MyFiziq and WellteQ’s integrated offering seen as paradigms shift

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

MyFiziq Limited (ASX: MYQ) has signed its first Binding Term Sheet to expand the newly developed CompleteScan platform capabilities with Asia Pacific corporate wellness platform WellteQ into the $10 trillion global telehealth, corporate wellness and insurance market.

Under the commercial terms, CompleteScan will be integrated into WellteQ’s personalised digital wellness and analytics platform in readiness for January 2021.

The integrated offering will be first offered to existing corporate customers including Willis Towers Watson APAC, NIB, Bupa Australia, Toll Logistics, Credit Suisse and DBS Bank before a wider reach into prospective clients and markets outside of APAC.

WellteQ anticipates that the CompleteScan platform will appeal to multiple verticals in telehealth, corporate wellness and insurance partners already engaged with WellteQ around the globe.

With regard to MyFiziq’s products, the company has developed its capabilities by leveraging the power of Computer Vision, Machine Learning, and patented algorithms to process images on secure, enterprise-level infrastructure, delivering an end-to-end experience that is unrivalled in the industry.

The technology simplifies the collection of measurements and removes the human error present in traditional methods.

COVID creates demand

WellteQ has an impressive background, being the leading digital wellness solution for employee health engagement and HR data analytics.

Recognised globally as a leading B2B wearable agnostic platform, the group offers a suite of innovative engagement programs including activity challenges, mental wellness, financial wellness, HR onboarding, virtual coaching and telehealth for employees.

With the COVID-19 pandemic, digital health platforms such as WellteQ are becoming a much sought after point of engagement for the medical, wellness and health sectors.

The use of video consultations is quickly becoming the norm with providers and their patients.

These sectors are looking for new and innovative ways to engage, diagnose and manage people remotely, both pre and post medical and health interventions.

WellteQ provides a unique solution that will now combine its mental health, nutrition, activity and wellness capabilities with the power of CompleteScan.

The group’s technology analyses multiple facets of health and activity with multiple engagement protocols from mental wellbeing to activity tracking.

Transparently optimising health outcomes and productivity

The holy grail of this activity for the providers is the ability to not only assist in better health outcomes and productivity, but to augment the change and be able to deliver a visual tool that shows the return and change their users are achieving, enabling them to understand the value that the combined platforms will bring.

MyFiziq chief executive Vlado Bosanac highlighted the significance of combining the technologies in saying, “This will be a world first as multiple organisations worldwide are positioning themselves with offerings to the corporate wellness space.

‘’Combining our new CompleteScan technology with WellteQ will be a paradigm shift in both tracking and analytic capabilities across multiple market segments.

‘’The WellteQ solution is a perfect fit for CompleteScan and the multiple verticals WellteQ has positioned itself in.

‘’It’s a great first deployment for CompleteScan when looking at the corporate register WellteQ brings to this partnership.

‘’This is an exciting new pathway to increase revenue for both organisations.’’

Highlighting the win-win benefits of the agreement, Wellteq chief executive Scott Montgomery said, “Not one of our corporate wellness industry peers possesses such comprehensive capabilities as that of our WellteQ and Complete Scan integration.

‘’Using just your smartphone we can assess, continuously monitor, coach and if needed triage a user into virtual care via telehealth.

‘’This extends our continuum of care and therefore user and client value substantially.

‘’We set out to bring affordability and accessibility to preventative care and through this integration we can deliver our on-demand insights and personalised coaching system, all for the annual price of a single doctor consultation.

‘’Healthcare has changed for the better and its technology collaborations like this that continue that evolution”.

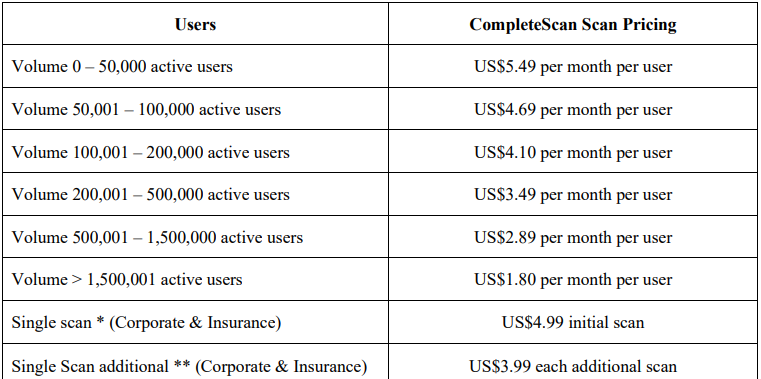

Under the terms of the binding term sheet, MyFiziq will be paid the following volume-based pricing by WellteQ.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.