Market volatility presents no challenges to Spirit Telecom

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Spirit Telecom (ASX:ST1) has delivered an impressive revenue and sales trading result for both the month of April and for the January to April 2020 period on a year-on-year basis.

Of particular note were the total revenues of $14.3 million, up 146% on the previous corresponding period.

Providing substantial income predictability is the company’s level of recurring revenue which is up 60% to $8.6 million, with business to business recurring revenue growing by 92% to $7 million on a year-on-year basis.

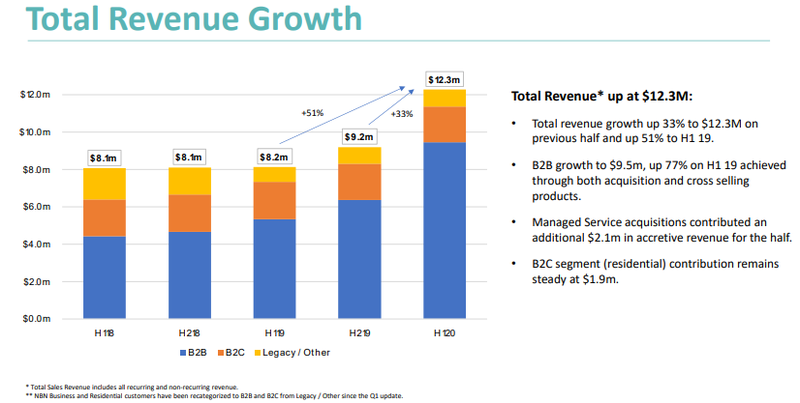

To provide further context, the company has already generated significantly more group revenue in the course of four months than it did in the six months to December 31, 2019 when revenues were $12.3 million.

As the table below shows, Spirit is establishing itself as a company that consistently delivers robust growth, and this is likely to continue as the benefits of recent acquisitions are realised.

The company has cash and debt of $14.8 million, providing it with the scope to make further acquisitions.

Acquisition of Trident paying dividends

From an operational perspective, Spirit continues to demonstrate successful execution of its strategy of bundling its high-speed Internet, Cloud and IT/MSP services.

The portfolio of products continues to show resilience and growth against the background of a volatile macro-environment.

With the recent acquisition of Trident Technology Solutions, Spirit has been able to tap into Essential Providers serviced by Trident with Schools and Aged Care providers taking up the Spirit Internet services as a cross-sell.

The group result is particularly impressive as Trident’s business mix has seasonal flows in the June quarter, which is typically the slowest quarter for Trident, only generating 15% of its revenue for the financial year.

With the company’s balance sheet in a very healthy position, expansion initiatives could see a broadening of the group’s Spirit X Digital Sales Platform.

NBN launch to reach more than 500,000 business locations

The Spirit X platform will launch the NBN Enterprise Ethernet range to its partners and direct customers in late May 2020.

The NBN product can reach more than 500,000 business locations nationally.

Commenting on these developments, managing director Sol Lukatsky said, “We are simply executing to strategy for our customers, who are demanding bundled High-Speed Internet links & IT services in one offering and it is working.

‘’The launch of the NBN EE product will add more than 500,000 locations we can sell into with our Internet and IT services bundles.

‘’This is a game-changer in terms of organic opportunity for Spirit."

Acquisition target opportunities continue to grow with revised valuation expectations of vendors becoming more realistic over the last period.

Our balance sheet position of $14.8 million in cash and debt puts us in a very unique position to acquire quality telco and IT/MSP assets at reduced prices.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.