MyFiziq upgrades provide enhanced security and operational benefits

Published 31-AUG-2020 10:08 A.M.

|

5 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

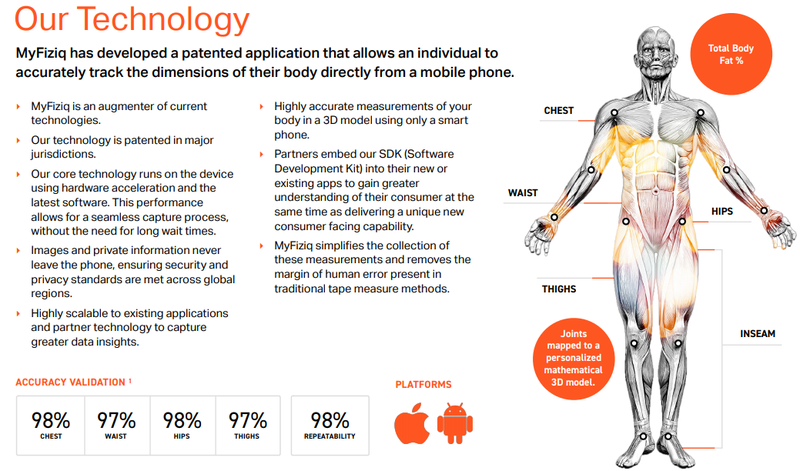

MyFiziq Limited (ASX: MYQ) has made further technological advancements with its body measurement related technologies, and following months of trials, testing, and validation the group will this week release a new Long-Term Support (LTS) Software Development Kit (SDK) which fully encapsulates MyFiziq's state-of-the-art capture process on a user's mobile device.

Management has achieved this objective by utilising modern hardware and software on both Apple's iOS and Google's Android platforms.

Following these changes, the group will no longer require Amazon Cloud.

The update combines on-device optimised Machine Learning and Computer Vision techniques that leverage both CPU and near-direct access to the device GPU to provide near real-time results.

As MyFiziq's process runs strictly on a user's device it removes the need for a network connection, thereby keeping the partner's applications responsive as well as securing a user’s private data, removing the need to enter a cloud network for the results capabilities.

Substantially reduced processing times

MyFiziq's Machine Learning and Computer Vision (MLCV) engineers have spent hundreds of hours training state-of-the-art models on an extensive dataset collected in collaboration with leading institutions such as The University of Western Australia, The University of Taipei, Mahidol University and EKA Hospital.

Following extensive internal validation of the data, ML models have been optimised for modern mobile devices using Apple's CoreML for iOS and TensorFlow for the Android platform.

Encapsulation of the process to solely on-device has reduced the need for network connectivity for inference and the inherent latency associated with HTTP requests.

Removal of external network calls and cloud-based inference has reduced processing times from up to 30 seconds to a mere fraction of a second on the latest flagship devices such as the iPhone 11 Pro and the Samsung S20.

Taking the cloud out of the equation improves privacy

In addition to speed optimisations, there are privacy benefits in not sending user data to the cloud for processing.

With the fast-changing global landscape of personally identifiable information (PII) legislation in relation to data privacy, retention and residency, MyFiziq's new solution means partners can be confident their users' data will not be compromised and all data and images involved in the process will remain on-device.

Commenting on this development and its significance for future technological development, Terence Stupple chief technology officer of MyFiziq said, "Reducing our reliance on cloud processing and cloud services, as part of this release has also been compelling. This update will ensure that our partner's applications will remain responsive and reduce the overheads, side-effects, and latency of cloud-based inference.

"On-device is an exciting step for us as we now look to fully harness the potential of real-time inference and see where it will take us.’’

Management has always strived to ensure that users' data is secure at both rest and in-flight and have mitigated risk by following best-practice cloud security protocols and de-identifying users.

With on-device classification, the classification process is now restricted to local in-memory compute which further ensures the privacy of user data.

General services still to be supported by cloud presence

MyFiziq will continue to maintain a cloud presence to support its general service, but it will no longer have a reliance on it for compute and inference functionality.

By shifting inference from cloud to on-device MyFiziq has exponentially increased its ability to scale to meet partner demands.

Previously limited by concurrent invocations of cloud functions, MyFiziq's classification process is now only limited by the number of user devices connected to a service.

This means the technology has moved from the ability to process 4.8 minute instances an hour to having zero limit.

This reduction means a substantial cost reduction as network calls and cloud function compute costs are removed from MyFiziq’s core service, effectively eliminating operational expenditure for classification.

New technology is strong attraction to partners

Discussing the significance of this step-change in the evolution of the company’s unique technology, chief executive Vlado Bosanac said, "This is a huge step forward for the technology and the company.

"This not only assists our partners with the infinite scale this brings but importantly, the new on-device functionality has not compromised our accuracy or repeatability.

"We need to keep in front of our potential competitors and offer our partners a solution that is embedded in their platform, which further assures them that their users and environment aren’t being forced onto infrastructure that may cause concern for their data or users.

"One of the strengths of the MyFiziq technology is we give our partners our measurement technology to embed in their platform and we allow them to control their data with their user's permission.

"Conversely, other systems that are using regression require the user to send their data to a third party to achieve a lesser outcome.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.