Pot-stock RotoGro's tech outperforms traditional flat deck growing

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

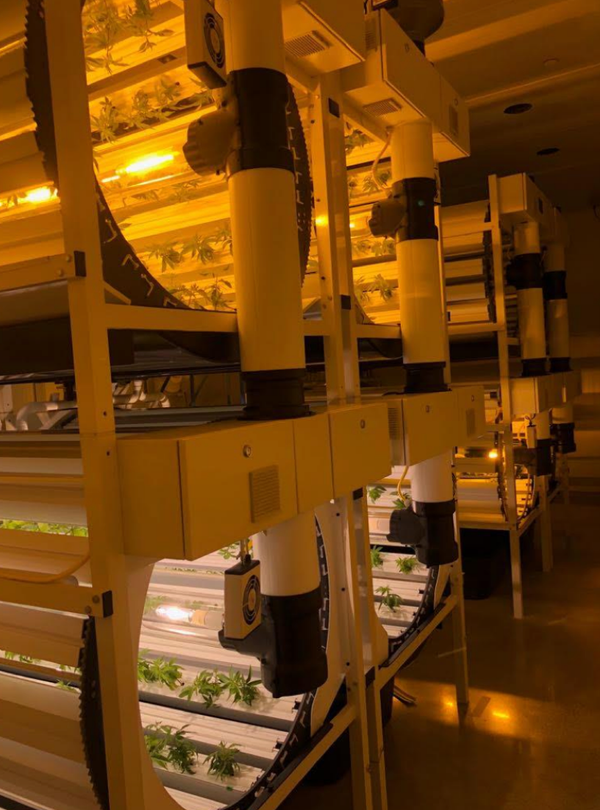

Ag-tech pot-stock, RotoGro International (ASX:RGI), has this morning updated the market on the ongoing trials undertaken at its state-of-the-art research and development facility in Ontario, Canada.

The standout highlight here lies in the significantly increased cannabis yields RGI has been seeing, which have consistently outperformed traditional ‘flat deck’ style systems occupying the same floor space.

Here, cannabis grown with the RotoGro Hydroponic Garden System has consistently yielded 7–9 lbs (3-4kg) of dry final flower product per harvest, compared to 2.8lb (1.3kg) with flat deck systems.

During the first quarter of the year, RGI designed and built the facility in question for the cultivation of both pot and perishable foods. The facility includes two grow rooms, an on-site laboratory, germination and propagation rooms, and a control centre for the remote monitoring of growing facilities around the world (a component of RGI’s growing management services).

Designed to showcase the substantial space, cost and yield advantages of the RotoGro System, the cannabis grow room houses two four-pod arrays of four-feet systems, while the perishable food grow room houses a new eight-foot system, together with one four-pod arrangement of four-foot systems.

Both grow rooms have been constructed to demonstrate a side-by-side comparison with a traditional flat deck system occupying the same amount of floor space.

Testing to date has focused on varying light sources, including light-emitting diodes (LED), ceramic metal halide lamps and high-pressure sodium lamps. This testing has been combined with adjusting rotational speeds to better understand their impacts on yield, room temperature, humidity management, CO2 demand and nutrient consumption.

Manwhile, in the cultivation of cannabis, the results of these tests have proven to be highly promising, with each four-foot system consistently yielding 7–9 lbs (3-4kg) of dry final flower product per 60-day cycle.

Perishable food cultivation has provided equally surprising results regarding crop density, yield and cycle times. A single RotoGro System occupies a footprint of three square meters or 32 square feet. The comparative yield of a traditional indoor flat deck system occupying the same footprint produces on average 2.8 lbs per harvest.

The average production per harvest for indoor flat deck hydroponic production is taken from a study by BOTEC Analysis Corporation in conjunction with Carnegie Mellon University and TRiQ, Inc., which saw 16 legal pot growers interviewed and studied.

On top of the significantly increased yields achieved by a single RotoGro System, when stacked two high, the average yield is 14-18 lbs, and when stacked three high, the average yield is 21-27 lb. These yields are achieved all within the same footprint.

Moreover, this doesn’t take into account the shorter growing cycle and greater number of harvests per year offered by the RotoGro System — this translates into greater advantages still over traditional flat deck hydroponic growing.

On top of this, during October, RGI kicked off trials on behalf of Freshero, covering a range of perishable food products spanning leafy greens, herbs, cherry tomatoes, cucumbers, capsicums and strawberries. These trials are progressing nicely, with the Freshero technical team onsite this past week.

By way of background, RGI penned a strategic deal with Freshero back in August within the organic, fresh produce supply industry. Freshero is an aspiring organic fresh produce grower with long-standing relationships across the wholesale, retail and food service space in Australasia and Southeast Asia.

RGI and Freshero have now undertaken economic analysis for a range of products suitable for the Australian market, as well as facility specifications and design layouts for Freshero’s own research grow room in Australia. Trials will continue into the new year, at which point the duo will begin designing Freshero’s first perishable food facility.

RGI Managing Director, Michael Carli, noted that continual research anddevelopment at the company’s state-of-the-art facility provides a strong foundation for supporting a wide range of clients’ needs.

“This, coupled with the commencement of our qualified botanist and completion of our on-site laboratory, further facilitates the testing, scientific analysis and study of different plants and strains in both the lawful cannabis and perishable foods space,” Carli said.

“The future is very exciting as we continually improve and refine our technology in conjunction with our global data control centre to optimise yields and maximise cost efficiencies.”

This latest piece of news comes on the heels of considerable highs for RGI. Last month, the small-cap pot-stock revealed that it’s acquiring Supra HC — a holder of a Health Canada-issued cannabis dealer’s licence, providing RGI company with a critical edge over both its Canadian and Australian pot-stocks peers.

This strategic acquisition gives RGI the ability to legally produce its own pot products in Canada’s newly opened recreational cannabis market.

Total Canadian legal weed sales are expected to exceed C$7 billion by 2019, according Deloitte — more than the C$5.1 billion Canadians spent on spirits in 2017 and on par with wine sales.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.