NetLinkz further expands its China footprint

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

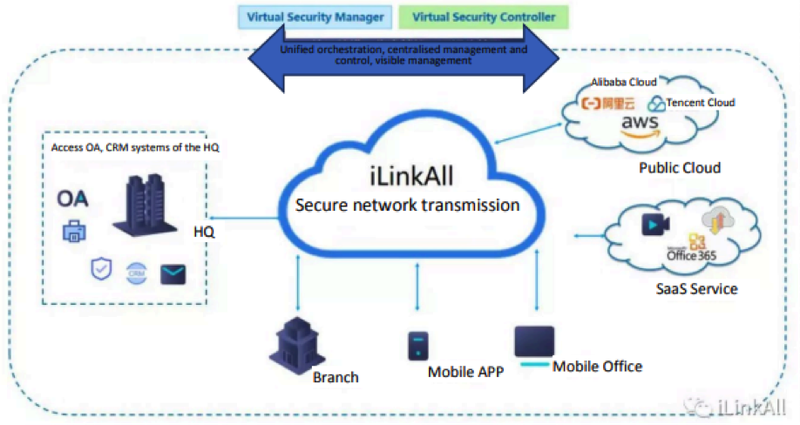

NetLinkz Limited’s (ASX:NET) majority-owned entity, the Beijing iLinkAll Science and Technology Co. (iLinkAll), has signed an agreement to provide its Virtual Secure Network (VSN) lite software to Pinnacle, a provider of services to the finance sector.

NetLinkz owns 80% of iLinkAll with an iSoftStone entity controlling 20%.

iLinkAll is a joint venture between Netlinkz through its wholly owned Netlinkz subsidiary Netlinkz Technology Hong Kong Ltd and an entity nominated by iSoftStone Information and Technology.

iLinkAll is approved to sell its products in China and has a 24/7 China wide customer service centre in Shandong, China.

iLinkAll will provide development and technical services in conjunction with its software to Pinnacle Shanghai whose customers include Morgan Stanley, Nomura and Aon Insurance.

The VSN software will provide a secure remote connectivity control system and an information management system platform.

This continues the focus of iLinkAll to provide secure network solutions for large scale projects such as the recently announced World Bank sponsored initiative to improve water supply and sanitation services in selected areas of Deyang Municipality of the Sichuan Province.

Immediate revenue recognition

The one year contract agreement will generate revenues for iLinkAll of RMB 1,000,000 (A$225,000) and will lead to a second phase of revenue generation to provide additional on-premise services and licences according to demand from Pinnacle’s clients.

The majority of the contract will be paid upfront.

Pinnacle will act as the agent of VSN Lite, iLinkAll’s intelligent network security product provided by ilinkAll and to sell iLinkAll network technical services and products for enterprise application purposes.

Pinnacle Shanghai, provides information technology services in various fields such as, web technologies, mainframe, SAP and as a global outsourcing service supplier.

In addition to the Pinnacle contract ILinkAll has signed a contract with another customer, Shanghai M-Soft Information Technology Co. Ltd., to distribute and sell VSN and VSN Lite which will initially generate revenue of 500,000 RMB (A$110,000) and lead to further enterprise sales of iLinkAll VSN product.

M-Soft’s client list includes China Aerospace Science and Industry Co. Ltd., and Abbott Laboratories (Shanghai).

Further opportunities could be on the horizon

The coronavirus shows no signs of letting up and in fact further opportunities for NetLinkz could emerge both in China and in other affected areas as the number of cases now exceeds 80,000, and related deaths are in the vicinity of 2800.

As MarketWatch.com reports, “Because of its genesis in China, coronavirus is both a demand and a supply shock to the global economy,” said Brian Nick, chief investment strategist at Nuveen, in a Tuesday note.’’

It was just a fortnight ago that Finfeed underlined the potential for NetLinkz to play an active role in assisting businesses in negotiating this tumultuous period, and since then the dire consequences of the coronavirus have become even more apparent in China and other global regions.

In discussing the order of this new contract, James Tsiolis, executive chairman of NetLinkz referred to other initiatives linked to the impact of the coronavirus in saying, “We have now engaged with Pinnacle Access Solutions to provide a total solution for networking remotely and securely, following on from our selection by the Beijing Municipal authorities to assist them with the fight against the coronavirus.”

Highlighting iLinkAll’s strong and well regarded presence in China, President Zen Wang said, “I am very pleased that we have signed up Pinnacle and M-Soft as our customers.

‘’Both companies have served the Chinese market for many years and they know the market very well.

‘’These contracts once again demonstrate that our customers recognise iLinkAll’s innovative products and solutions and our engineering capability.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.