NET accelerates growth as it hits significant milestones

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The centralisation of data has serious alarm bells ringing for some, particularly for those who value their privacy above most things.

There are, however, arguments for and against.

Advocates, including Amazon and Microsoft will say it preserves data, improves physical security, data security, reduces costs and improves reliability and speed.

The flipside points to high dependency on network connectivity, bottlenecks due to high traffic and limited access.

If companies are looking to bring data management in-house and secure their operations, a decentralised approach is best.

In 2020, a year that has transformed the world into one heavily attuned to data breaches, many companies have turned their attention to providers of more secure, less decentralised data products.

In this mix is Netlinkz (ASX:NET).

Netlinkz, an Australian software company that specialises in secure virtual network solutions, has been refining its data security products since 2014.

Its core product is a globally-patented, award-winning technology called the Virtual Invisible Network (VIN), which is proving to be a popular network security solution around the globe.

This was no more evident than in the formative days of COVID-19.

At this pandemic gripped the world, NetLinkz through its 80% owned Beijing iLinkAll Science and Technology Co. Ltd, was asked to help lead the fight against the virus, whilst improving information flow and work process using NetLinkz’s Virtual Secure Network (VSN).

“We are proud to be supporting the people of Beijing during an extremely difficult period for the city and the people of China. iLinkAll’s VSN has been selected as the City’s first batch of ‘remote and mobile’ technology solutions to help small to medium-sized companies and their professional workers remotely log into their office and help those businesses get back to work,” James Tsiolis, Executive Chairman of NetLinkz said.

Notably, iLinkAll is the 2019 award winner of the Innovative Cloud Service Platform by the China Software Industry Association. It leads the China SDN market in providing innovative intelligent enterprise solutions to secure networks and assists their digital transformations.

China is indeed a major market for NET and iLinkAll has already started generating sales across various sectors.

These sectors offer a range of opportunities for the company:

These sectors have been developed to meet the demands of increased mobile application.

Allied Market Research suggests the Global Mobile application market will grow to US$407 billion in 2026, from $106 billion in 2018.

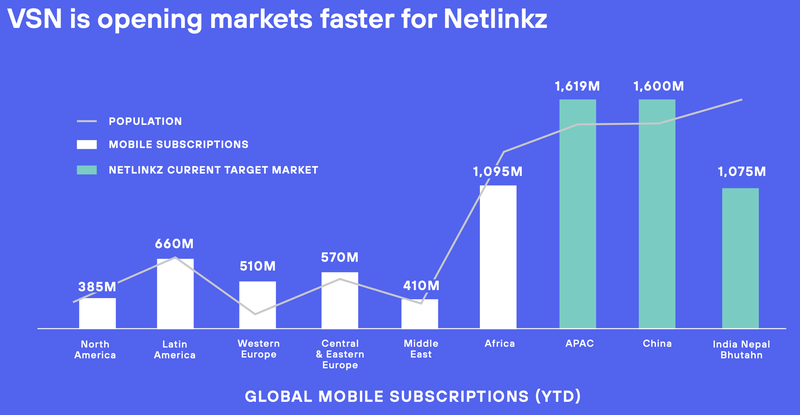

Netlinkz expects its Virtual Secure Network to quickly open these markets:

There have been six million mobile subscriptions alone in 2020, compared with one million in the US, hence the company’s focus on this market as well as in the APAC region.

The company’s VSN will be crucial in its expansion into these markets.

How the VSN works

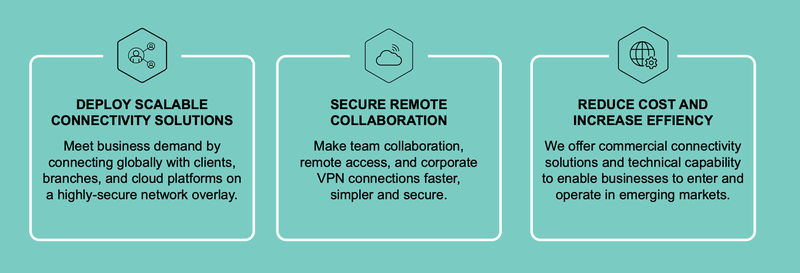

Netlinkz developed the Virtual Secure Network (VSN) overlay technology platform, as a cost-effective connectivity solution that enables simple, fast and secure day-to-day networking and connectivity.

VSN allows organisations to underpin their network operations with an intelligent networking platform that provides a secure and elastic network overlay that extends all the way to the edge of the organisation’s network and offers high quality of service and infinite scalability.

The following graphic highlights its capabilities:

VSN utilises an award winning, world-class encryption that protects all network transmissions from edge to edge. In fact, the benefits of the VSN are many and varied:

- VSN offers autonomous adjustment of bandwidth & smart routing

- VSN can switch between peer-to-peer and mesh mode

- VSN employs a powerful backbone over any existing network

- VSN uses access control lists (ACLs) to ensure that network services are only available to authorised users - making the network invisible to unauthorised users

- Security policy management is centralised in the VSM and enforced at the edge

- VSN blends open standards with cutting edge virtual technology, giving it a rich feature set that is ahead of the SDWAN market

- VSN offers 5G-ready edge devices that support IoT and extends the network edge to the mobile device for demanding branch edge deployments.

- Leapfrogs latent technologies

These benefits, along with creating a secure network were paramount in the Beijing government selecting iLinkAll to help combat COVID and put people back to work.

“The Beijing Government has released a list of selected IT enterprises in Beijing that have approved products and services aimed at assisting business and the community through the epidemic, with practical actions,” Tsiolis said at the time.

NET was in good company including Alibaba, Baidu, Ten Cent, Jingdong and JD.com.

iLinkAll VSN was the only majority foreign owned company selected by the Beijing Government – testimony to its ability to create a secure and trusted solution for the Chinese market including businesses and the broader community.

Read: NetLinkz further expands its China footprint

The Virtual Secure Network (VSN) product, evolved out of Netlinkz’ Virtual Invisible Network (VIN), an evolutionary step in virtual networking that can be used over any other type of established public or private network, including the Internet.

In essence, the VSN platform of technologies is an integrated solution delivering network connection, security, flexibility, control, management and monitoring of any network requirements for any enterprise client.

It embraces all aspects of technology including SD-WAN, cloud, mesh, edge, peer to peer and IOT and can deliver at scale.

As we reported earlier in the week, Netlinkz is positioned to cater for basic to extremely complex client-driven customised solutions.

Netlinkz is well positioned to grow revenue satisfying both ‘connectivity’ to basic infrastructure demand and growing demand for Cloud hosting and delivery of services to clients’ (SaaS) business models.

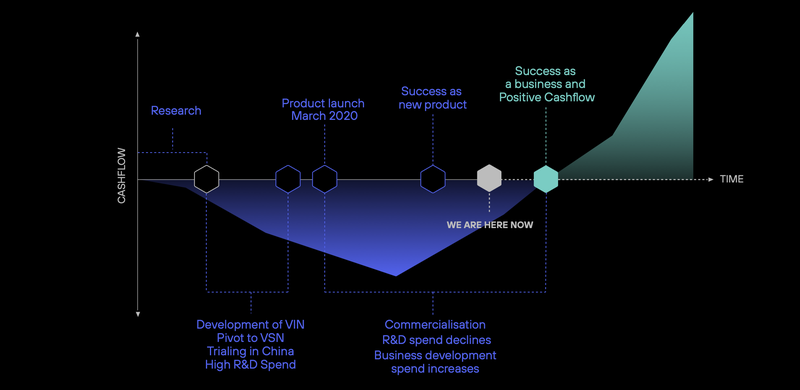

Strong revenue growth leads to major milestones

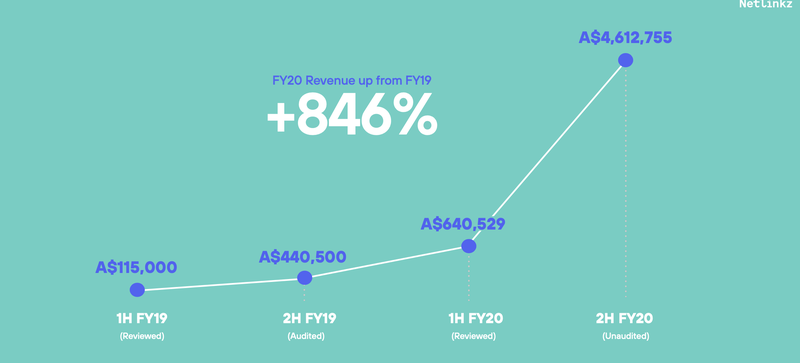

Netlinkz products are in demand and has led to exceptional growth in 2020.

The company recently reported fiscal 2020 sales of $5.25 million, up 846% on the previous corresponding period, mainly due to rapidly increasing sales in China.

Netlinkz has also entered the Indian market.

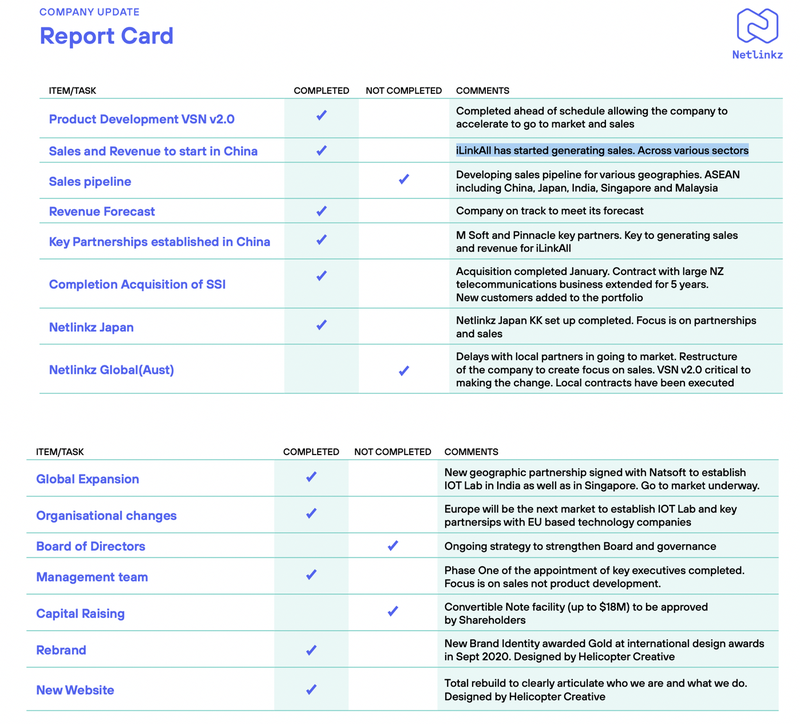

Its current report card, illustrates how proactive the company has been recently and the milestones it has ticked off.

The company remains on track for its previously stated guidance of $15 million of customer receipts by year's end and its approaching cash flow positivity.

For Tsiolis, this is just the start of things to come.

“The 2020 financial year has been a transformational one for Netlinkz and we now have in place the foundation to capitalise on the initiatives we undertook during the year to really fast-track growth in the current financial year and beyond.

“We remain on track to meet our previously stated guidance of $15 million of customer receipts by year-end, with the Board being of the firm view that we are only just in the very early stages of growth.

“We have market-leading VSN (virtual secure network) technology, an expanding global footprint, quality partners, a growing base of blue chip and government customers, as well as other revenue streams and technologies that underpin this confidence.

“As such, Netlinkz is exceptionally well positioned to capitalise and it has a very strong market advantage.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.