veredictum which he helped establish using the immutable providence properties of blockchain to help solve the $20 billion film piracy problem, enable video content producers to protect their copyright and to track derivatives of their content as they are uploaded to major video platforms.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.